February 2018 Report

Fun things that happened this month:

- I spent almost the whole month working on Get Your Money Together book, which started coming out in weekly chapters on Feb 7th to backers. Weekly readers are now on Chapter 4 (Savings), and it’s been really fun to see their feedback (and get their typo fixes – wow!) The deadline to get the book to the printer (in order to ship to readers during April) is this week! So that’s terrifying.

- I’ve continued co-hosting “News with Friends” on XRAY.FM’s morning show on Wednesdays from 7AM – 8AM, though we had a week off due to Portland snow.

- I went to a screening of a rare Todd Haynes film hosted by Todd himself at the Hollywood Theater. I can pretty much touch the Hollywood Theater (a rad non-profit movie spot) from my apartment window, but we almost never go see films (because I’m cheap and don’t like to stay up late)!

- I got a new workout shirt

and mildliner pens

with free gift cards I earned on Swagbucks. It was fun to get things with no money out of my own pocket. Both were purchases to replace worn-out items, and brought me a great deal of joy. Sometimes it’s the simple consumerism that can delight. ;)

- I also used Swagbucks giftcards to offset some of the cost of restocking my skin care items that I last got in Seoul in September. The winter biking and cardio workouts have been brutal on my skin so I decided to invest in getting high-quality skincare.

Things I want more of in coming months:

- Time to work on the business without distraction: I am feeling very stretched right now with my part-time job, volunteer obligations, side projects, radio show, sales, and launching the book. I only am getting ˜23 hours a week to focus on the business despite working 7 days a week. I need to say no to additional obligations in order to make time for my business.

- Dancing: I have been working out and stretching, but I haven’t gone to a dance class despite budgeting for it. If I am going to accomplish my secret dance-related project this summer, I need to move this up in priorities.

- Lifting: The gym has been really crowded around the weight racks, and I haven’t been doing strength training much. Back to it!

- Dedicated down time: I have not been scheduling down time (especially whole days off). So instead, I get overloaded and my brain just “gives up” and I have terrible procrastination-guilt-monster unscheduled downtime that’s not even fun because I feel I should be working. Not to mention, I get sick from going too hard (like right now). It would be better to pre-plan down time and not have awful unplanned days.

- Speaking and teaching gigs: I come alive when I’m teaching and speaking in public. I got into this whole business thing in order to do more of it. It’s time go hard on the speaking gig sales!

- Income: Maybe it goes without saying, but I would like to increase my business income. I’m aiming to get to $1000 per month take-home averaged by the summer (right now I’m averaging $600 per month take-home) from my business.

Things I want less of in coming months:

- Doubt about my business: This month was particularly fraught with the anxious thought loop of “should I even be doing this?” and “why don’t I just get a ‘real’ job and save a ton of money?” and “this industry is so crowded, I should just go get a job as a [flight attendant/data analyst/figure skating coach/grant writer/tax preparer/english teacher in Austria]” Though entrepreneurship is rarely easy and currently isn’t paying me super well, I would like to stop second-guessing my decision to try this thing out for my own mental health for at least the next 6 months. I’m super-excited about the work I’m doing! I want to keep doing it! Sometimes I wonder if I would go “all-in” on the business (instead of having a side gig) if I would have more doubts or less doubts.

- Coffee consumption: I’m working on reducing this; I stocked up the decaf teas and that has been helping. But caffeine consumption is still too high (for example, as I write this, I’m on my 4th cup of coffee.) I need to invest in matcha, which is better for my skin and my anxiety levels, and is delicious – but it’s pricey!

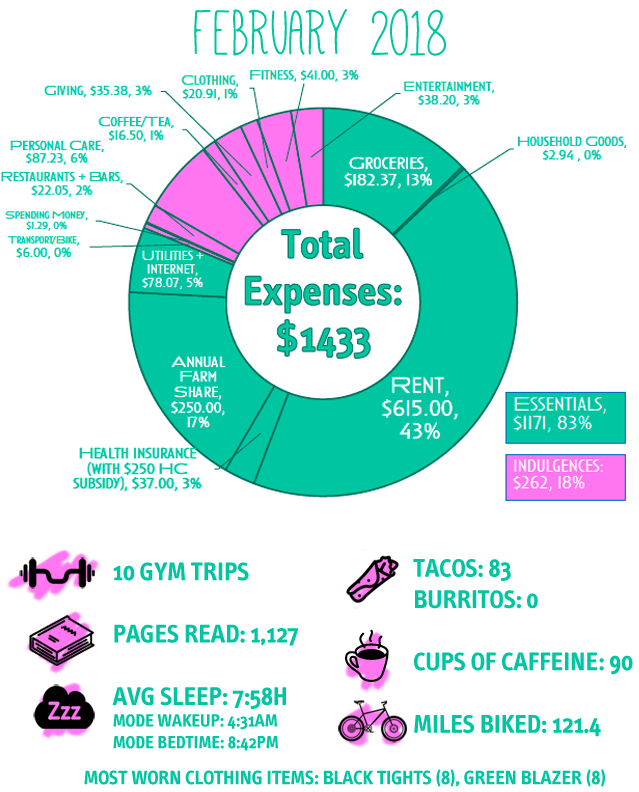

- YTD Spending: $2,609/ $20,000 maximum goal

(13% of total at 16% through the year)

