Who knows what 2022 is going to hold? Each year I publish an estimated budget and then reflect on how I did at the end of the year. Here is last year’s budget.

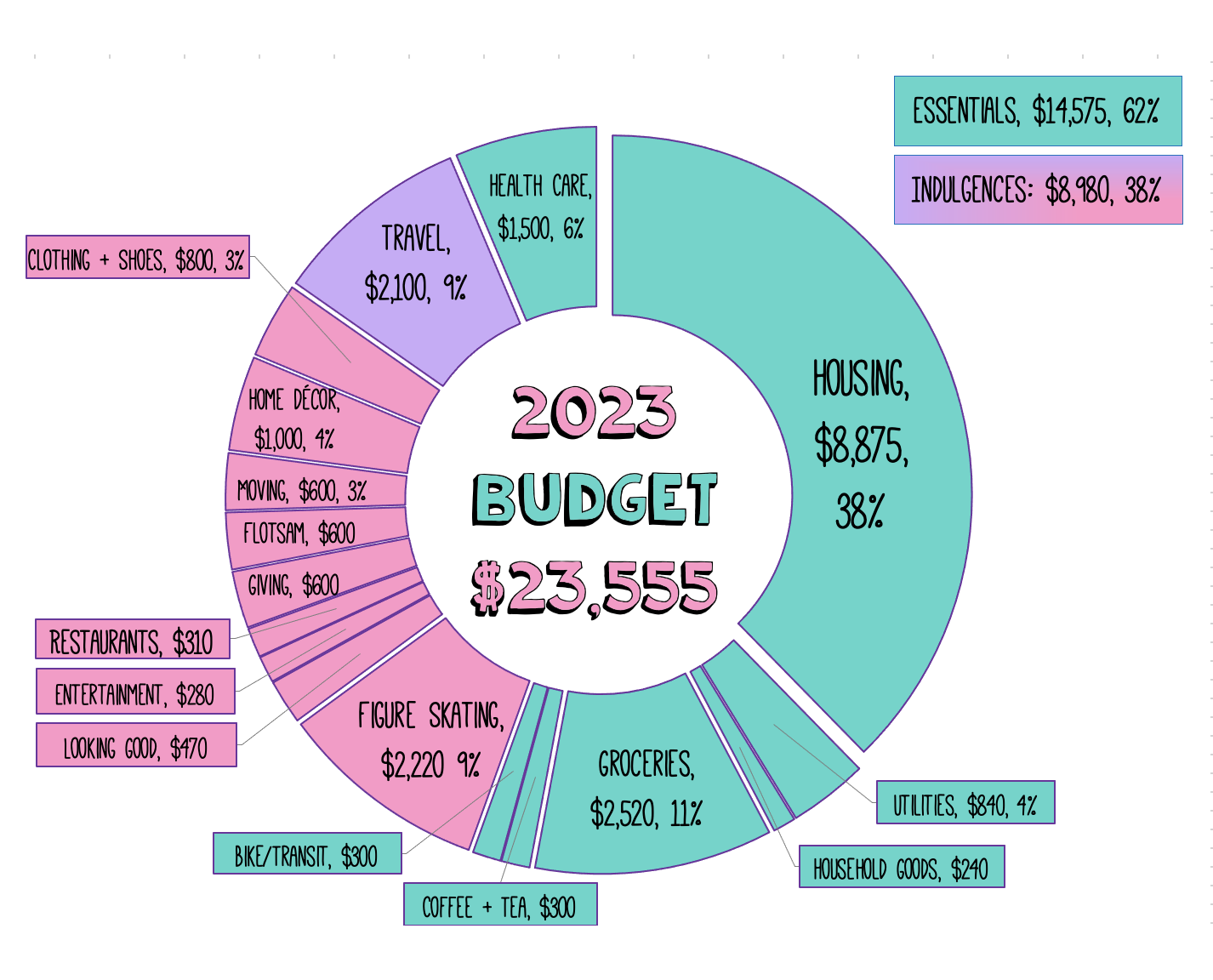

Projected 2023 Spending: $23,555

Household & Insurance – $9,465 ($789 per month)

- Rent/Housing: $8,875 ($740 per month) Our lease is up in May 2023, and we’ll go month-to-month and move into the triplex sometime later in the year. Budgeted for an increase in my portion of housing costs after June.

