Hustle culture is selling a lie.

I have had 3 full days off work since Thanksgiving (that’s 3 days off in 155 days.) I worked Christmas. I worked New Years Day.

2 of those were unplanned days where my body and brain just could not take it any more. I left work undone and sat on the couch. Luckily, those days I didn’t need to bill hours.

I have paid time off at both of my W2 jobs, but anytime I take it I’m using it to catch up on the other job or record for the show.

It’s been 5 months working on this three-jobs-65-hours-a-week schedule, and…it’s just not sustainable if you want to do anything else with your life. Don’t let anyone tell you otherwise.

Anyone trying to tell you that you can just pick up two extra jobs or start a small business on the side and also stay in great physical shape and have your mental health stay stable – well, they’re selling you something.

A course on how to build a business. Or a box of food to be sent to your house. Or clicks and ad revenue they get from their content, based around their “systems” as someone who “works hard, plays hard.”

I keep thinking it was my failing, that if I just “tried harder”, if “I was more strategic”, I could make this work.

I don’t have physically hard jobs – I’ve worked on farms in 90 degree heat, in jobs where I worked outside in freezing temperatures and walked for hours a day, I’ve danced in 8″ platform heels on stage in my underwear, and just a few months ago I was serving whipped sprinkly drinks to Karens and teenyboppers in the mall on my feet all day for minimum wage.

I don’t have dangerous jobs – I get to work from home while I’m shielding from covid-19. I’m not getting sneezed on by anyone at the grocery store. The hardest part about my job hitting auto-redial, trying to get ahold of officials at the unemployment office to get comments for a story. Or maybe it’s trying to broadcast live radio from my closet while sitting in my laundry basket.

But maintaining focus and quality for three jobs, for 65+ hours a week, for a sustained period of 5 months, it’s harder than most jobs I’ve done.

I looked up tips for how to prioritize working out when one is in medical residency, thinking they would have tips. I kept up tracking my time to the minute.

Here’s the lesson I took away: something will fall apart. This isn’t possible to do in a sustained way if you also want your mental and physical health to be in good shape – even under “normal circumstances.” And it sure as heck isn’t possible to do with a global pandemic going on.

And I removed ALL the distractions. We all did. Many of us have been isolated in our houses for 50 days. I don’t leave the house, I don’t have a commute, I don’t have any social activities. I don’t have kids to raise. I don’t have a dog to walk. The distance from my bed to my workplace is 10 steps.

I’m here to tell you that doing this kind of schedule is just…

Not a good long-term plan.

Frankly, ignore anyone who tells you that this is a happy, healthy life plan. It’s doable for awhile, it’s worth doing for a bit. And of course, everyone is going to have crunch times at work.

But this work schedule. It isn’t sustainable. Perhaps if I had a housewife or a house-husband or a house-gender-non-conforming-spouse, I could pull this off longer than 6 months. But it certainly wouldn’t be fun.

That being said, I’m pretty proud of the work that I have managed to do. I have been doing the most original reporting I have ever done.

I’ve also kicked up livestreams to be weekly instead of bi-weekly during lockdown and have been having more fun with them. Here’s one on the economics in the game Animal Crossing.

And one where Aaron joined me and I tried to get him to understand how US Treasury Bonds work while we ate nachos.