Essential Expenses (in descending order): $1,171.38

Rent: $615.00

Groceries: $167.39

(Groceries – $115.58, “Treats” – $51.81, Coffee/Tea for Home – $14.98)

Annual farm half-share: $250

(I pay for this once a year, and during summer and fall it provides 24 weeks of fresh organic vegetables from a local farm. I save for it in my sinking funds.)

Electricity: $30.60

Health Insurance (after subsidy)*: $37.00

Water/Garbage: $27.50

Internet: $19.97

Bikeshare Membership: $6.00

Household Goods: $2.94 (parchment paper)

Notes: Treats budget (meant for ice cream, mochi, pre-packaged beverages, and snack foods) is out of control. I discovered that they have vegan mochi at the Trader Joe’s one block from my house, and I also wanted a lot of snacks thanks to book deadline. Emotional grocery spending at its highest. Maybe I need to do a treat-free challenge month?

Discretionary Food & Drink (in descending order): $38.55

Restaurants: $22.05

Coffee: $13.50

Fancy Tea: $3

Bars: $0

Discretionary (in descending order): $224

Skin Care: $58.37

Fitness Monthly Membership: $41.00

Grooming: $28.75 (got my eyebrows sugared for the first time.)

Clothing: $20.91 (Popflex Workout Shirt)

Entertainment: $38.20 (Bought ticket to a live Crazy Ex-Girlfriend show)

Gifts: $25.48

Giving: $10.00

Pocket Money $1.29

*Health Care Subsidy Note

My high-deductible health insurance is super-cheap at $37 a month, thanks to taking the low-income ACA health care subsidy (down from a “sticker price” of $284 per month). This subsidy is based on an adjusted gross income (AGI) of $22,000 – which I hope to exceed, if my business goes well. If I do exceed that, I will have to repay a portion of my health care subsidy, up to $2,964.

Because of receiving the health care subsidy, I’ve switched from putting my retirement savings in my Roth IRA to a Traditional IRA, since Traditional IRA contributions are deducted from your AGI.

This means that if my income goes up by $5,500 and I manage to put that all in my Traditional IRA, I will owe nothing back for my health care subsidy because my AGI will not change (Roth contributions are not deducted from AGI because they are post-tax).

2017 Taxes Total Paid This Month: $193

Portland Arts Tax: $35.00

Oregon Tax: $158.00

This is actually excellent news. I had expected to owe up to $2,000 in taxes and had saved for it, but thanks to the health care subsidy, I’m actually getting back $1,300 from the federal government. So this actually is amazing for me!

Money Set Aside in Sinking Funds (Not Yet Spent): $161.20

CSA Farm Share $20.85 ($250 per year)

Bike Drivetrain Repair Fund $40.00 (towards $200 in May)

Renter’s Insurance $11.50 ($140 per year)

Dental Fund $30

Half Marathon Fund $16.63

Haircut Fund $12.22 ($55 every 5 months)

Clothing Fund $30

Savings: $1,412.92 (50%)

Traditional IRA contribution: $304

Cash Savings: $1,108.92

($2,598 YTD or 25% towards my goal of saving $10,000 this year)

Instead of showing last month’s income, I will now show my true income for the month. This is due to a change in the way YNAB does reporting, but also because it was getting confusing for folks since I have variable income. I still live off last month’s income.

My income was high this month due to the tax refund but is expected to go down in the coming months (possibly below regular expenses), so I actually “sent” forward quite a bit of my income to future expenses. My expenses are now budgeted through the end of April, meaning I have $2,312.43 in my checking account allocated towards future expenses but not reflected in my “savings total”.

I try to have as long a wait as possible between acquiring money and using it on expenses. The savings total is reflected is only money set aside specifically as long-term savings/retirement investing.

Total After-Tax Income: $2,822.14

Oh My Dollar!: $662.50 (this is my paycheck after expenses, COGS, and tax)

Part-time Fitness Studio Job: $853.63

Federal Tax Refund: $1,306