In April, I am focused on studying for the Series 65 exam – all I did most of the month was study, work, and skate. So this is rather boring!

We did get a new lease offer, and our rent is going up by $100 per month (split in half) in July, but since we’ve lived in this apartment for over 5 years and never had the rent raised, we’re feeling okay about that. The big issue is with building the house, but with an unclear construction timeline, we didn’t want to sign a too-long-lease when the new house is ready in 2023 and have to pay double rent for months. We considered going month-to-month for the flexibility of not having to pay to break the lease, which would’ve raised our rent 9.9%, but we ended up negotiating for a 10-month-lease renewal.

Thanks to Portland’s renter relocation assistance law, at the end of 10 months, we can go to month-to-month and they still can’t raise our rent more than 10% before the one-year-rolling period without having to pay a huge chunk of relocation assistance for us. So this was the best option.

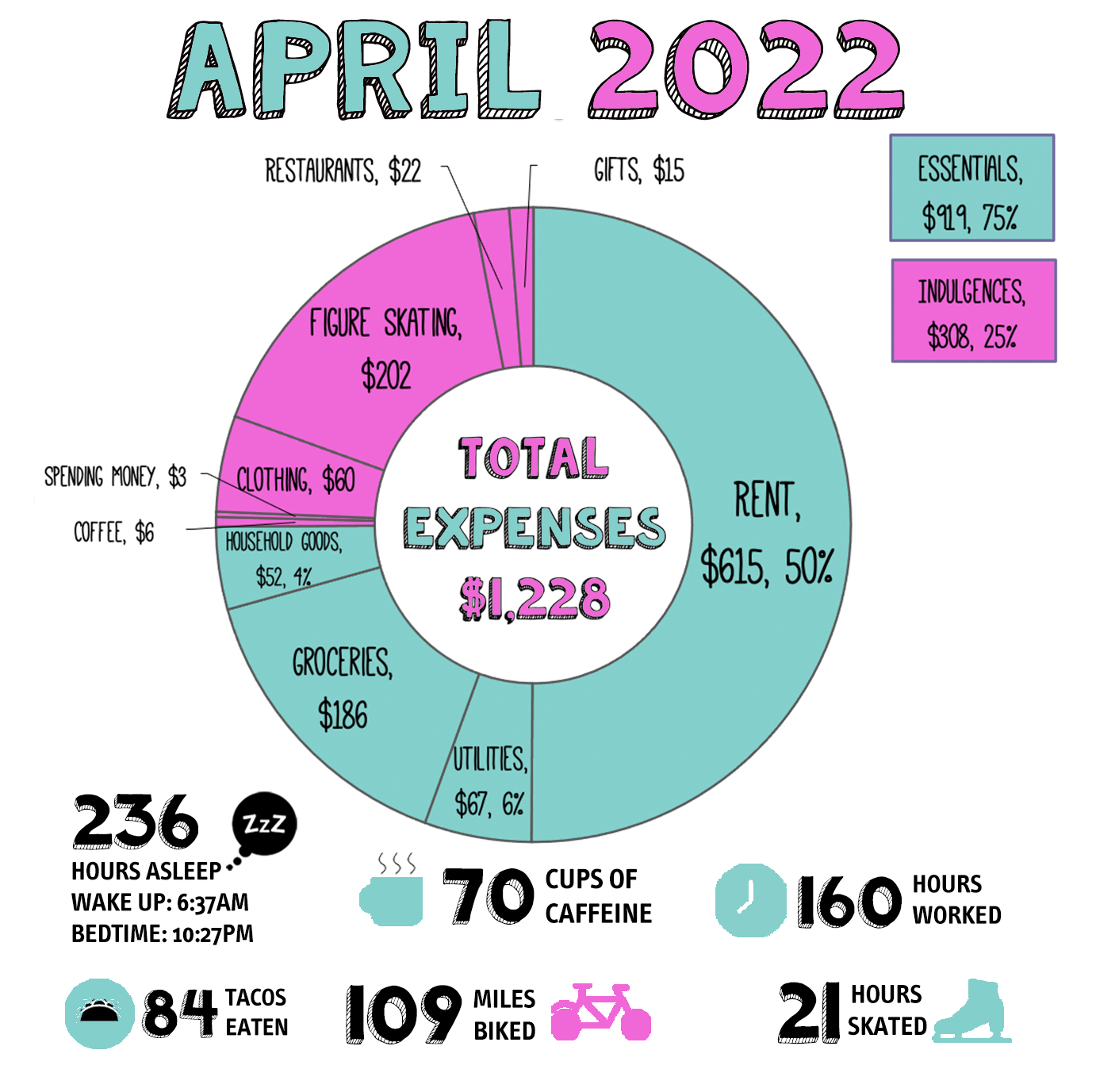

Full April 2022 Spending Report

Total Spent: $1,228

On track! 22.7% of my total annual budget at 32.8% of the way through the year.

Household & Insurance – $733.56

- Rent: $615

- Water, Commons, Garbage, Sewer: $32.50

- Trash: $7.50

- Electricity: $26.88

- Household Items (detergent, TP, toothpaste, razors, etc): $51.68 a pet hair remover tool and a stock up of deodorant

- Internet at Home: $0 This is now paid for by SSO’s employer due to being remote employee, was $20 per month.

Basic Food – $206.96

Groceries are expensive now and I hate it. I also bought a few convenience foods for studying time, so it’s a bit higher due to that.

- Basic Groceries: $193.88

- Treats (non-essential snacks): $8.09

- Coffee/Tea For Home: $4.99

Extra Food & Drink – $27.00

- Restaurants: $26.00– because I was in study mode and not caring about cooking as much, I ended up getting a few takeout snacks

- Coffee $1 – got a free coffee coupon, this was the tip

Health/Fitness – $0

My health insurance premium is now covered under my SO’s employer plan and comes out of their paycheck. It comes to $110 per month pre-tax, but we’ll likely settle up at tax time rather than me paying my SO each month because of the complexities of our taxes and my health care costs.

Figure Skating $207.00

- Coaching: $80 Coaching! this is two privates.

- Ice Time: $127.00 Seven weeks of skating class, plus one freestyle at the “big rink”

Looking Good – $60.000

- Clothes: $60.00 a used jumpsuit off poshmark

Flotsam: $18.33

- Spending Money: $3.33

- Gifts/Mutual Aid: $15.00 Support for a friend.

Savings: $488.38

I do not have an employer 401K any longer, so for now I am saving in a SEP-IRA. I am not currently prioritizing savings while I’m studying for my new job!

Retirement savings: $488.38

Cash savings: $0

YTD Total Savings: $1,000.94/$10,000

(10% Total of goal at 32.8% of the way through the year)

Your post is very informative. Thanks for sharing it. Keep it up!

https://crackingfiles.com/idm-patch-crack/

The survey underscores the importance of addressing issues such as limited space, access to amenities, and the need for sustainable practices.

Learning is something that never stops

awesome post Armed Guards New York

Learning is the fastest path to success

April 2022 Studying All the Time is a nice post with the details that people need to know. Also it provide helpful information that helps us to find what we are searching. There are a lot of people talking about it.

Wheel spinner is a game that I am sure that anyone who loves spins of fortune will be addicted to sitting in front of the computer playing this game for hours on end.

This piece was both intriguing and informative for me. We appreciate that you shared some of your unique ideas with us. I will forward this to my buddies.

April sounds intense! Studying, working, and skating… Sounds like a real grind. At least you’re still having fun with figure skating! Reminds me, I need something chill to relax after work, maybe I’ll try Sand Crush .