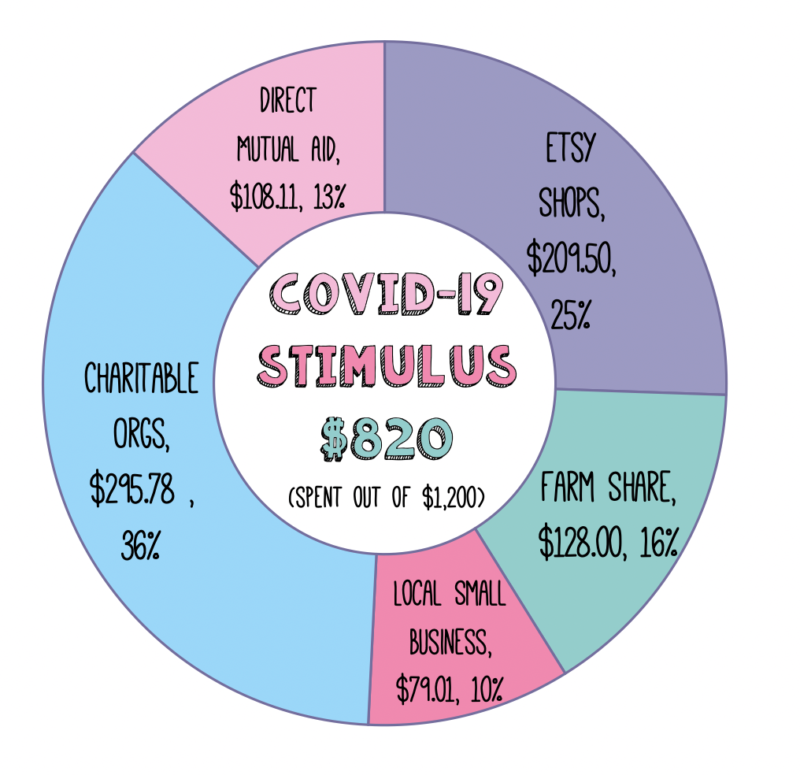

In other news, I spent a ton of money because I made a lot of money and decided the best choice I could make with my stimulus $1,200 would be to donate it and spend it on small businesses. I am very fortunate to have work right now and I feel it’s my duty to spread as much of my luck and privilege around as I can, even in this uncertainty. The full report on that down below.

I’m also really struggling with the fact that I can’t skate right now, and my health is suffering from a lack of regular exercise now that I have no bike commute. I’ve dropped from an average of 90 minutes – 2 hours a day of cardio to about 20 minutes on a good day. It’s looking very likely I won’t be able to go back to any rinks for nearly 6-9 months as someone who is immunosuppressed.

I need to figure out a better plan for working out, and I’m seriously contemplating if that better plan is a pair of $700 inline roller figure skates…

Onto the numbers.

April 2020 Post-Tax Income: $5,059.41

fun fact: this month’s post-tax income is 74% of my adjusted gross income for the entire year of 2019.

- Day Job: $2,915.52 (lower than last month – increased withholdings + have a pre-tax deduction for dental/vision)

- Radio Job: $936.78

- Stimulus $$: $1,200

- Bank account interest: $2.66

- Oh My Dollar (full income/expenses report below): $0 – took no income this month, actually put in a tiny bit of personal money

Full April 2020 Spending Report

Stimulus $$$ – $820

While I really wanted to spend all of my $1,200 in one big go at small businesses and charities, it turns out I’m a big scaredy-cat and outlaying that kind of cash was hard for me, even when I feel it’s my duty to do as someone currently in a financially secure place (as secure as anyone is right now). However, I am insecure inside and still need to save a lot of cash.

I spent some of it stimulating small etsy shops. No, they aren’t essential services but they are still someone’s livelihood. And small businesses are freaking important to this economy. And plus, when else am I going to be able to spend money on ridiculous donut hats and be DOING MY PATRIOTIC DUTY?!

Here’s the list of businesses I bought from:

- Little Otsu – local stationery shop and small press (I got my first fountain pen!)

- Neemo Fashion – This is the Brooklyn-based designer who made the jumpsuit that everyone wants to know about ;)

- TheYoungandCoMakery – handmade resin jewelry

- OHMEShop – feminist jewelry

- JessPaulArt – food-themed accessories and patterns

- ButtonsRingsCo – handmade resin jewelry

- Jill Makes – “handmade jewelry for upbeat people”

- ElmairaShopping – custom-made clothing

- Cherry Bomb Vintage – vintage reproduction clothing

I also got a Farm Share ($128.00) – Spoke and Leaf Farm (Portland area vegetable CSA run by a friend of mine!) I had originally opted out of doing a CSA based on my household’s expected travel schedule for the summer and fall. Since, umm, neither of us are going anywhere for quite awhile, we decided to pick up a CSA again for this year, especially with grocery shopping being a whole thing these days. This is one of those things I probably would’ve done without the extra stimulus cash similar to some of the charitable contributions. But the stimulus cash made it easy to say “YES! support local farmers and small businesses and get food for myself!)

Mutual aid ($108.11) went directly to folks in need in my community – to a group of teachers supporting immigrant families at the local high school, direct venmo-ing of some folks in need, etc. I’m hoping to do more next month.

Charity ($295.78) took up the largest portion. Here are the charitable groups I supported this month: XRAY.FM, Mermaids, Voz Workers Solidarity Fund. I will definitely be doing more next month.

