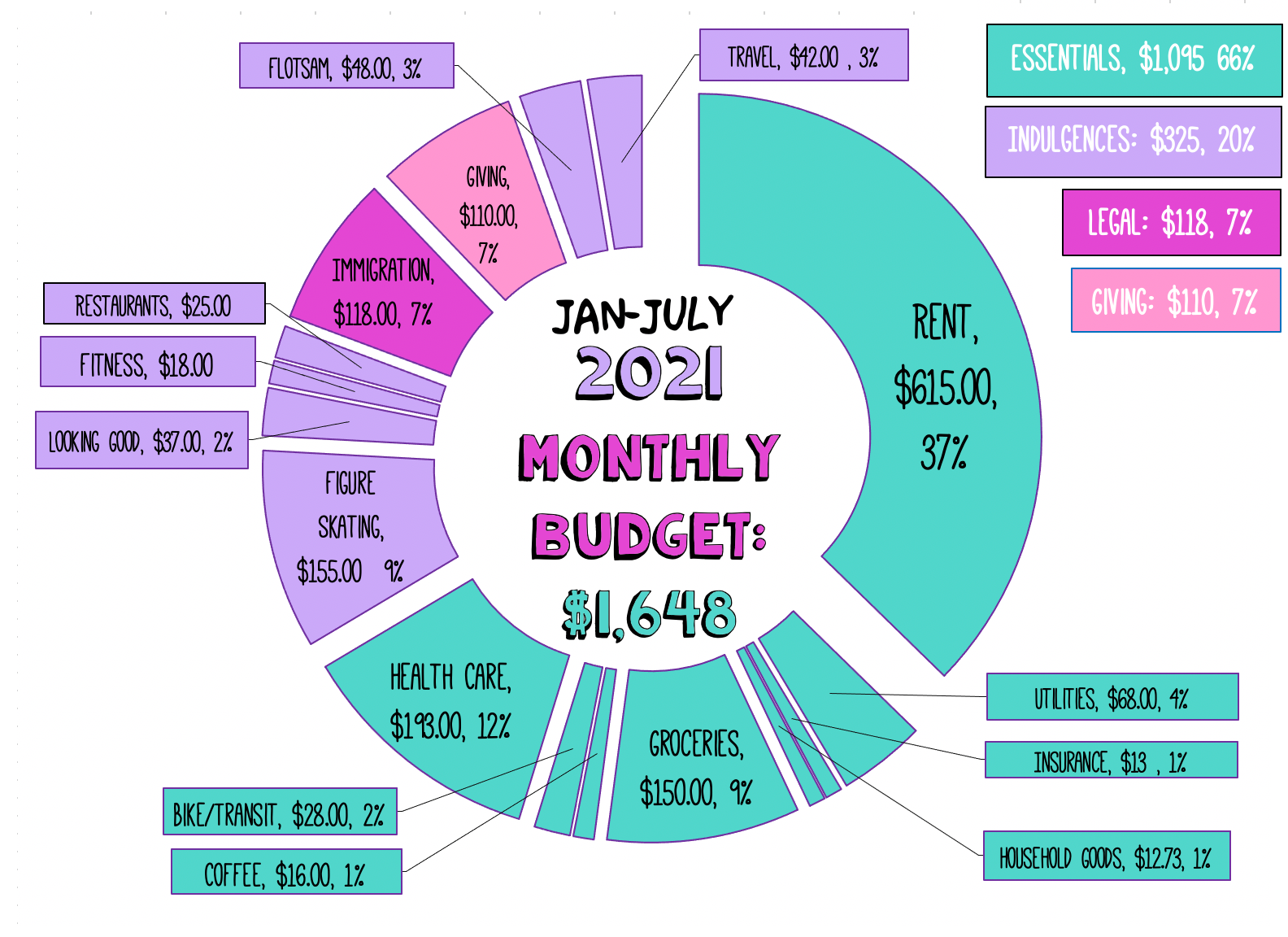

Projected January – July 2021 Spending: ~$11,536

($1,648 per month)

If 2020 has taught us anything, it’s that there are no guarantees – almost anything can happen.

