November was…a month.

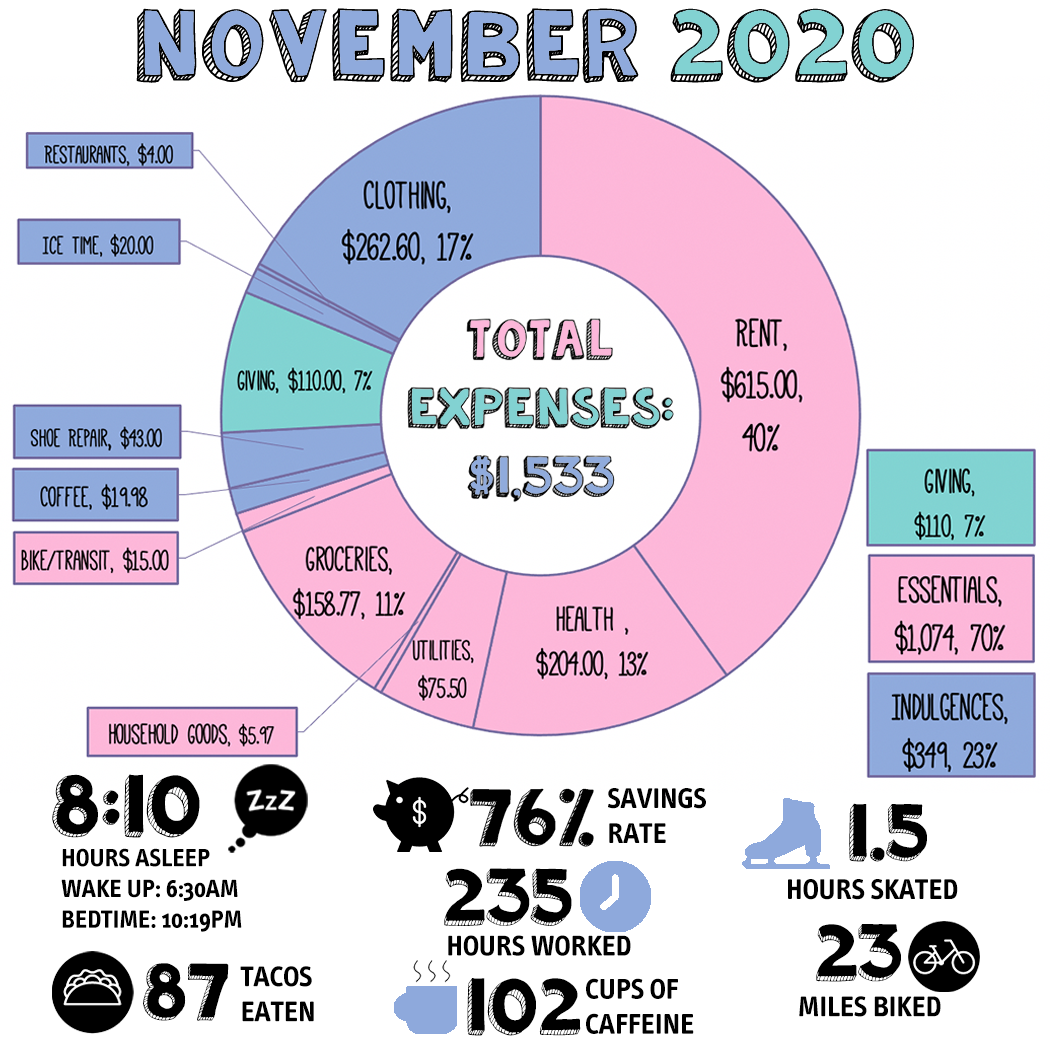

I don’t know what to say about it. I worked a lot. I shipped over 100 packages. I applied to grad school. I tried to hold myself together through the election uncertainty by putting my phone into airplane mode for most of my workday. My workout regime started to fall apart as soon as the time change happened and my workday started when it is pitch black, and ended when it is pitch black.

Trump was NOT re-elected president of the United States.

An article with my face on it came out in the local paper, as part of a group of staff and former staff who whistleblew on the executive director’s treatment of women and mismanagement of the finances at my former employer. I lost my Uncle unexpectedly due to suspected long-term complications from contracting Covid in the spring. It was just…a month.

I also went skating for 90 minutes, taking the day off after the election and biking 16 miles to Vancouver, WA to a rink that just reopened two days earlier. Unfortunately, 2 weeks after the rink reopened, they had to close again as Covid cases surged again, to the worst levels the pandemic has seen. The ice wasn’t even set all the way before they had to shut down again.

I paid myself a lot from Oh My Dollar! after finally getting the check from a gig I did in August, but I don’t feel great about my work on OMD right now. I’m not producing the quantity or quality of content I wish I could be doing. Working a full-time job and running a business is…a lot.

