September 2018 Life + Money Report

YTD Spending: $12,218/ $20,000 maximum goal

(61% of total at 75% through the year)

Well, I said last month that choosing to take a full-time temp job while speaking or staffing a conference every week, plus keeping the radio show and business afloat was a lot of work. Guess what? It was! I worked 276.5 hours of on-task time this month between all the jobs and conferences – and I actually took two full days off (one out of complete exhaustion after I unexpectedly didn’t have to staff a podcast gig, the other because I ran a race/did domestic chores all day). I attended 3 conference in as many weeks. I’m tired.

What’s getting me through right now is the phrase “this, too, is temporary”. My temporary full-time job is nice and they feed me lots of food and let me play with spreadsheets, the show is doing well, and I am back to squirreling away a significant amount of money to prepare for next year’s dark times. The work I’m doing isn’t physically hard, there’s just a lot of it.

And oh yea, big deal to me – I am giving a TEDx talk in just 10 days!

Good Things that Happened

- I spoke twice at Quantified Self in Portland: I kicked off the second morning with plenary talk about my #100daysofQS project.

- I launched a Patreon to support the show, and was floored at how awesome the response was. Thank you so much. I made a radio show about how my feelings of creativity have improved with the financial support.

- I staffed/sold books/recorded shows/dressed as bowie at Fincon and XOXO. My attendance at Fincon was supported by a scholarship from Brotman Financial Group – which meant a ton to me, as I wouldn’t have gone to Orlando on my own and the experience was really valuable. Both conferences made me excited about upcoming projects (youtube, mainly.)

- I bought the suit I’ve been on about since July (after much hemming and hawing and instagram polls). That’s why my expenses are so high this month. This suit was not cheap – but it’s made in the US, fabulous, has lots of cool pockets, and I’ve already worn it a ton. I expect to get lots of use out of it, including wearing it for my Ted talk.

Things to Improve On

- After the air quality disaster that was August, I was seriously behind on training for the Boring Half-Marathon as I wasn’t able to run outside for weeks in August. Both myself and Aaron decided to shift down to the 8K, thinking we may injure ourselves in the half.

We both did well in the 8K (I PR’d and came in 2nd in my age group, Aaron came in 1st in his age group!), but the point of the half-marathon wasn’t to go fast, but to train consistently. We failed on that front. I also lost one of my running shoes coming back from the race, and then used that as an excuse to not really work out the rest of the month save ~9 miles a day of bike commuting. I’m embarrassed for how bad my training was.

In October, I’ve decided to try out different workout options again with Classpass, which worked well in 2016 when I used it nearly every day. I am striving for 31 minutes of non-biking physical activity every single day in October.

- I slid in quite a lot of work at the last possible minute (talk slides, show uploads/notes) due to general exhaustion/procrastination. Must endeavor to do less of that procrastination thing.