- Water, Commons, Sewer: $330 ($27.50 per month, level billing)

- Trash: $90 ($7.50 per month, level billing)

- Electricity: $420 ($35 per month average) This includes higher average bill in summer due to portable AC unit when the air is bad quality.

- Household Items (detergent, TP, toothpaste, razors, etc): $240 ($20 per month average)

- Internet at Home: $0 This is now paid for by SSO’s employer due to being remote employee, was $20 per month.

Basic Food – $2,820 ($235 per month)

- Basic Groceries: $2,280 ($190 per month average) – this is much higher than it’s ever been, but I can’t see it going any lower.

- Treats: $240 ($20 per month average) – this is a category for cookies, chips, things I don’t really need but get as a “treat.” I track it separately from regular groceries to be aware. My 2021 average was $17.75/month, my 2022 average was $19.58/month.

- Coffee/Tea For Home: $240 ($20 per month) Coffee is getting priiiiicey

- Farm Share: $0 We are likely not getting a farm share again this year.

Local Transport – $300 ($25 per month)

- Bike Repairs & Parts: $155 A tune up on my bike.

- Local Transit Trips: $145 – No more free transit through work.

Fitness – $100 ($8 per month)

I’ll probably spend some money on things like stretching bands or new running shoes.

Health Care – $1,500 ($125 per month)

My health care costs were a disaster this year because of the implementation of a Copay Accumulator Adjustor Program. Until this program was implemented, most of my medical copays were covered by the co-pay assistance program for my drug (which currently has retail costs of $10,300 per month). Within a month or two, I would hit my out-of-pocket maximum using the manufacturer assistance. This year, in order to not get screwed, I switched to a no-deductible EPO.

- Copays: $660 This will cover my other drugs not covered by co-pay assistance and provider copays.

- Contacts: $260 Cost of a one-year supply after vision insurance.

Figure Skating – $1,895 ($185 per month)

In 2019, I took up figure skating again after a 15-year break from the sport. I love it and am better at it than I am at most things. It’s exercise, community, meditation, creativity, sparkly costumes, and skill, all rolled up into one big expensive package.

- Ice Time: $905 this is honestly quite low

- Coaching: $660 (Private lessons)

- Fees: $100 (annual USFSA membership)

- Skate Sharpening: $40

- Costumes, Laces, Bunga Pads, + Tights: $150

Looking Good – $470 ($39.17 per month)

- Hair: $380 4 professional haircuts, 2 bang trims, and restocking supplies.

- Makeup: $130 A professional necessity.

Clothing/Shoes – $800 ($66.67 per month)

- Clothing: $800 I’m hoping to focus more this year on only filling in and replacing clothing, as we’re moving.

Food & Drink Out – $310 ($26 per month)

- Restaurants + Bars/Takeout: $240 this is pretty low, but yet still higher than my historical numbers (about $7 per month).

- Tea/Coffee Out: $120 ($10 per month average) consistent with 2017/18 levels, way above 2019 and 2020 averages.

Giving/Gifts – $600 ($50 per month)

- Charitable Donations: $500 I do most of my giving through Oh My Dollar!

- Gifts: $100 – A pretty consistent annual amount, give or take a wedding/baby.

Flotsam $600

- Spending Money: $120 $10 per month – This is for candy, library fines, random things not captured elsewhere.

- Citzenship Costs: $240 I applied in 2021 for Croatian citizenship via heritage (my grandfather emigrated from Yugoslavia). I will hopefully find out in summer 2023

Home Decor $1,000

??? No idea how much this will be, we are moving.

Moving Expenses: $600

We don’t know when we’re moving out of this apartment, but the end of our lease is this summer, and we hope to have the triplex ready to move into

Entertainment: $280

I want to prioritize going to more live performances this year.