In order to try to figure out how to manage making content and working my full-time job, I ordered a new planner for 2021. Planners solve everything, right?

My big splurge of the month was this raincoat from independent designer Miss Candyfloss. I’d been contemplating it for about a year, but it’s quite expensive – rightly so for a small brand that is made sweatshop-free in the EU. I went back and forth on whether or not it made sense to make an investment in a rain coat. With a higher amount of business income this month, I decided this was the month to splurge (My current raincoat is one I got for free from a clothing swap and actually doesn’t work great for my needs – it’s hard to bike in because it’s a straight-cut, for example).

I actually bought it lightly used from Poshmark when I saw it pop up in my size, which allowed me to save on shipping from the EU and get it for slightly less than the list price.

So, rain coats and planners aside – this was a month. We lived through it, okay? We survived to the end of November 2020.

December’s OMD challenge is called Put out the Dumpster Fire December

and I feel like that’s a good summary of how November 2020 felt.

and I feel like that’s a good summary of how November 2020 felt.

November 2020 Post-Tax Income: $6,462.33

(This is not normal income, just to be clear!)

- Day Job: $2,927.01

- Bank account interest: $.32

- Visa Gift Card Rebate from 1-800-Contacts: $35

- Oh My Dollar (full income/expenses report below): $3,500

Full November 2020 Spending Report

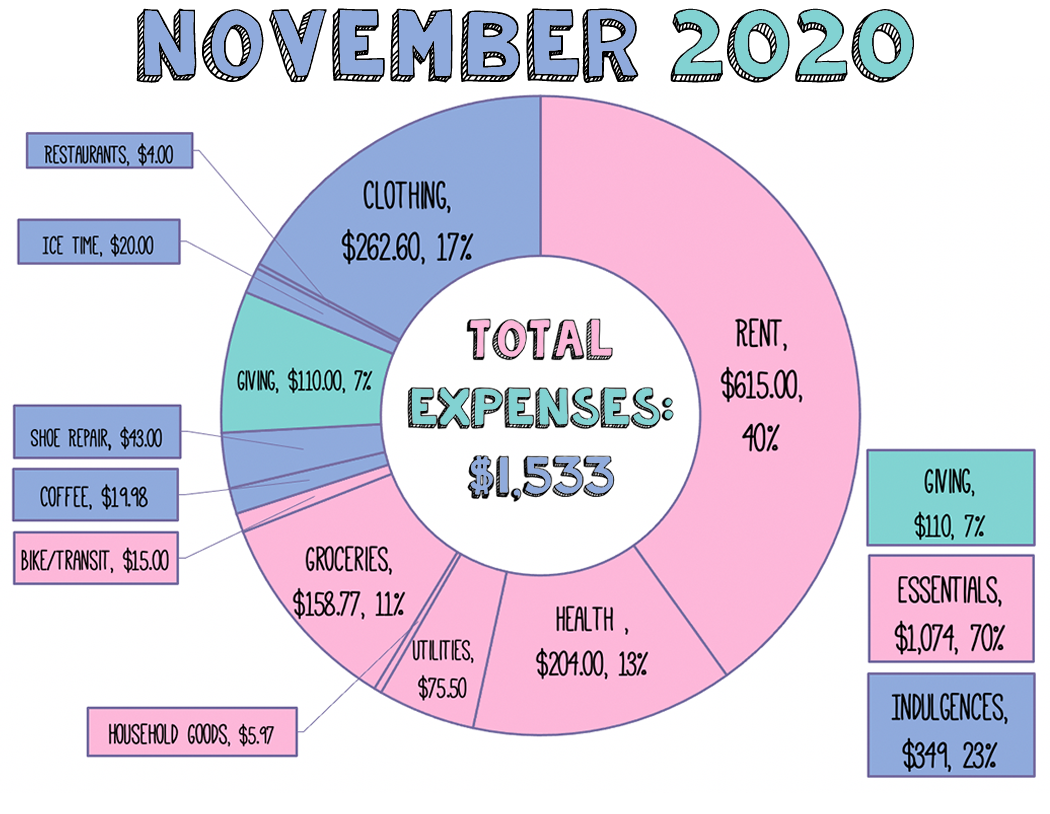

Total Spent: $1,533

On track! 78.7% of my total annual budget at 91% of the way through the year.

Household & Insurance – $711.22

- Rent: $615

- Water, Commons, Garbage, Sewer: $32.50

- Trash: $7.50

- Electricity: $35.25

- Household Items (detergent, TP, toothpaste, razors, etc): $5.97 (laundry detergent)

- Internet at Home: $0 This is now paid for by SSO’s employer due to being remote employee, was $20 per month.

