Good things that happened

Closed out a very successful Kickstarter for the reprint of (now titled) A Cat’s Guide to Money

This June, I closed out the kickstarter for A Cat’s Guide to Money, the new title for the 2nd printing of my book, raising $19,211 from over 600 generous people – way more than the $6,000 goal. The early bird books are (hopefully) shipping to backers in July, and the rest of the books and goodies are going out in September! (You can still preorder here.)

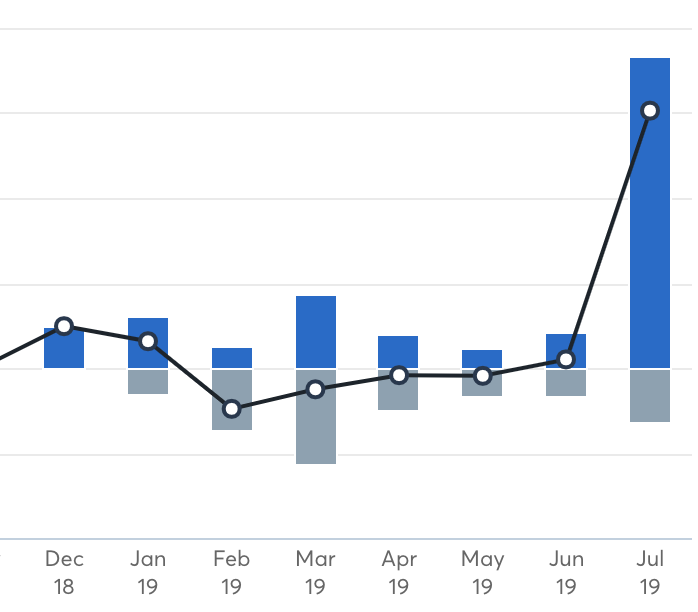

Income!

After months of complaining, the combination of Kickstarter money (though a low percentage is passed on to me), numerous speaking gigs, and other delayed checks coming in means that my income is rather high this month. I’ve put a LOT aside for future months, including my upcoming month living in London.

Less Good things that happened

Broke my left wrist

I broke my left wrist, unexpectedly, while just falling while standing and chatting with some folks at the ice skating rink. (Pretend I was doing a triple salchow instead, it sounds more impressive.)

It didn’t hurt much, and I honestly thought it was sprained not fractured. Having broken my other wrist 7 years prior, I know wrists are sneaky, so I did get an xray (and then a CT scan) and confirmed it was broken and I probably needed surgery – again.

I learned that people with RA have softer bones, meaning it’s harder to simply cast the bone and have it heal all on its own. Unfortunately, the CT scan also revealed some long-term damage to my joints due my RA – things called “bone cysts”. Nothing we can really do about them, and they aren’t immediately worrying, just something to keep an eye on.

Because my upcoming travel schedule was/is packed (I’m typing this on a plane right now, actually), I had to thread the needle with scheduling surgery and follow-up appointments, and I got in for surgery just 5 days after I broke my wrist. While surgery is a great and justifiable excuse to take some time off, I felt like I don’t have a lot of time to lay around, so the day after surgery (after my mandatory 24 hour by my generous mother and friend S), I was off to a conference all weekend.

The wrist is healing, but I have to be careful skating while it heals, which is a bummer as I don’t want to lose my progress I’ve made since I started back a few months ago. I also can’t bike, which means I’m stuck on transit; which definitely adds up in both time and expense.

Incidentally, the wrist breakage led to me engaging a bit of food- and retail-related therapy, so look for those on my July report.

My pebble finally died

My pebble smartwatch finally stopped working, 2 years after the company was acquired by fitbit. I am sad, and have now replaced it with a Fitbit Versa, which is fine, but: “it isn’t a pebble”.

Still Drowning

Catch up on Video Editing Backlog

This has only gotten worse. Three months running now, I have filmed lots of footage and not finished editing it to upload.

I actually recently rewatched my youtube videos and I don’t hate them! I want to do more of this, I have big plans for videos I want to make – I simply need to prioritize the time.

Projects coming up:

- Oh My Dollar! budget planner comes out in September – my first ever planner!

- Better patreon perks! I have been slacking on my stewardship of my patrons, and am going to revamp this program.