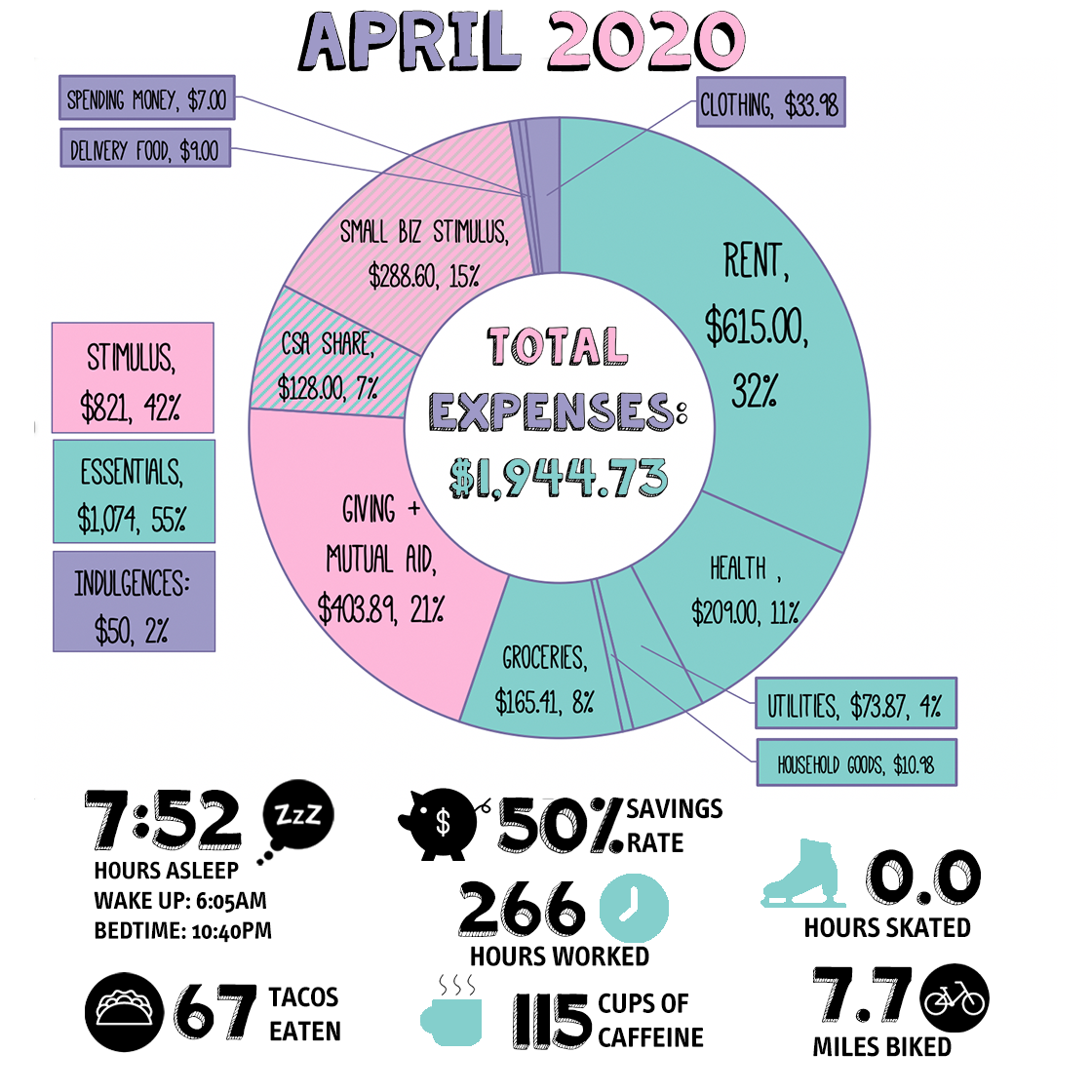

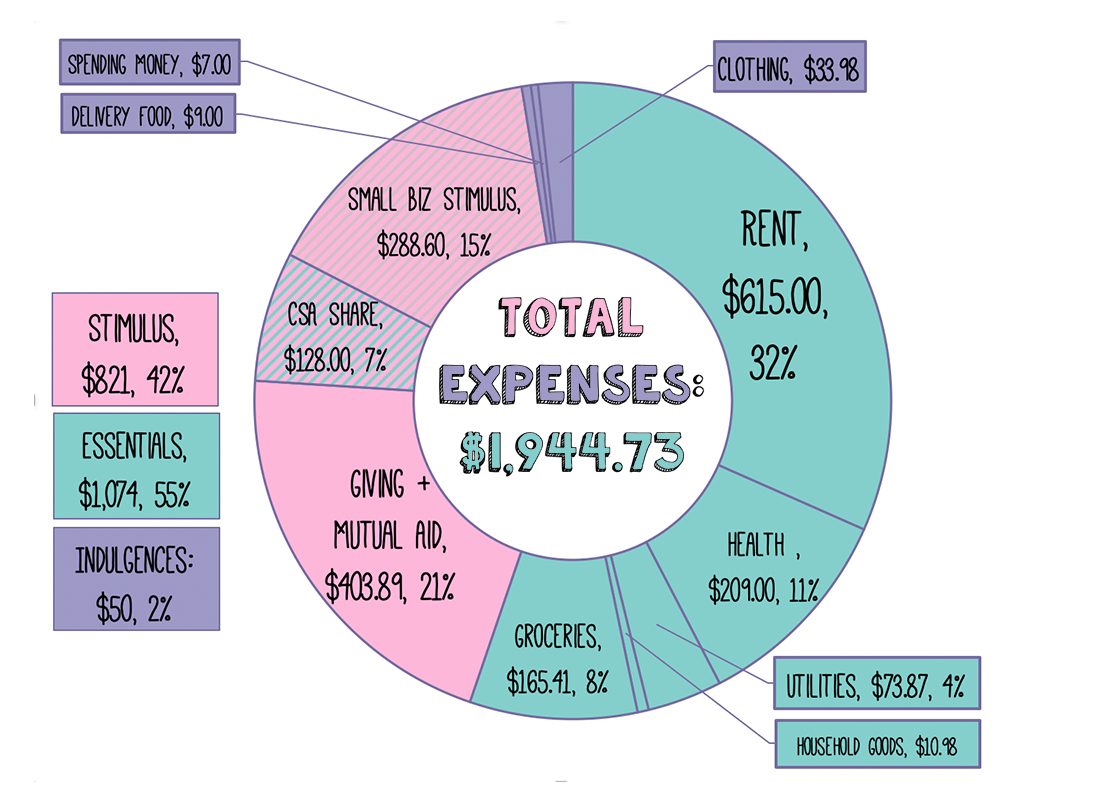

Total Spent: $1,944.73

27.4% of total annual budget at 33% of the way through the year.

Household & Insurance – $699.85

- Rent: $615

- Water, Commons, Garbage, Sewer: $27.50

- Trash: $7.50

- Electricity: $33.62

- Household Items (detergent, TP, toothpaste, razors, etc): $10.92 (half of laundry detergent)

- Internet at Home: $0 This is now paid for by SSO’s employer due to being remote employee, was $20 per month.

Basic Food – $165.41

Ugh. Groceries are way more expensive right now for me – I am not shopping for myself since I’m immunosuppressed, and a lot of the cheap options are out of stock or not available at all (like bulk dry beans), and in an effort to limit the trip to one store, there’s no comparison shopping between stores as I would usually do.

We’ve also been spending more on stocking up. I’m not someone who usually has more than a week of groceries around. But we’ve been stocking up on things as they’re available, so now we have bags of cans underneath our couch (we do not have anywhere else to store them in our apartment kitchen…) I also haven’t been denying myself anything like nice crackers or vegan cheese because there’s a global pandemic on and it’s okay to have the $1 more expensive crackers if that’s what gets you through it.

But now that I can’t just run to the store when I crave chips or candy, my treats budget has gone down.

- Basic Groceries: $158.25

- Treats (non-essential snacks): $10.62

- Coffee/Tea For Home: $0 (my day job sent over some coffee for home and Stumptown was giving away gallons of cold brew!)

Travel – $0 (lol)

Health – $209.00 ***Why this is cheap

- Health Insurance Premium: $204.00

- Co-pay: $5

Figure Skating $0

I’m wrestling with the fact that I won’t be able to skate at the rink for possibly another 6 months due to being immunosuppressed and am considering getting some inline figure skates to go to the rink…I put $350 in my savings category for $700 boots and wheels, watch this space.