Biking/Transit – $15.00

- Bag Repair: $15 I got the zipper repaired on my bike pannier after being broken for several years. Highly recommend. Should have done ages ago.

Giving + Mutual Aid – $110 (7%)

I am also donating through OMD (below). Giving this month was to XRAY.FM and TheNumberz.fm.

Basic Food – $178.75

- Basic Groceries: $143.13

- Treats (non-essential snacks): $15.64

- Coffee/Tea For Home: $19.98

Travel – $0 (lol)

Health – $204.00 ***Why this is cheap

- Health Insurance Premium: $204.00

Figure Skating $20

- Ice Time: $20.00

I went to the rink for 90 minutes of skating for the brief 2 weeks the rinks were allowed to be re-opened before we went back into “freeze”. I’m expecting that is the end of skating for the year as the rinks are now closed and cases are skyrocketing.

Looking Good – $262.20

I went wild here. I saw a raincoat I had wanted to get for over a year appear on poshmark and decided to go for it, and that was the bulk of the expense. I also bought a pair of sweatpants and a dress (from a US-made small business) during Black Friday sales.

- Clothing: $262.60 ($189.11 was the rain coat)

Extra Food + Drink – $4.00

- Restaurants $4.00 I split an order of take-out garlic knots from Sizzle Pie during pre-election night stress.

Flotsam: $43.00

- Shoe Repair: $43.00 I got the zipper repaired on my winter boots and the heels resoled. I spent almost double on the repair as I did on the boots when I bought them used, but oh well. Happy to have boots that actually stay closed now that’s it’s raining again.

Savings: $4,924

This is a combination of cash + traditional IRA savings.

I do not qualify for my employer-sponsored Simple IRA until Jan 2021, so for now I am saving in a traditional IRA – particularly because I expect to have a high tax burden this year (due to my highest ever income and having to repay my $70 per month health care subsidy). I expect to max out my Traditional IRA for the year ($6,000 maximum).

I am also saving cash towards the possible goal of paying for a master’s degree in cash in 2021-2022. There is nothing certain about that plan, but the worst-case scenario is that I save cash and I have more cash saved and can always invest it instead if the masters doesn’t happen. Not really terrible, all things considered.

Retirement savings: $931

Cash savings: $3,993

Savings rate: 76.2% of Post-Tax Income

YTD Total Savings: $26,314/$20,000

(131% Total of goal at 91% of the way through the year)

OMD Business Income + Expenses Report

It was Black Friday/Cyber Monday this month, so I shipped a LOT of stuff. OMTea sold out again.

I have put money aside for inventory restock and shipping, and other fulfillment costs.

My purrsonal finance society members have been keeping the business afloat in 2020 – with book sales, speaking income, and podcast advertising all down.

This is cash-based accounting, not accrual, so this only accounts for income received this month, not invoices billed.

Gross Receipts + Sales: $7,586

- Amazon Book + Kindle Sales (net after fees): $51.96

- Video Appearance Fees: $6,000

- Shopify/Direct to Consumer Sales: $673.72

- Radio Ads: $26.34

- Wholesale (Buyolympia): $86.70

- Patreon Memberships: $747.83

Total Expenses: $748.96

Charity: $103.00

This month our support went to Black Trans Femmes in the Arts (BTFA Collective).

OMTea Specific Expenses: $191.93

- COGS: $122.43

- Packaging: $69.50

Operating Expenses: $279.22

- Convertkit: $49

- Candy Rack for Shopify: $29.99

- Exist.io $6.00

- Meals: $41.89 (bought a gift certificate to make things easier for donuts for livestreams)

- Mailgun: $11.04

- Backblaze : $6.00

- Storage: $4.98

- Office Supplies: $95.32

- Hosting + Servers: $30 (Linode and Dreamhost)

- Media Subscriptions: $5.00

- Adobe Creative Cloud: $29.99

Cost of Goods Sold: $171.81

- Inventory (Print on Demand): $17.53

- Shopify: $29.00

- Shipping Supplies: $102.40

- Shipping: $22.88

Net Income: $6,837.59

- Tax Savings: $1,709 (25% of net income)

- Lily’s Salary: $4,662 (only $3,500 paid yet)

Thanks for sharing the information

Stickman Hook invites players of all ages to unleash their inner acrobat.

Thank you for this wonderful contribution. Your essay demonstrates your dedication and experience in this sector.

November sounds intense! Balancing work, grad school apps, and election stress is no joke. Sorry to hear about your uncle. Glad you found some escape skating. Maybe a little downtime with something simple, like playing block blast, could help de-stress and recharge. Hope your new planner brings some much-needed organization and focus for 2021. It’s great you’re prioritizing content creation!