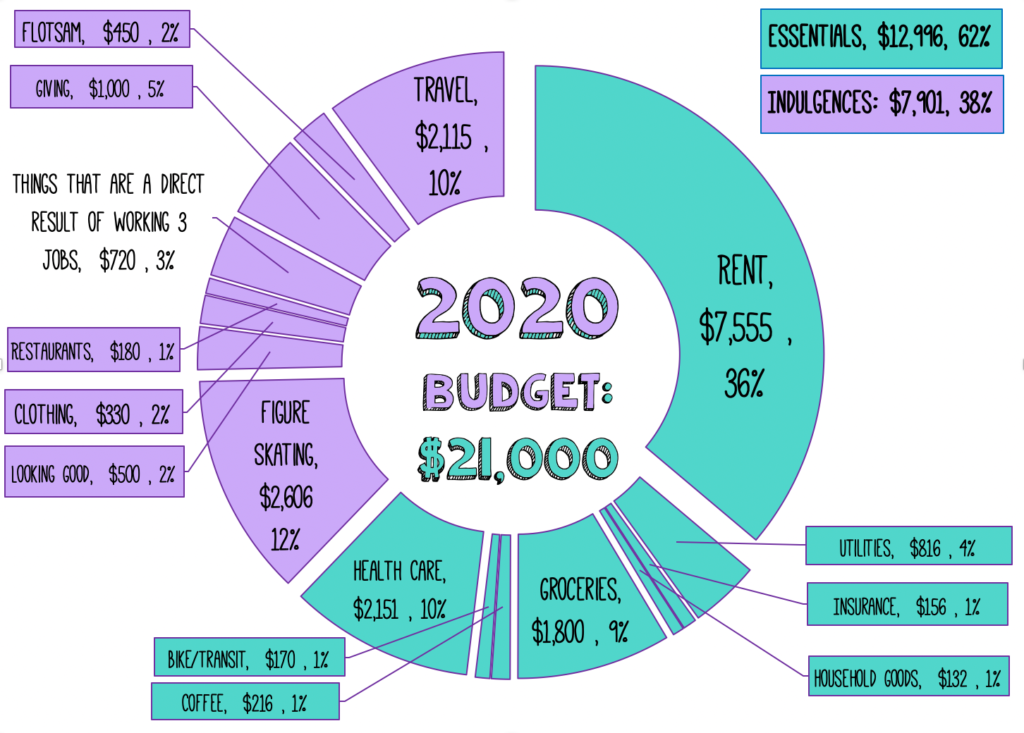

Projected 2020 Spending: ~$21,000 ($1,750 per month)

This year’s budget is a return to previous year’s goals – SAVING. In 2016, my goal was to save 50% of my income, and I managed to save more than 54% of my income. In 2018, I set a $10,000 savings goal, which I came just shy of- despite working a minimum wage, part-time job for most of the year.

In 2019, I didn’t set a savings goal – I instead made my only financial goal to come out $1 ahead. So in 2019, I put away $1,400 for retirement, and otherwise I ate down my savings as I planned.

Was it worth it? Well, I think so? Towards the end of the year, I had grown tired of watching my cash savings get whittled down and my anxiety about money was far too high. But I stayed within my $18,000 budget for the year, and I got to travel a lot, and I didn’t take on any debt.

I also proved to myself that I am capable of generating enough income through the business to support myself (and that I don’t really like working entirely alone, lifestyle-wise.) At the end of November, I ended up getting a day job, and then a second day job which I will start in the beginning of 2020!

Because I’m going to have three jobs (2 day jobs + OMD), this year I’m returning to my previous structure of savings goals. I am aiming to save 20% of my income at a minimum, and my stretch goal is to save $20,000 as part of the 20 in 2020 Challenges we’re holding over at the OMD forums. My stretch, STRETCH goal is a 50% saving rate.