- Macroeconomics for Muggles video series

- More video and radio collaborations

- Filming a (secret project) on ice

- Staying in London for all of August

- Training to compete at the Adult Figure Skating Nationals

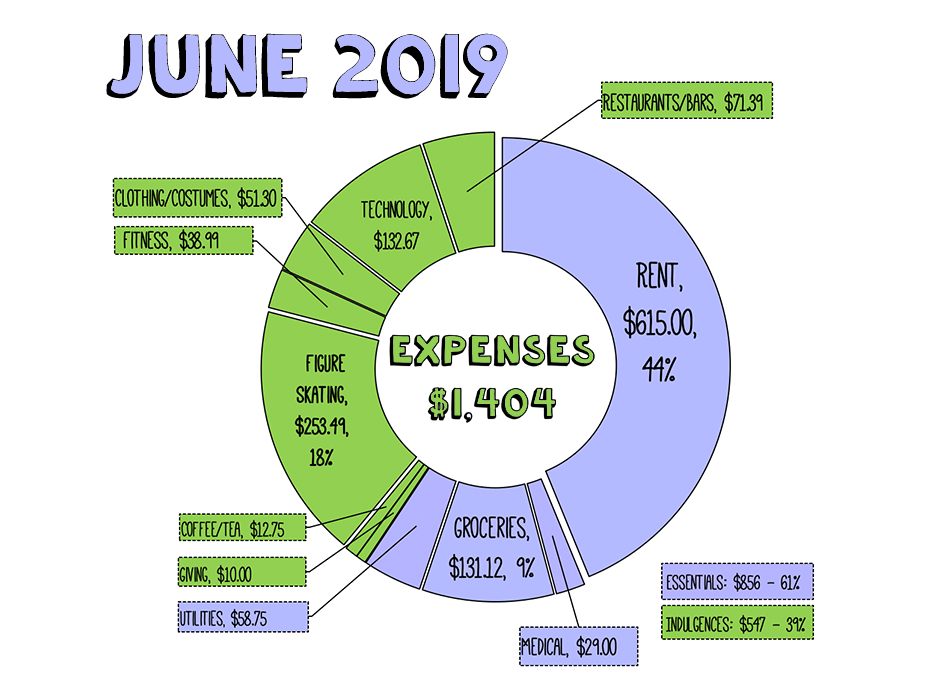

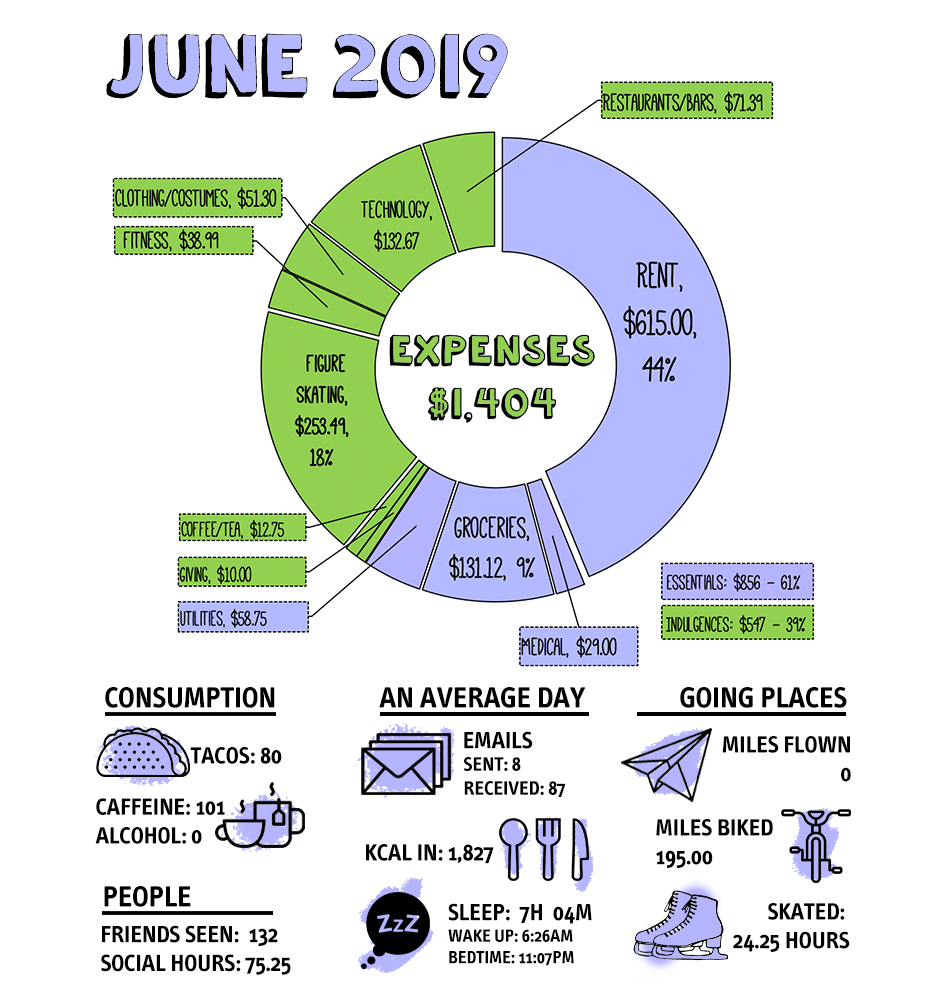

Full June 2019 Spending Report

Total Spent: $1,404

Right on target – 49% of total annual budget at 49% of the way through the year.

Household & Insurance – $668.86

- Rent: $615

- Water, Commons: $27.50

- Garbage: $3.33

- Electricity: $27.92

- Internet at Home: $0 This is now paid for by SSO’s employer due to being remote employee, was $20 per month.

Basic Food – $158.45

- Basic Groceries: $117.97

- Treats (non-essential snacks): $35.48 – very high this month due to pedapalooza and post-surgery expenses

- Coffee/Tea For Home: $5.00

Extra Food + Drink – $79.14

- Coffee Out: $7.75

- Restaurants: $63.89 (high due to pedalpalooza)

- Bars: $7.50 (tips for club soda and pride brunch mocktail)

Medical – $29.00 ***Why this is so cheap

- Health Insurance Premium: $29.00

Fitness – $38.98

- Gym Membership: $38.99

Giving/Gifts – $10.00

- Charitable Donations: $10.00

Random Indulgences – $183.97

- Fitbit Versa Special Edition: $132.67 (to replace my 5 year old pebble that died)

- Clothing: $51.30 (first new bras in 5 years)

Figure Skating $253.49

Figure skating is super expensive- ice time is one of the most expensive things you can buy. Currently, I’m mostly skating on low-traffic public session at a mall instead of the advanced freestyle sessions and I don’t have a coach (which I need). I pay for 7 weeks of public skate time at once and try to get my marginal cost per hour as low as possible. Year to Date, my marginal cost per hour of skating for ice time is $3.91/hour.

- Ice Time: $134 (public skate through July 20th and 2 freestyle sessions)