Looking Good – $33.98

- Clothing: $33.98 (I got this lounge jumpsuit from target and I’m living 24/7 and won’t even apologize)

Extra Food + Drink – $9

- Restaurants: $9

There was a buy-one-get-one-free burrito sale so I got a burrito and tipped 30% to the delivery person. I have been getting donuts from Doe Donuts for livestreams as well, but that is a work expense (below). I’m just not that excited about doing takeout/delivery food even though I know that supporting local restaurants is important! It’s just very much not part of my usual budget.

Flotsam: $7.00

- Spending Money: $7.00

Retirement savings: $300

Cash savings: $2,244.98

YTD Total Savings: $10,375/$20,000 goal (51.8% Total of goal at 33% of the way through the year)

OMD Business Income + Expenses Report

Everything dropped this month, revenue-wise. My distributor, Buyolympia, has experienced a decline in orders because most retail businesses they supply are shuttered (you can order directly from them to support small artists like me though- free domestic shipping!)

Far fewer people are ordering books and stickers (for obvious reasons). Amazon (rightly) has completely de-prioritized fulfilling physical book sales while they focus on life-saving goods.

My purrsonal finance society members have been the only thing keeping the business at a near break-even point, and I cannot get over how much that means to me. It’s allowing me to pay hosting, shipping, and pay the contractors who work on my show, at a time when I’m producing more shows than ever. Thank you so much. I’m not taking a salary from OMD for the ongoing future, and everything is just going to paying contractors and overhead.

Luckily I’m not living off this income, because if I was, I wouldn’t be in great shape. I also have sinking fund savings in the business, and so things will be okay. But they will be tight – possibly for the rest of 2020.

This is cash-based accounting, not accrual, so this only accounts for income received this month, not invoices billed.

Gross Receipts + Sales: $954.85

- Amazon Book + Kindle Sales (net after fees): $8.21

- Shopify/Direct to Consumer Book Sales: $10.90

- Radio Ads: $24.85

- Wholesale (Buyolympia): $32.18

- Refund from Hotel for cancelled trip: $244

- Patreon Memberships: $634.71

Total Expenses: $747.44

Equipment: $382

- Phone: $382 (this came from sinking funds, I’d been saving for quite a long time)

Contractors: $102.10

- Artwork $52.50

- Transcription : $49.60

Operating Expenses: $220.94

- Phone: $67.78 (prepaid for 3 months via Mint – average is $20 a month)

- Licensing: $1.29

- Convertkit: $49

- Exist.io $6.00

- Mailgun: $7.65

- Meals: $6.25

- Backblaze : $6.00

- Storage: $6.98

- Hosting + Servers: $20.00 (Linode and Dreamhost)

- Media Subscriptions: $5

- Sonix: $15.00 (will be phased out as I do the work to copy old transcripts out of their player)

- Adobe Creative Cloud: $29.99

Cost of Goods Sold: $42.80

- Shopify Monthly Fee: $29.00

- Shipping: $13.80

Net Income: $207.41

- Tax Savings: $51 (25% of net income)

- Lily’s Salary: $0

It has been enhanced as a result, enabling anyone to do beneficial testing prior to building. I’ll be able to produce more pieces similar to this one.

You have a very detailed and specific analysis article with illustrative charts, I am really interested in this content.

It takes courage to speak out against the narrative that glorifies overwork and neglects personal well-being.

Gaming tournaments promote healthy competition and sportsmanship among players.

Those unplanned days off were your body’s way of telling you to slow down. Ignoring your physical and mental well-being will only lead to burnout in the long run.

Personalize your character

This is a great report and the accompanying growth chart, I really appreciate your seriousness in this work and I am very pleased with what I see here.

With its unique visuals, engaging gameplay, and humorous tone, Pizza Tower has quickly become a favorite among fans of indie games.

Lillian’s report underscores the pressures of juggling multiple roles in a crisis and provides a transparent look at how she managed her finances amidst these challenges.

The game’s dynamic environments keep players engaged as they navigate through various terrains in Drift Boss.

Wow those are great ideas how did you get them henry stickmin unbelievable

Sprunki is a captivating and adventurous mobile game that invites players into a colorful world filled with challenges and excitement.

The open-ended nature of The open-ended nature of Sprunki Game encourages players to think creatively. Experimenting with different sounds and combinations allows users to express themselves musically and develop their unique style.