The good news about this year is that I have a much higher predicted income, as I am working three jobs, one of which is full-time. The bad news is that my higher income means a few things: much higher health care expenses (since I no longer will get the federal health care subsidy), and more “convenience” spending – I am considering hiring a cleaner for my apartment, for example, and I budgeted more for groceries knowing I will be buying more pre-prepped foods. Oh yea, this year I also picked back up my addiction to one of the most expensive sports you can do.

My income is variable, and will likely change a lot over the year depending on how book/ad sales do and if I change up working three jobs (not positive how sustainable it is long term, but I’m fairly positive it’s workable for 6-12 months as I’ve done it before). Here’s my predictions for take-home pay (after taxes and other withholding).

Job #1: $37,140 (After taxes, salaried $50,000 * 40 hrs/week)

Oh My Dollar!: $2,400 $200 per month average, after $500 in contractors and overhead and taxes per month – I made a lot more than this in 2019 (closer to $43,000 gross, $20,000 take-home), but I suspect OMD will take the back burner this year, and I’ll have a lot more contractor expenses to keep it running

Job #2: $10,248 After taxes – which have an additional $75 withheld to compensate for my self-employment income – salaried at ~$20/hr * 15 hrs/week.

Total Predicted Take-Home Income: $49,700

Total Predicted Expenses: $21,000

Predicted Savings Rate: 57%

Household & Insurance – $8,389

- Rent: $7,555 ($615 per month) I have a lease with a locked in rate through the end of November 2020, so this is pretty set.

- Water, Commons, Sewer: $330 ($27.50 per month, level billing)

- Trash: $90 ($7.50 per month, level billing)

- Electricity: $396 ($33 per month average) This includes higher average bill in summer due to portable AC unit.

- Renter’s Insurance: $156 ($13 saved monthly in sinking funds)

- Household Items (detergent, TP, toothpaste, razors, etc): $132 ($11 per month average)

- Internet at Home: $0 This is now paid for by SSO’s employer due to being remote employee, was $20 per month.

Basic Food – $1,830

- Basic Groceries: $1,500 ($125 per month average) – 2018’s average was $115 and 2019’s average was $101.67 but there was a lot of travel in both years, so I will assume a higher amount this year. Also I have a lot more biking for commutes this year so I’ll need more food.

- Treats: $300 ($25 per month average) – this is a category for cookies, chips, things I don’t really need but try to emotionally compensate with. I track it separately from regular groceries just to be aware. My 2019 average was $20/month.

- Coffee/Tea For Home: $96 As I get free coffee through work, this is just for some variety.

- Farm Share: $0 We are likely not getting a farm share again this year as it is hard to keep up with all our travel.

Local Transport – $170

- Bike Repairs & Parts: $150 This is for tunes ups, no big overhaul expected.

- Local Transit Trips: $20 – I get a free transit pass through my new job!

Medical – $2,151***

- Copays: $50 So, I currently have crap insurance ($8,000 deductible/OOP max) but have co-pay assistance for my $5,800 per month drug from the drug company – which means I hit my OOP max in February of each year and don’t owe co-pays after that point.

- Health Insurance Premiums: $1,731 This is complicated this year, as I have 3 months of a healthcare.gov, for which I will need to pay the full premium given my high income ($277/month), and then I will be eligible for work insurance which is 75% employer covered (assuming a $450/month plan with $100 per month as my costs), but then I need to hit a deductible again for my $5,800 per month drug using copay assistance.

- Dental Exams/Cleanings: $230 This is the cash rate for twice yearly exams & cleanings. I am extremely lucky I haven’t had a cavity yet so I usually don’t need more than this. Through my day job, I will be eligible for dental in March.

- Contacts: $140 I have to wear contacts most days now due to figure skating.

Figure Skating – $2,606 ($217 per month)

In 2019, I took up figure skating again after a 15 year break from the sport. Reluctantly, I admit I love it and am relatively good at it. It’s exercise, community, meditation, creativity, sparkly costumes, and skill, all rolled up into one big expensive package.