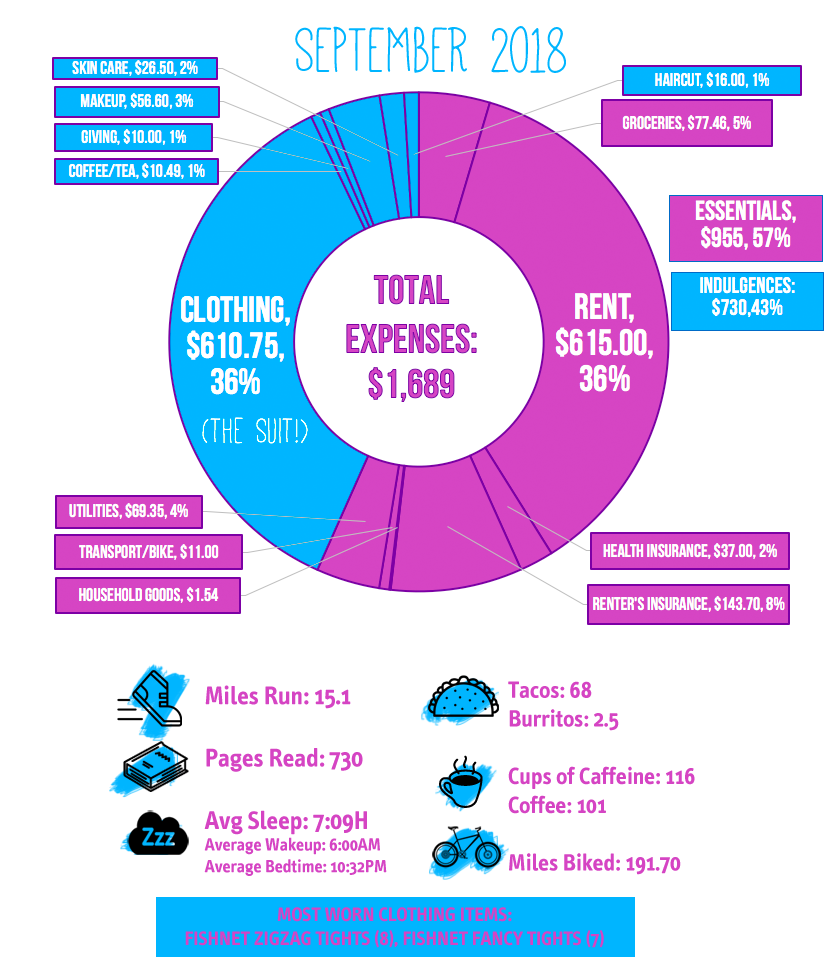

Full expenses report – $1,689.19

Essential Expenses (in descending order): $776.84

Rent: $615.00

Groceries: $79.95

(Groceries – $67.97, “Treats” – $9.49 Coffee/Tea for Home – $2.49)

Electricity: $41.85 (high due to using AC during bad air quality)

Water/Garbage: $27.50

Internet: $0 – our internet is paid for by my SSO’s employer due to being a remote employee!

Transport/Bike: $11 (Bike Share + TriMet Ticket)

Household Goods: $1.54 (hand soap)

Health Related Essentials (in descending order): $37.00

Health Insurance (after subsidy)*: $37.00

Insurance: $143.70

Renter’s Insurance: $143.60 (annual fee, saved for in sinking funds)

Discretionary Food & Drink (in descending order): $8.00

Restaurants: $0 (all eating out was done when on business per diem for travel)

Coffee/Tea Out: $8.00

Discretionary (in descending order): $772.65

Clothing: $610.75 ($579 for THE SUIT, plus a two cat-related used clothing pieces…)

Skin Care: $26.50

Makeup: $56.90

Haircut: $16.00

Fitness: $2:50 (gas money to half-marathon)

Charitable Giving: $10.00

Money Set Aside in Sinking Funds (Not Yet Spent): $115.32

CSA Farm Share $21.00 ($250 per year)

Haircut: $17.00

Savings: $680.00 (22%)

Cash Savings: $580

Traditional IRA contribution: $100

($4,583 YTD or 46% towards my goal of saving $10,000 this year)

September Total After-Tax Income: $2,989

Oh My Dollar!: $808.00

Temp Job: $2,181.32 (I am withholding at a very high rate at this job rather than paying quarterly taxes this quarter)

Because I bought a suit and needed to fill out my future month’s expenses, my high earning did not translate to a high savings rate this month – but it will next month. I’m also passing less income on from Oh My Dollar! as I’ve started paying my editor (yay!) and am saving for a new laptop, which is very much needed.

I was able to set aside 22% of my income for savings this month- but it would’ve been almost double if I hadn’t bought the fancy schmancy suit. I also spent a lot less than 88% of my income, but I put a lot of of money aside in either categories or future months (my low grocery spending, for example, means I have grocery money through November right now.)

My expenses are budgeted through October, meaning I have $913 allocated towards October’s expenses but not reflected in my “savings total”.

The savings total reflected is only money set aside specifically as long-term savings/retirement investing, not for future expenses.

*Health Care Subsidy Note

My high-deductible health insurance is super-cheap at $37 a month, thanks to taking the low-income ACA health care subsidy (down from a “sticker price” of $284 per month). This subsidy is based on an adjusted gross income (AGI) of $22,000 – which I hope to exceed, if my business goes well. If I do exceed that, I will have to repay a portion of my health care subsidy, up to $2,964.

Because of receiving the health care subsidy, I’ve switched from putting my retirement savings in my Roth IRA to a Traditional IRA, since Traditional IRA contributions are deducted from your AGI.

This means that if my income goes up by $5,500 and I manage to put that all in my Traditional IRA, I will owe nothing back for my health care subsidy because my AGI will not change (Roth contributions are not deducted from AGI because they are post-tax).

I love watching TED Talks – was there a video of yours? There was a TED event in the town I live in and I volunteered to steward (so I could hear the talks without having to pay for a ticket because it was crazy expensive!) but no-one got back to me in the end. Thanks for joining in with the Monthly Review again :D

There will be a video of mine but it won’t be out for a few weeks. I’ll definitely drop a link in my monthly report as soon as it’s out.