In 2020, despite a lot of unexpected changes and a ~~global pandemic~~, I managed to pull off a 71% post-tax savings rate, and I saved more than $25,000 (exact number to be determined). That was largely due to working 3 jobs for half of the year, a thing I would not recommend to anyone.

I am very grateful that I did have so much work, though, and that my income allowed me to save for the future uncertainty and give away more money via charity and mutual aid. It was a privilege that my work allowed me to work from home and avoid covid.

In 2021, I obviously have no idea what’s going to happen.

- Will I keep my day job?

- Will the economy collapse under the weight of the Covid pandemic?

- Will OMD, my business, continue to do well?

- Will I be able to get a vaccine?

- Will travel resume?

- Will I keep having enough energy to do my business and my full-time day job?

- Will I get into graduate school in London and be allowed to move abroad?

- Will I manage to climb all the hurdles of Croatian bureaucracy and successfully get my EU passport?

What I do have planned to do is to lock in my expenses as much as possible through July of 2021, regardless of income, and attempt to save as much money for a few different possibilities: increased health care costs, reduced income, or attending graduate school abroad in the fall.

Both my expenses and my income could change significantly in July, as our housing will be up in the air (our lease is up in July) and there’s a possibility I end up enrolling in graduate school and moving abroad.

With the rinks continuing to be closed and the schedule being very hard to combine with my work schedule, I am budgeting less for figure skating.

I am continuing to budget very little for travel, as I have almost 130,000 travel miles that I haven’t gotten to use in 2020, $600 in travel vouchers for canceled flights, and an expectation it still won’t be safe to travel for leisure for at least another 6-9 months.

I did budget for the taxes and fees on an awards ticket, in case I end up booking a flight for late 2021/early 2022 with those sweet sweet award miles. (I’ve started plotting a train trip from Odesa, Ukraine to Istanbul, Turkey via Croatia, Serbia, Bulgaria, Romania, and Moldova when it’s safe to travel again).

Currently, I am in the process of applying for Croatian citizenship via heritage (my grandfather emigrated from Yugoslavia). The total cost for that I expect to be about $827 more in lawyer fees, translation fees, vital records fees, and travel to the consulate in Seattle – if I do manage to get my actual passport. If I end up with an EU passport, this is worth the cost. If I don’t end up with an EU passport, it will at least make a good episode of Oh My Dollar!

I am also considering taking a class via University of Zagreb in Croatian language in March 2021, which will cost €250. I have exhausted most of the free resources available for Croatian, as the language is relatively new (upon its split from Serbian and Bosnian) and does not have many global speakers. That class is not reflected in this budget, and I will find the money from other categories if I do decide to wake up at 3AM to attend class on Central European Time.

Because so much is unknown after July (including what country I will be living in!), I have decided to estimate my expenses only for the first 7 months of the year. Usually, I prefer to do an annual budget – but this year there is too much uncertainty.

When there is more information about housing, health care, immigration, and skating, I will finish out the second half of the year’s expenses.

January – July 2021 Predicted Expenses: $11,536

Household & Insurance – $4,991 ($708 per month)

- Rent: $4,305 ($615 per month) Our lease is up at the end of July 2021, and our rate is set through then.

- Water, Commons, Sewer: $227.50 ($27.50 per month, level billing)

- Trash: $52.50 ($7.50 per month, level billing)

- Electricity: $231 ($33 per month average) This includes higher average bill in summer due to portable AC unit when the air is bad quality.

- Renter’s Insurance: $91 ($13 saved monthly in sinking funds)

- Household Items (detergent, TP, toothpaste, razors, etc): $87.50 ($12.73 per month average)

- Internet at Home: $0 This is now paid for by SSO’s employer due to being remote employee, was $20 per month.

Basic Food – $1,162 ($166 per month)

- Basic Groceries: $945 ($135 per month average) – this is higher than in past years, but my expenses rose significantly in 2020 with supply chain issues and not having any travel or even occasional provided meals at work meetings.

- Treats: $105 ($15 per month average) – this is a category for cookies, chips, things I don’t really need but try to emotionally compensate with. I track it separately from regular groceries just to be aware. My 2019 average was $20/month, my 2020 average was $15/month.

- Coffee/Tea For Home: $112 ($16 per month) Once I stopped getting free coffee through work, this increased significantly. My March – November average for 2020 was $14.10 per month.