I am going through hell and high water to keep this sport up in 2020 (i.e. getting up at 4:30am to take a 40 minute train to the suburbs to skate before work), even though it’s expensive, time-consuming, hard, dangerous, and made for people half my age. Darn it, I kinda love it.

- Ice Time + Group Lessons: $1,200 (Public session pass every 7 weeks for $114 + occasional advanced freestyle at $12 per hour)

- Coaching: $816 (1 hour of private lessons a month)

- Testing, Registration, + Competition Fees: $300

- Skate Sharpening: $90

- Costumes, Laces, Bunga Pads, + Tights: $200

Looking Good – $832

- Hair: $220 A professional haircut, give or take every 3.5 months, as long as I don’t go full rainbow unicorn hair again.

- Makeup: $100 A professional necessity I do not enjoy but is expensive and I have to buy it because HD cameras are unforgiving.

- Skin Care: $180 $15 per month average – I like fancy sunscreen and nice moisturizers.

- Clothing: $330 $27.50 per month – This is mainly for mending, or replacing things as they wear out, but I like buying used clothing off poshmark, I’m sorry. It’s a big character flaw of mine.

Food & Drink Out – $300

- Restaurants + Bars: $180 ($15 per month average) consistent with 2019 levels; usually this is about 0-2 cheap meals out a month, and a few pricier ($17-$25) meals for birthdays/holidays. I don’t drink so bars are usually a soda water for me. This does not include meals during work travel, paid for by the business.

- Tea/Coffee Out: $120 ($10 per month average) consistent with 2017/18 levels, above 2019 averages.

Things that are a direct result of working 3 jobs – $720

- Cleaner $720 $60 per month – I’m not positive we’re going to do this, but this is splitting the cost of a cleaner for our 680 sqft flat once a month or so. Working three jobs and making decent money, I think it’s a practical thing to do. RIGHT? RIGHT? Will I be able to, really, though?

Giving/Gifts – $1,000

- Charitable Donations: $550 ($45 per month average) pulling way back in 2019 from $3,000 annual high (2015) but up from $222 low (2018), contingent on income.

- Gifts: $150 – A pretty consistent annual amount, give or take a wedding/baby.

- Patreon Memberships: $300 ($25 per month spread over many creators) This is done prior to my own cash out, so it doesn’t appear on my monthly reports.

Flotsam $450

- Entertainment (theatre, movies): $100 I spent $18.99 for all of 2018, and $13 in Portland in 2019, so this is maybe too high. But I live right next to an amazing movie theatre; I should go more often.

- Spending Money: $120 $10 per month – This is for candy, library fines, random things not captured elsewhere, my 2018 average was $5.66 and 2019 average was $3 per month.

- Bike Camping: $80 Hoping to go on a few short out-and-back weekend bike trips this year, this would cover campsite fees

- New Pannier: $150 I can almost guarantee I am going to need to replace my 11-year-old north street backpack pannier this year. It’s a trooper but it’s really doing doing…worse for wear.

Retirement savings: $6,000

This priority is lower than prior years, as I’m focused on rebuilding my cash savings before retirement savings; however, the minimum I’ll put into my Traditional IRA is $1,200 as I contribute $100 per month automatically. I am aiming for a ~20% retirement savings rate, the rest of my savings into cash savings.

Travel $2,115

So, this is the big change. In 2019, I spent all my money on travel – my planned expenses were $3,900 and I clocked in at $3,190 in travel for the year. I spent more than 3 months of year out of the country, including a month renting a flat and a letting a coworking space in London and 3.5 weeks of travel around Japan (plus trips to LA, Scotland, Australia, Singapore, London again, NYC twice, and Chicago.) This year I’m doing less international travel, but still a fair amount.

San Francisco (March): $320

This would be for Pacific Coast Adult Sectionals, if I can afford the time and money! Can stay with a friend and the flight down is cheap.

- Flight: $150

- Food: $150 Bay area ain’t cheap

- Local Transit: $20 (have $40 on clipper card already)

Delaware (April): $728

This would be for U.S. Adult Figure Skating Championships. I’m not sure it makes sense to do, this year, financially and time wise, but I want to do it!