- Coaching: $68 I finally got a coach this month and this cost represents an hour of private coach time.

- Costumes: $40.99 After 3 months of keeping this up, I treated my to first figure skating costume in 15 years from ebay. I got it to match my hair!

- Random: $10.99 (tape for my skates)

Sinking Funds – not yet spent

- Renter’s Insurance: $11.50 ($140 per year)

Retirement savings: $100

OMD Business Income + Expenses Report

This is cash-based accounting, not accrual, so this only accounts for income received this month, not invoices billed. Some of the income may be work done in previous quarters, depending on how fast people pay me. That means that a number of the expenses incurred may be covered by reimbursements or sales received in another month. This month in particular is a LOT fuzzier on the tax savings side due to the

Income & Sales: $18,947.05

- Book + Kindle Sales (net after fees): $308.62

- Kickstarter (after kickstarter fees): $17,141.54

- Radio Ads: $13.16

- Freelancing: $75.00

- Online Course: $28.31

- Patreon Memberships: $379.41

- Speaking Fees: $750

- (Random Refund): $58.27

Expenses: $610.23

- Charitable Donations: $25.00

- Advertising: $43.00

- Meals: $12.48

- Shipping: $19.00

- Hosting + Software: $201.80

- Payroll & Contractors: $250

- Phone: $40.00

- Professional Fees: $58.95

I pay quarterly estimated taxes on my business income, so I save 30% of my net (after expenses) income in a separate account. Please note reimbursements for expenses incurred – such as travel to a gig – are not considered taxable income. There is less here than 20% of June’s net because I have more than $11,000 earmarked for various COGS/expenses related to the kickstarter fulfillment.

Congratulation! I have a good day

The post presented me with a wealth of information, allowing me to broaden my horizons