Travel: $2,108

I’m going to Japan in March 2023, but I won’t have much lodging costs as we have a combination of work trip. I already purchased the flights using points.

Japan

- Food and Coffee: $480 is an average of $40/day which is a bit higher than the past. Inflation hasn’t affected Japan as much as most of the world due to their deflationary currency. I’ll likely be able to keep the expense lower than this because theres’s some costs. In 2019, I spent $516 in Japan, an average of $32.25 per day.

- Local Transit: $300 Includes shin

- Tours/Events/Museums: $100

- Incidentals: $280 – Random

- Shopping: $700 – this is how much I spent in 2019. I did go a bit mad then, but you know – stationary, things shaped like cats, sunscreen, lolita clothes 😂

Other Travel

- Probably a few other trips $700 – this is how much I spent in 2019. I did go a bit mad then, but you know

Savings Goal: 23% of my income

This is almost all retirement savings (SEP IRA). If I can stretch my income this year, then I will be able to save more.

My stretch, streeeetch goal is to save $20,230 as part of the 23 in 2023 Challenges we’re holding over at the OMD forums.

Monthly Business Overhead Costs: $171.98

Not in personal budget!

I have a number of regular costs that are not reflected in my personal budget. Most of these would not exist if I did not run a business and are used 90%+ for business purposes.

This does not include costs like equipment, paying contractors (editors, transcriptionists, assistants), Cost of Goods Sold (COGS), or the hundreds a month I spend on shipping. All of that appears on my monthly reports.

Below is my monthly overhead, including my cell phone, paid for by my business.

- Mobile Phone Plan through Mint: $25 per month

- Adobe CC Membership: $40 per month

- Shopify: $29 per month

- Convertkit: $49 per month

- Web Hosting: $50 per month

- Google Storage: $1.99 per month

- Backups: $5 per month

- Apple Storage: $9.99 per month

I agree that this essay is great and full of important information. I will visit your blog more. While you make a good point, what about the other side? I appreciate it.

Ah, the budgeting adventures of Lillian! From figure skating to Japanese adventures, it’s a financial rollercoaster with a dash of lolita clothes and stationary madness!

The plan appears to be quite detailed, even including potential fluctuations due to events such as moves and travel.

Newsom presented a 2023-24 budget that dealt with a projected $31.5 billion deficit.

Lillian’s budget is really detailed! It breaks down her spending on everything from groceries to figure skating. I wonder how close she came to her goals.

One of the highlights of the Incheon Room is its stunning views. Whether overlooking the city skyline or the tranquil waters of the Yellow Sea, each room offers a picturesque panorama that captivates the senses. Wake up to the sight of the sun rising over the horizon or unwind in the evening as the city lights twinkle in the distance.

Collection of reliable Coatings supplier information from around the world. Help buyers and sellers establish initial digital contact and promote subsequent good cooperative sales relationships.

From large multinational groups to small start-ups, COATINGSDIRECTORY have been committed to establishing equal and accurate customer group linkages for many years.

Functionally, underclothes serves numerous functions. for example, it facilitates take in sweat and moisture, keeping the frame dry and relaxed at some point of the day. that is particularly essential for the duration of bodily activities or in warm climates. additionally, certain sorts of undies offer aid to precise regions of the frame, including the genitals or breasts, supporting to prevent pain and capacity harm.

As day turns to night, London’s skyline comes to life with twinkling lights, mirroring the city’s endless possibilities. From chic rooftop bars to historic pubs, the nightlife caters to every taste, ensuring that the pulse of London never wanes.

Whether adorning a tabletop, adorning a facade, or simply enriching our daily lives, ceramiche invite us to connect with the past, celebrate the present, and imagine the possibilities of the future. In their beauty and simplicity, they remind us of the enduring power of human creativity and the profound significance of the objects we create.

Step into the world of luxury timepieces with our range of replica watches. Meticulously crafted to capture every detail of the iconic designs, our watches offer impeccable accuracy and style. Whether you prefer the classic sophistication of a Rolex or the sporty elegance of a TAG Heuer, our replicas deliver the prestige without the hefty price tag.

