YTD Spending: $15,466/ $20,000 maximum goal

YTD Spending: $15,466/ $20,000 maximum goal

(77% of total at 91% through the year)

This is the latest that I’ve ever gone in posting my monthly report (it’s the 17th of the next month now) and that’s largely because I’m not super proud of how November went. Worn down by 13 weeks of putting in 60+ hours a week, with a lot of business things in process that I can’t talk about yet, and finishing up a full-time contract, I just – don’t have much to talk about.

I also bought some expensive stuff this month and didn’t really want to show it off! I also barely exercised. But this isn’t meant to be a “monthly brag report” – it’s meant to be an accurate depiction of my expenses and stats. So here goes!

Exciting Things that Happened

- I spoke at PatreCon (Patreon’s conference) in LA, which was delightful. I met so many amazing creators and had great conversations with them, recorded some podcast episodes, and rocked a hot pink suit and a Bowie costume, and saw some friends.

- That’s pretty much the only thing that happened. Other than that I worked a lot and I bought a rug. This is the first time in my life I have purchased a rug. It was stressful. Rugs are expensive and hard to judge online.

- Oh, I had dental + vision insurance for one month through the contracting job I was doing, so I milked it for all it was worth and got everything I could possibly get – a year’s supply of contacts, a custom fitted biteguard so I stop grinding my teeth at night, a chip fixed in my front tooth – yay milking dental and vision while I have it.

- I moved to a new podcast network, AdLarge’s Cabana, but I don’t have much to talk about yet with that.

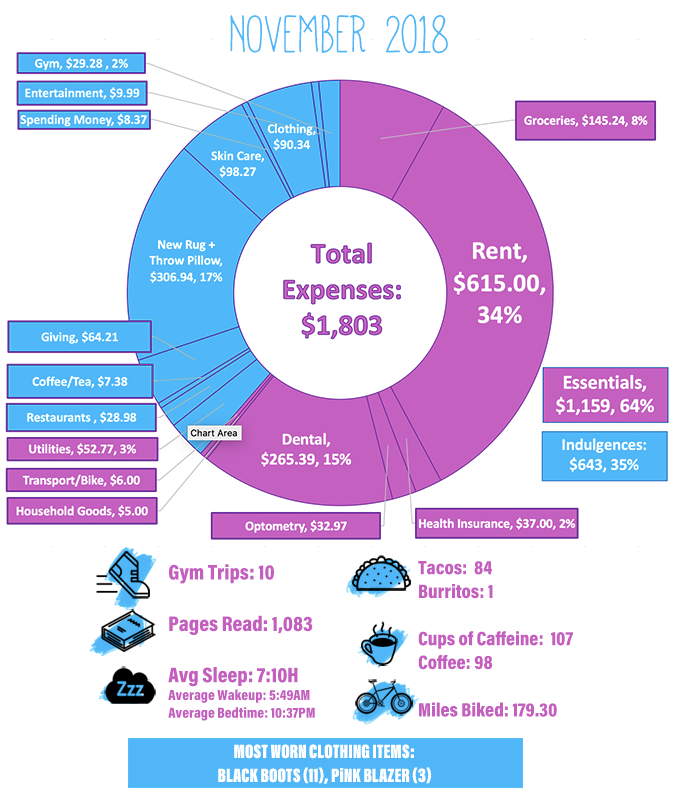

Full expenses report – $1,803

Essential Expenses (in descending order): $826.50

Rent: $615.00

Groceries: $147.73

(Groceries – $131.29, “Treats” – $13.95, Coffee/Tea for Home – $2.49)

Electricity: $25.27

Water/Garbage: $27.50

Internet: $0 – our internet is paid for by my SSO’s employer due to being a remote employee!

Transport/Bike: $6 (Bike Share)

Household Goods: $5.00 (dishwasher tablets)

Health Related Essentials (in descending order): $335.36

Health Insurance (after subsidy)*: $37.00

Dental Copays: $44.40

Dental Co-Insurance: $34.99

Biteguard Co-Insurance: $186.00 (~$400 covered by insurance)

Optometrist Co-Pay: $10.00

Contacts: $22.97 ($120 covered by insurance)

Discretionary Food & Drink (in descending order): $29.32

Restaurants: $28.89 (one ramen bowl + veggie wings for hot sauce competition at work + one salad)

Coffee/Tea Out: $4.89

Discretionary (in descending order): $607.40

Clothing: $90.34 (pusheen hoodie + new workout shirt + slippers for our cold house)

Skin Care: $98.27 (stocked up on a 6 month supply of various products during Cyber Monday)

New Rug: $280.94 – I have never in my life bought a rug, but I decided it was time. Rugs are expensive, especially new! I love this giant wool rug, so I think it was a good investment. It was about 40% off market rate on Overstock.com.

Throw Pillow: $26.00

Gym Membership: $29.28 (rejoined 24 Hour Fitness through a corporate rate from my contract job)

Gifts/Giving: $64.21 (combination of charity + personal gifts)

Spending Money: $8.37 (candy + a meal planning app)

Entertainment: $9.99 (interactive introverts on iTunes)

Money Set Aside in Sinking Funds (Not Yet Spent): $11.50

CSA Farm Share – We decided not to renew our Farm Share in 2019 due to all our planned travel abroad, so I removed the $188.95 built up in this category.

Renter’s Insurance: $11.50 ($140 per year)

November Savings: $947.00 (46%)

Cash Savings: $747.00

Traditional IRA contribution: $200

($7,200 YTD or 72% towards my goal of saving $10,000 this year)

November Total After-Tax Income: $2,025.57

Temp Job: $2,052 (I am withholding at a very high rate at this job rather than paying quarterly taxes this quarter)

Oh My Dollar! made ~$800 this month, but I am saving that up for a number of expenses coming in December so I did not cut myself a paycheck!

The savings total reflected is only money set aside specifically as long-term savings/retirement investing, not for future expenses. Due to some expenses being covered by sinking funds or previous months’ income, it may seem higher than possible compared to expenses.

*Health Care Subsidy Note

My high-deductible health insurance is super-cheap at $37 a month, thanks to taking the low-income ACA health care subsidy (down from a “sticker price” of $284 per month). This subsidy is based on an adjusted gross income (AGI) of $22,000 – which I hope to exceed, if my business goes well. If I do exceed that, I will have to repay a portion of my health care subsidy, up to $2,964.

Because of receiving the health care subsidy, I’ve switched from putting my retirement savings in my Roth IRA to a Traditional IRA, since Traditional IRA contributions are deducted from your AGI.

This means that if my income goes up by $5,500 and I manage to put that all in my Traditional IRA, I will owe nothing back for my health care subsidy because my AGI will not change (Roth contributions are not deducted from AGI because they are post-tax).