April 2018 Life + Money Report

YTD Spending: $4,866/ $20,000 maximum goal

(24% of total at 33% through the year)

Good things that happened this month:

- Get Your Money Together book came out in ebook form to all pre-orders!

- I taught 4 workshops this month! I taught at Life After Americorps and at both SMYRC locations. I LOVE TEACHING about money and was only able to do these presentations because of the generous Pay It Fur-Ward backers from my kickstarter campaign.

- Oh My Dollar! got some press: I was on the Stacking Benjamins podcast and featured in Portland Monthly magazine.

- I did on-site contracting for a large corporate client all month, which was delightful for these reasons: I like the work (data processing/SQL), I like the office (and its free coffee and healthy snacks), I was able to listen to a ton of podcasts, and it is right next to the gym I also work at so I was able to go to the gym much more often.

- My article at Racked.com about cataloguing all of my clothing came out. It’s full of graphs! I’m pretty excited that I was able to share that weird day where I catalogued all of my clothing and made nice excel charts.

- I got to have some nice social time with Friends From the Internet, including a picnic in a rainy/sunny Laurelhurst park and a delightful nacho and mochi night at our place. My favorite social time by far is picnics and homemade meals with friends.

- I got all the stickers for the book! They are beautiful!

- I was a judge for a Monster Pageant, which was as awesome as you can expect.

- I worked 229.5 on-task hours last month (57 hours per week) and still took 2 days totally off. The biggest category of work was my on-site data contracting, followed by my part-time gym job, with only 86 hours towards my business/the book.

- I started the 100 Days of QS project, which is a fun creative exercise each day even if I am worried I am running out of things to do for the next 70 days!

Things I want more of in coming months:

- Business INCOME!!!! – I have spent only 86 hours on my own business this month, but over 120 hours on other people’s businesses. This month I’m launching a project I call “DIY Business Incubator” where I am treating my summer as a business incubator by myself. The goal is that by the end of the summer, I’m paying all my monthly expenses off income from the podcast/book/teaching/blog and won’t decide to go back to a day job.

- Reading Fun Books – I spent so much time reading my own work for editing, that I only read 364 pages this month of other people’s books, a third of my usual pages read. I always enjoy an afternoon spent reading.

- Responding to emails – I’m usually an inbox zero sort of person, but between the book deadlines and all the on-site contracting work where I have no access to email, I have been doing the inbox bare minimum. It’s out of control right now and makes me feel flaky.

- Yoga – I stopped doing yoga for financial reasons in November (I was work-trading for the previous year but then didn’t have the time anymore to do so), and it turns out that stretching alone in a crowded gym is NOT the same as doing yoga in a calm room with 20 other sweaty people. I am terrible at sitting meditation but better at moving meditation like yoga and it really does help my mental health, so I’ve decided to shell out some $$ on yoga this summer.

Things I want less of in coming months:

- Uncertainty about money I am working my ass off right now in order to have the business support me, but this month I’m not even taking a paycheck from my contracting work or my own business, because I have so many expenses with printing the book. I am excited to get the book out there finally, but I am hoping this means that I can now focus on the selling and revenue side of the business, not just content creation.

- Clothing – This summer I planning on selling off/giving away half of my 206 items of clothing. This will be a podcast episode and maybe a youtube video! I also would like to replace my POS dresser because it is actually falling apart causing some extreme frustration.

- Bike Maintenance Problems – I am getting my entire drivetrain replaced, and my brake cables replaced, and both my wheels rebuilt next week. My bike is my most expensive belonging and my only transportation and I love it – but I’ve been a bad bike mom and let my bike go 14,000 miles past the recommended service mileage for my chain. For the past month I have been avoiding unnecessary trips due to bike maintenance issues, but luckily I saved up for this overhaul in my sinking funds and I got offered the early birthday gift of a tune-up!

Favorite podcasts this month:

- By The Book – two women try out different self-help books for 2 weeks at a time and report on it. It’s really well-produced and hilarious.

- Happier with Gretchen Rubin – This is two sisters talking about the science of being happier – one works in Hollywood as a screenwriter and the other is a writer about happiness based in NYC. My favorite episode is this live closet clean-out episode.

- Masters of Scale – This show is all about scaling a venture-backed business, so you think it wouldn’t apply to my tiny lifestyle business, but, it’s both excellent business advice and a great reminder of why I’m not VC backed!

- The Tim Ferriss Show – I resisted Tim Ferriss’s podcast for so long because I could not escape the fact that he seemed like a bro-y digital nomad with no concept of privilege after reading the 4 Hour Workweek. But I admit it, I really like his long-form interview podcast. He’s a fantastic interviewer and I’ve come away with a lot of great business and life advice from his accomplished guests. Listening to old episodes you really see how he has improved.

