January 2018 Report

January involved a lot of staying inside trying to finish Get Your Money Together Workbook, which comes out in digital format next week! The stress of writing a book is reflected in my high coffee + “grocery treat” spending. I also worked a fair amount at my part-time fitness studio job, which has me getting up at around 4:30AM (I love it!)

Fun things that happened this month:

- I catalogued all 198 clothing items I own in a giant spreadsheet (holy procrastination!) I’ll follow up with more details on this project soon.

- I was a radio newsreader for the first time, co-hosting “News with Friends” on XRAY.FM’s morning show. I’ll now be co-hosting most Wednesdays from 7AM – 8AM.

- I had a piece published in the Portland Mercury.

- Stream PDX announced our inaugural fellowship program.

- A bunch of cool business things I can’t talk about yet.

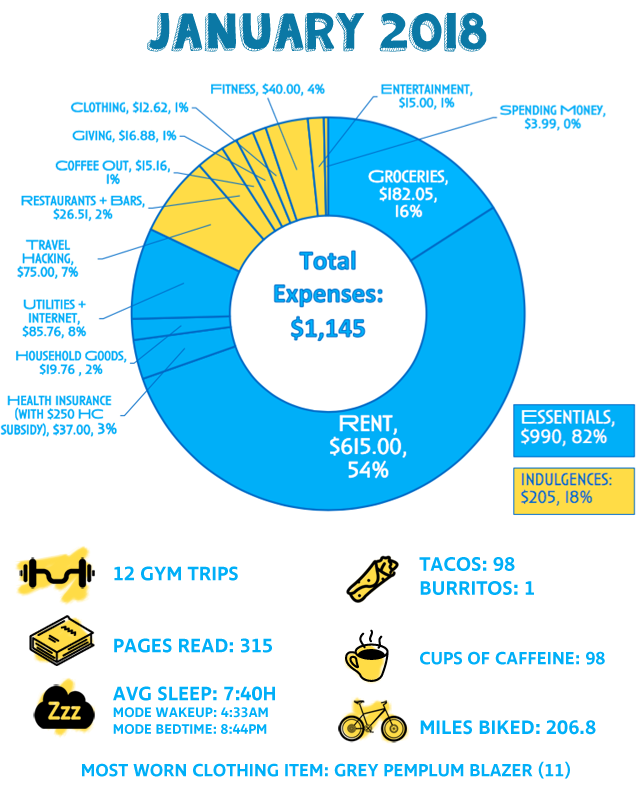

YTD Spending: $1,145/ $20,000 maximum goal

(5.7% of total at 8.3% through the year)

Essential Expenses (in descending order): $990

Rent: $615.00

Groceries: $182.05

(Groceries – $144.60, “Treats” – $26.47, Coffee/Tea for Home – $10.98)

Electricity: $38.29

Health Insurance (after subsidy)*: $37.00

Water/Garbage: $27.50

Internet: $19.97

Household Goods: $19.76 (semi-annual TP + laundry detergent restock)

Notes: I actually had to move money from other categories into the grocery budget, that’s how over budget I went. I spent a TON this month on “treats” (snacks, kombucha) which was almost all related to book stress.

Discretionary Food & Drink (in descending order): $41.67

Restaurants: $21.51 (2 were emergency burritos during unexpected double shifts at work)

Coffee: $15.16 (mostly “work from coffee” shop purchases)

Bars: $5.00 (three soda waters at bar meetings)

Travel Hacking: $75.00

Bank of America Card fee: $75.00

Discretionary (in descending order): $58.99

Fitness Monthly Membership: $40.00

Clothing: $12.62 (was $37.62 but got a $25.00 swagbucks gift card)

Entertainment: $15.00 (Funhouse Lounge show)

Spending “Fun” Money: $3.99 (Stylebook app)

Health Care Subsidy Note

This was the first month where my health insurance dropped from $231 a month down to $37 a month, thanks to taking the low-income ACA health care subsidy. This subsidy is based on an adjusted gross income (AGI) of $22,000 – which I hope to exceed, if my business goes well. If I do exceed that, I will have to repay a portion of my health care subsidy.

Because of receiving the health care subsidy, I’ve switched from putting my retirement savings in my Roth IRA to a Traditional IRA, since Traditional IRA contributions are deducted from your AGI.

This means that if my income goes up by $5,500 and I manage to put that all in my Traditional IRA, I will owe nothing back for my health care subsidy because my AGI will not change (Roth contributions are not deducted from AGI because they are post-tax).

Money Set Aside in Sinking Funds (Not Yet Spent): $250.51

CSA Farm Share $21.00 ($250 per year)

Bike Drivetrain Repair Fund: $40.00 (towards $200 in May)

Renter’s Insurance $11.50 ($140 per year)

Dental Fund $50

Half Marathon Fund $26.67

Haircut Fund $18.34 ($55 every 4 months)

Clothing Fund $33.13

Makeup $50 (I hate makeup but it occurs to me I should learn how to do it for camera)

Savings: $1,555 (32%)

Traditional IRA contribution: $196

Cash Savings: $1,359.51

(15% toward my goal of saving $10,000 this year)

Total After-Tax Income: $4,830

My stated income comes from my December income, because I live on last month’s income. Because December was such a high earning month due to Kickstarter income and the next couple months will likely be thin for earning, I actually allocated December’s income out 3 months in the future.

Oh My Dollar!: $3,417.60 (about $3,000 was take-home from $15,000 Kickstarter after expenses and taxes)

Part-time Fitness Studio Job: $774.74

Freelance Graphic Design: $639.00