- Flight: $378 (if I can’t cover it with points)

- Train from Philadelphia <> Newark, DE: $60

- Hotel Cost: $200

- Food: $50

- Transportation: $40

Madrid (July): $365

- Hotel/Plane Taxes + Fees: $80 (booked + covered by points)

- Food Costs: $120 (This is an estimate for 1 week of travel)

- Transit: $35

- Sim Card and other incidentals: $25

- Bike Rental: $25

- Attraction/Museum Fees: $80

Bangkok + Kuala Lampur (November): $702

- Flight: $212 in taxes and fees (lower cost with points)

- Accommodation: $100 (taxes/fees on reward nights)

- International Train Bangkok > Kuala Lampur: $100

- Food/Coffee: $130 – This is a pretty generous budget based on Malaysian and Thai prices.

- Local Transit: $30

- Fun Things Budget: $60

- Incidentals: $50

- SIM Card $20 So that I can use my phone!

Monthly Business Overhead Costs: $140

Not in personal budget!

I have a number of costs that are not reflected in my personal budget. Most of these would not exist if I was not self-employed, as they would be covered by my employer or unnecessary. Many are covered by clients when I travel to speak. Some of these costs include: business travel costs including per diem (food) on the road, costs to replenish inventory, printing and shipping costs, video production and equipment costs (including laptops and cameras), and things like Wifi or data when traveling.

Those are project-based and vary depending on work, but I will list out my monthly overhead, including my cell phone, paid for by my business.

- Mobile Phone Plan through Mint: $15 per month

- Adobe CC Membership: $29 per month

- Convertkit: $39 per month

- Audio Transcription for Podcast via Sonix: $20

- Web Hosting: $22

- Google Storage: $1.99

- Apple Storage: $2.99

***How my health expenses work!***

Per usual, I have to make a disclaimer about my health expenses since American heathcare is broken and I have fallen into a weird personally fortunate loophole of the current US brokenness. I am extremely happy to have ACA-compliant health insurance- I mostly didn’t have health insurance before the ACA passed as an adult.

Currently, I have the absolute cheapest plan on the Oregon healthcare.gov market, which is $277 per month for a single, non-smoking 32-year-old female – which comes with a whopping $7,500 deductible before a single thing is covered ($7,500 out-of-pocket maximum). It would be considered a “catastrophic” plan for most people.

There’s two absolutely bizarre things in my favor, however, neither of which I expect to continue into perpetuity. I have a chronic autoimmune condition that has only responded to treatment with one drug – a weekly shot of entercept (Enbrel). Each weekly shot is about $1,400, and must be delivered on ice to my house by a specialty pharmacy. This all sounds terrible, right?

Well, the first piece of good news is that it works- my RA is completely managed with almost no pain or activity restrictions. The other piece of “good news” is that this drug is SO expensive with no generics available (under patent protection in the US for another 10 years) that the company that makes it offers a co-pay assistance program, which does not have a high or low income requirement – you can receive up to $18,000 of your co-pay covered by the drug company each year – as long as you are on private insurance and not Medicaid/Medicare.

The drug company’s co-pay assistance counts towards my deductible and co-insurance. This co-pay assistance pays for my ~$5,800 a month of medication, which means I hit my $7,500 deductible AND out-of-pocket maximum by the end of February, all covered by the drug company.

After that point, my medication, labs, doctor’s visits, and everything else are paid for by the insurance because I’ve hit my out-of-pocket maximum, which means I pay $0 for the rest of the year aside from my monthly premiums. This year is a bit more complicated as I’m switching insurance plans on April 1st when I become eligible for my new job’s plan, which makes me (one again) have to restart the whole deductible clock again.

Crazy Cattle 3D brings unfiltered fun to battle royale. Take control of a wild sheep and hurl yourself at others in a no-holds-barred bash-fest. Stay upright, stay hilarious, and be the last sheep rolling!