- Farm Share: $0 We are likely not getting a farm share again this year.

Local Transport – $200 ($28 per month)

- Bike Repairs & Parts: $200 I expect to get a new wheel + a tune-up to then sell my beloved xtracycle.

- Local Transit Trips: $0 – I get a free transit pass through my day job. Also I don’t have anywhere to go.

Fitness – $126 ($18 per month)

Obé Subscription: $126 I have been subscribing to Obé since November after running in the park has become more challenging due to THERE BEING NO LIGHT OUTSIDE IN THE WINTER and the rinks and gyms are closed. I don’t think I have the “perfect” workout going on, and I think that is okay. I am at least exercising, which is important for my mental health. I am aware there are free exercise videos, but actually paying some money turns out to be pretty important to consistency for me (I hate wasting money so I will show up to something I am paying for) and I really like the live class aspect. It works for me!

Medical – $1,353 ($193 per month)

I can’t even get into how complicated my health care costs are this year (I will write a whole post on it at some point), but I hope the situation to be relatively stable and affordable through the first half of the year, but I might be looking at $3,000-$8,000 in out of pocket costs after July depending on several situations outside of my control. The only thing I can do is to save money and be aware each time things change.

- Payback 2020 health care subsidy: $1,153

In 2020, I was given a monthly health care premium subsidy based on my predicted income, but halfway through the year, I qualified for a workplace plan (but could not take it due to OOP maximum reasons and had to keep paying for my healthcare.gov plan). After I qualified for the workplace plan, I no longer qualified for the premium subsidy and will have to repay it with my taxes. Every month in 2020, I put aside some money to pay back this health care subsidy at tax time (February 2021). There is no penalty for this, as long as you pay it back at tax time.Continuing to pay for my healthcare.gov plan (even with a total cost of over $3,000) still saved me thousands of dollars compared to hitting a new out-of-pocket maximum on my workplace plan, since my medication costs $1,950 per week and I had already hit my annual $12,000 maximum for drug manufacturer co-pay assistance. - Copays: $160

- Health Insurance Premiums: $0 My HDHP is paid for premiums through work at $0 cost to me but the plan is… not great… I really hope this ends up working out.

- Dental Exams/Cleanings: $20 I have dental through work now for $30 (pre-tax) a month! I haven’t needed anything beyond a regular cleaning and exam usually, but my 2020 appointments were canceled due to covid, so I’m behind on these. This is the co-pay for a cleaning.

- Contacts: $0 I get a one year supply through vision insurance.

Figure Skating – $1,090 ($155 per month)

In 2019, I took up figure skating again after a 15-year break from the sport. I love it and am better at it than I am at most things. It’s exercise, community, meditation, creativity, sparkly costumes, and skill, all rolled up into one big expensive package.

I barely skated in 2020, however – with the combination of working three jobs, the general pandemic worry (especially as someone who is immunosuppressed), and the rinks in the area being closed for most of the year due to covid (over 8 months of the year), I barely skated. Frankly, I have no idea what it’s going to look like for 2021. I still would like to compete at the Gay Games in Hong Kong in 2022 and would like to take my 2nd gold test sometime in 2021, if possible, if I can ever land a double axel again.

But, at the time of writing, the rinks are still closed. Figuring out how and when to get to the rink for the 2 weeks they were open was rather an exercise in frustration with a 9-5 job and a pandemic going on and all the rinks being located far outside the city. Because they’ll have to limit how many people are on the ice when rinks reopen, it will likely cost about $20 per hour of ice time. Hours of ice time directly correlates to whether or not you successfully make any progress in skating as it is a skilled practice.

I’m just going to put aside some money, hoping that skating happens. It probably won’t. But I’m hoping.

-

Ice Time: $600

- Coaching: $300 (Private lessons)

- Fees: $100 (annual USFSA membership)

- Skate Sharpening: $40

- Costumes, Laces, Bunga Pads, + Tights: $50

Looking Good – $265 ($37 per month)

- Hair: $100 God I need a haircut, I hate covid. This is for two haircuts I probably won’t be able to get at this rate.

- Makeup: $60 A professional necessity.

- Skin Care: $105 $15 per month average – I like fancy sunscreen and nice moisturizers.