Wow, Lillian’s meticulous budget breakdown for 2023 is eye-opening! Her detailed planning and transparency are inspiring. It’s impressive how she juggles personal and business expenses with such clarity and foresight.

Virtual simulations in gaming allow for experimentation without real-world consequences.

The architecture along Grand Avenue is diverse, reflecting different periods of Pomona’s development. From historic buildings that hark back to the early days of the city to modern constructions that illustrate its growth and modernization, the avenue showcases a fascinating architectural timeline.

Another gift of faith is hope. Faith instills a belief in the possibility of a better tomorrow, even in the darkest of times. It empowers individuals to persevere through adversity, knowing that there is light at the end of the tunnel. Hope fuels optimism and fosters a sense of purpose, guiding individuals towards their aspirations and dreams.

GCT Solution is a comprehensive service designed to address various business needs with a focus on innovation and efficiency. This solution leverages advanced technologies and methodologies to optimize processes, enhance productivity, and drive growth for companies across different industries. By integrating cutting-edge tools and techniques, GCT Solution provides tailored strategies that align with the specific goals and challenges of each business.

In addition to automation, Zillexit Software offers robust workflow management features. With customizable workflows, businesses can map out processes, assign tasks, track progress, and ensure accountability across teams. Whether it’s managing projects, handling approvals, or coordinating complex workflows, Zillexit Software provides the flexibility and scalability to adapt to the evolving needs of modern businesses.

The plan is very detailed and even accounts for changes due to things like moving or traveling.

This article offers a fascinating insight into a detailed budget and honest reflections on projected expenditures for 2023. Impressive to see such levels of organization and financial responsibility.

One of the most appealing aspects of Basketball Stars is the ability to construct characters based on great players.

French Bulldogs are known for their adaptable and friendly nature. They thrive on human interaction and enjoy being part of a household’s daily activities. Whether it’s lounging on the couch, playing in the yard, or going for a walk, Frenchies are always eager to be by their owner’s side. Their sociable nature makes them excellent pets for families with children, as they are patient and gentle with kids. Additionally, their small size and minimal exercise requirements make them suitable for apartment living, as long as they get enough mental stimulation and affection.

construction fast &easy funding loan Minneapolis

Electronic cigarette oil is often preferred over traditional cigarettes due to its cleaner vapor and lack of combustion.

Ragnarok Servers with unique pet systems can add an extra layer of strategy and fun to the game.

Bensedin Diazepam 10mg helps me with my insomnia and anxiety. It’s a very effective medication when used correctly.

Thanks for sharing the details about 2023 Budget: Who Knows and it will provide us the information that we all need. Many people are searching for it and it will provide us the right results.

The 2023 Budget Who Knows provides the best results and it is good for the users who want to know more about these budget details. If you find more and more ideas here you will find the best solutions that you need to know.

We express our sincere gratitude for the vast expertise and sincere enthusiasm you so generously shared. I am extremely grateful for the support you have given me, because it is important in my work and inspires me.

Your 2023 budget seems really well-thought-out! I’m impressed with how detailed your categories are. How do you find balancing the figure skating expenses with your other priorities?

Your plan for saving 23% of your income is ambitious and inspiring! How do you stay motivated to stick to such a high savings goal throughout the year? Any tips for maintaining that level of discipline?

Engage in a musical journey with a virtual choir of animated blobs. In blob opera, you guide four blobs to sing in harmony by adjusting their pitch. It’s a creative and engaging game that allows players to experiment with different sounds and create unique compositions.

Nice post! Thank you for the great content you shared.

Thanks for sharing this. It’s exactly what I needed to read today.

Glad to check this site, it’s informative.

Thanks for the information you shared here.

I would love to see more articles like this in the future. Keep up the good work!

Interesting post! Thanks for the share.

Who knows is the best for us and can provide us the ideas that are good to get the solution that we need. These updates are the best for us, and it can provide us with the right results.

I’m glad to see an informative content on this site.

I appreciate the depth of research and clarity in your writing.