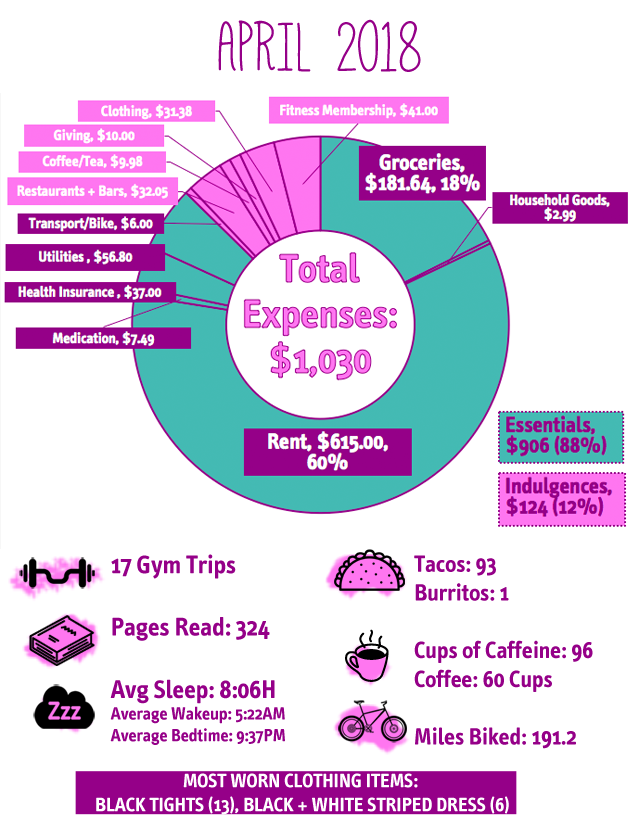

Full expenses report

Essential Expenses (in descending order): $906

Rent: $615.00

Groceries: $191.62

(Groceries – $155.43, “Treats” – $26.21, Coffee/Tea for Home – $9.98)

This was partially high because instead of a brunch outing with friends, we did a last minute park outing – but my “make falafel at home” cheap picnic strategy was killed by “buying $9 of food at whole foods to eat” due to the last minute switch in plans.

Electricity: $29.30

Health Insurance (after subsidy)*: $37.00

Medication not covered by insurance: $7.49

Water/Garbage: $27.50

Internet: $0 – as of this month, our internet is paid for by my SSO’s employer due to being a remote employee!

Transport/Bike: $6.00

Household Goods: $2.99 (Cleaning Supplies)

Discretionary Food & Drink (in descending order): $32.05

Restaurants: $28.55 (four meals – bowl at Job #2’s subsidized cafeteria, smoothie at Job #2′, 1 burrito, and 1 giant delicious bowl of ramen)

Coffee/Tea Out: $0

Bars: $3.50 (mocktail at a sunny day outside meeting)

Discretionary (in descending order): $82.38

Clothing: $31.38 (replacement stockings + shirt from ebay)

Fitness Membership: $41.00

Charitable Giving: $10.00

Money Set Aside in Sinking Funds (Not Yet Spent): $66.11

CSA Farm Share $21.00 ($250 per year)

Bike Drivetrain Repair Fund $31.50 (towards $200 in May)

Renter’s Insurance $11.50 ($140 per year)

Haircut Fund $15.16 ($55 every 5 months)

Yoga Classes: $11

Savings: $120.41 (16%)

Traditional IRA contribution: $100

Cash Savings: $20.41

($3,764 YTD or 37.6% towards my goal of saving $10,000 this year)

This month’s savings were historically low because 100% of my business income (~$1,498) went to printing + future shipping expenses.

Total After-Tax Income: $727.71

Oh My Dollar!: $0 (I took no paycheck after expenses, COGS, and tax due to printing expenses, I actually lent the business some money this month, to be repaid in May)

Side Podcasting Gig: $100

Part-time Fitness Studio Job: $627.71

My income continues to be low this month due to sending all my business/contract income towards book expenses. Luckily in February I “sent” forward quite a bit of my income to future expenses, completely covering this month’s expenses from my February income.

My expenses are budgeted through May, meaning I have $933.90 in my checking account allocated towards May’s expenses but not reflected in my “savings total”.

The savings total reflected is only money set aside specifically as long-term savings/retirement investing, not for future expenses.

*Health Care Subsidy Note

My high-deductible health insurance is super-cheap at $37 a month, thanks to taking the low-income ACA health care subsidy (down from a “sticker price” of $284 per month). This subsidy is based on an adjusted gross income (AGI) of $22,000 – which I hope to exceed, if my business goes well. If I do exceed that, I will have to repay a portion of my health care subsidy, up to $2,964.

Because of receiving the health care subsidy, I’ve switched from putting my retirement savings in my Roth IRA to a Traditional IRA, since Traditional IRA contributions are deducted from your AGI.

This means that if my income goes up by $5,500 and I manage to put that all in my Traditional IRA, I will owe nothing back for my health care subsidy because my AGI will not change (Roth contributions are not deducted from AGI because they are post-tax).