- Clothing: $0 Net Zero. I love clothes way too much and I spend about an average of $30 a month on clothing (mostly used), but in preparation for moving, I am doing my best to not buy any clothing for the first half of the year. The last time I did a “no buying clothing” ban was 2016 and it worked out okay.

I expect to need clothing sometime in 2021 if I do move abroad, though (but I don’t want to bring it with me) I’m allowed to sell clothing to fill those coffers, so I’m aiming for net zero. I am also allowed to spend money on repairing/mending clothing when it’s something beyond my own skillset.

Food & Drink Out – $175 ($25 per month)

- Restaurants + Bars/Takeout: $105 ($15 per month average) this is pretty low, but yet still higher than my historical numbers (about $7 per month).

- Tea/Coffee Out: $70 ($10 per month average) consistent with 2017/18 levels, way above 2019 and 2020 averages.

Citizenship and Visa Costs – $827 ($118 per month)

- Immigration Lawyer $527 This is the expected (after exchange rate) balance of document preparation and research for my Croatian citizenship by my Croatian immigration lawyer.

- Translation $80 This is the cost of translating materials for official records.

- Vital Records $80 The cost of vital records from Oregon, New York, New Jersey, and Ohio.

- Assorted other costs $140 Cost of a train ticket to Seattle to the consulate, wire transfer and exchange fees, etc

Giving/Gifts – $770 ($110 per month)

- Charitable Donations: $700 ($100 per month average) this is contingent on income, I donate more through OMD rather than via my personal account.

- Gifts: $70 – A pretty consistent annual amount, give or take a wedding/baby.

Flotsam $340 ($48 per month)

- Entertainment: $70 I should spend money on this? I spent $6.00 total last year… but you know. I might. Maybe theatres will reopen.

- Spending Money: $70 $10 per month – This is for candy, library fines, random things not captured elsewhere, my 2018 average was $5.66 and 2019 average was $3 per month, 2020 average was $3.14 per month.

- Moving Expenses: $200 We are likely moving out of this apartment at the end of our lease, and inevitably moving comes with expenses.

Travel $300 ($42 per month)

As we know, travel isn’t really safe right now. I expect to spend some money on taxes and fees for international flights sometime in late 2021, but who really knows.

Savings Goal: $10,000 ($1,428 per month)

This is a combination of retirement savings (Simple IRA and Traditional IRA) and cash savings. If I can stretch my income and lower some business expenses, I would like to save more than $12,000.

My stretch, streeeetch goal is to save $21,000 as part of the 21 in 2021 Challenges we’re holding over at the OMD forums. To be on track for that, I need to save $12,250 from January through July.

Monthly Business Overhead Costs: $224.98

Not in personal budget!

I have a number of regular costs that are not reflected in my personal budget. Most of these would not exist if I did not run a business and are used 90%+ for business purposes.

This does not include costs like equipment, paying contractors (editors, transcriptionists, assistants), Cost of Goods Sold (COGS), or the hundreds a month I spend on shipping. All of that appears on my monthly reports.

Below is my monthly overhead, including my cell phone, paid for by my business.

- Mobile Phone Plan through Mint: $25 per month

- Adobe CC Membership: $52 per month

- Shopify: $29 per month

- Convertkit: $39 per month

- Web Hosting: $30 per month

- Google Storage: $1.99 per month

- Apple Storage: $2.99 per month

- Patreon Memberships: ~$45 (spread over many creators) This is done prior to my own cash out, so it doesn’t appear on my monthly reports.

What a great blog man!!!!

Cracked4pc

Well, I have to state that I completely concur with this essay and that it is excellent and extremely useful. I’ll surely continue to read your blog. You make a valid point, but I have to ask: what about the other viewpoint? Many thanks

¡Gracias por este artículo tan revelador! Tu perspectiva única y los ejemplos claros transformaron por completo mi comprensión del tema. Espero con entusiasmo leer más de tu trabajo

Great article. Thank you so much for telling me what you know! It’s great to see that some people still work hard to keep their websites up to date. I’m sure I’ll be back soon.

Experience Chiikawa Puzzle – Unique kawaii puzzle game with hidden pieces after placing, gentle gameplay but full of thinking and entertainment.