This was my last month working a full-time job, a 15-hour-a-week job managing finance for a radio station, and running my business. It was a lot.

It’s been very tiring. In the midst of *waves hands at the general year of 2020*, I’ve been working between 62-78 hours a week at 3 jobs for the past 7 months. I took 5 total days off between Thanksgiving day in 2019 and June 15th and worked on every holiday and every weekend.

This month was the conclusion of a chapter for me and should’ve been climatic – but within the context of daily global protests for black peoples’ lives, an ongoing pandemic, the affordable care act being threatened, 20% unemployment in the US, a worldwide recession…

Honestly, it just felt insignificant. I feel insignificant in my inability to help – especially not being able to put myself on the street for protests for Black Lives Matter.

I struggled to be useful to others while dealing with closing out a job for the first half of the month while still working a full-time job, and running my business. The only thing I feel I can do right now is signal boost petitions and black and trans voices on social media and donate money.

I have every symptom of burnout right now – coming off of 7 months of working a minimum of 65 hours a week across three jobs, I am tired. Really, really tired. I’m out of shape because since lockdown began, I haven’t been bike commuting or figure skating and doing situps in my living room with my cat just isn’t the same. My mental health has been suffering.

Making the decision to leave the radio station was the right decision – but it wasn’t easy. I have wanted a paying job working in media for 4 years. I’ve loved radio my whole life and have been making radio for 11 years. I have nothing but respect for the staff and volunteers at the station and it’s been great to work with the staff there.

But, it became clear the station was not a healthy or stable work environment and my day job is quite stable and healthy. Additionally, in my role, I was working mainly on finance (especially given how drastically organizational finances have changed with covid) and not making media. Doing the job was cutting into my time for actually making my own show and working on media projects. My day job is still A Job, not a passion, but it’s a good company doing good work in the world that I care about (making transit easier to use!)

The three-jobs hustle could not continue sustainably and if I had gone full-time at the station (if that was even financially feasible for the station), I would’ve been taking a 28% pay cut, losing my access to employer-paid health care and a retirement account, employer-paid transit, and swapping my relatively low-stress job for a high-stress job. I also had concerns about the organizational structure at the radio station and quite simply, decided I didn’t have it in me to fight those battles. It’s really hard to advocate for others when you are constantly uncertain about your own finances.

On the other hand – life is so easy making this middle-class salary right now. Making this money and saving it – it’s like being given the cheat code to saving money. I didn’t quite grasp how much less stressful decisions are when you are taking home $3,500 every month, rather than $1,600.

A good few things happened: Oh My Dollar! got featured in Forbes and I took an entire week of PTO off my full-time job (hence the less than normal work hours this month) to recover after I left the radio station. I tried to vacation and I may have even succeeded. I only did a little work.

I’m not quite recovered from the burnout yet, but I’m starting to get excited about both my full-time job and (perhaps more importantly) creating great educational and helpful content through Oh My Dollar!, including doing what I can to highlight more BIPOC and transgender voices on my platform – because frankly, taking care of one another is all that’s truly important right now.

But I needed a little rest and reset before I could do more, and I’m finally coming out of the burnout.

June 2020 Post-Tax Income: $3,461.51

Last month of 3 jobs!

- Day Job: $2,859.16

- Radio Job (half-month): $452.44

- Bank account interest: $.07

- Oh My Dollar (full income/expenses report below): $150.00

Full June 2020 Spending Report

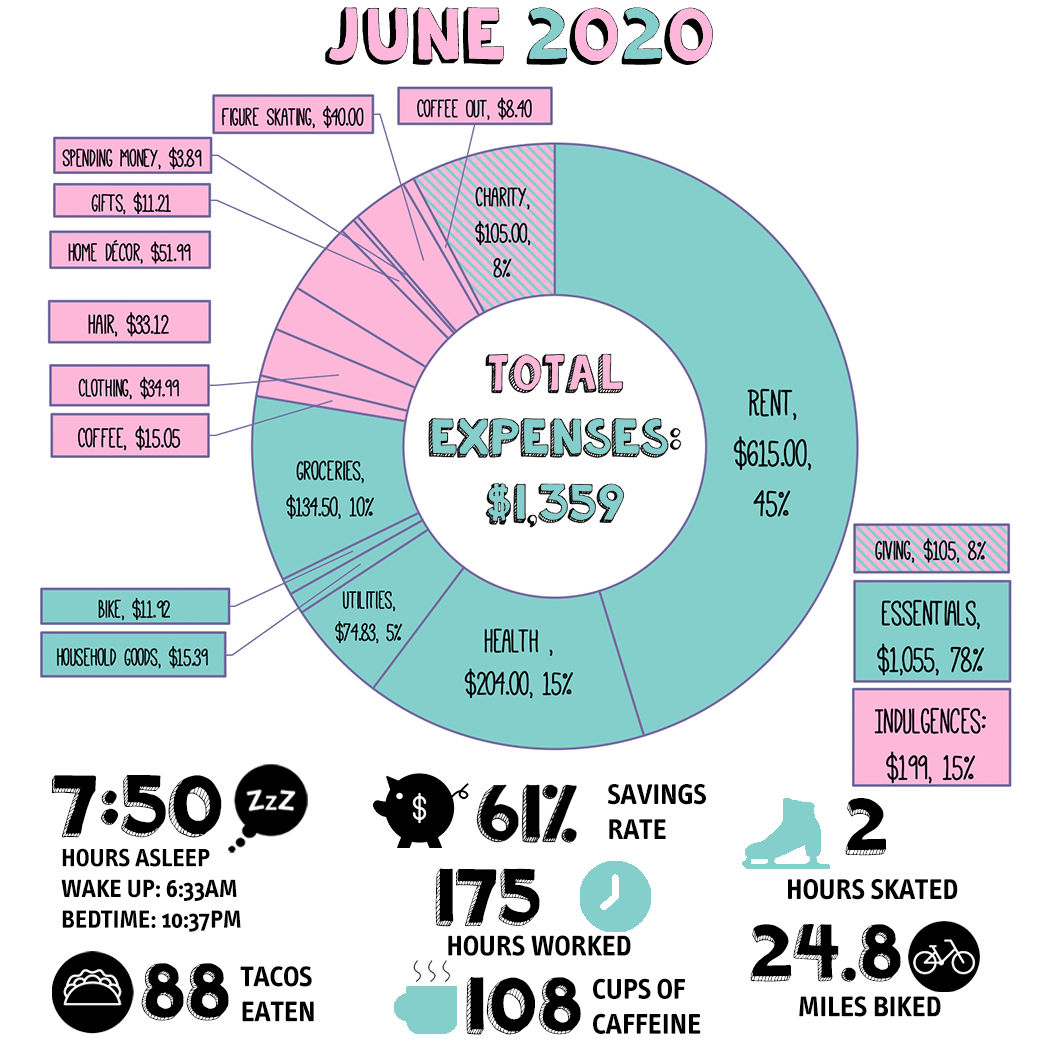

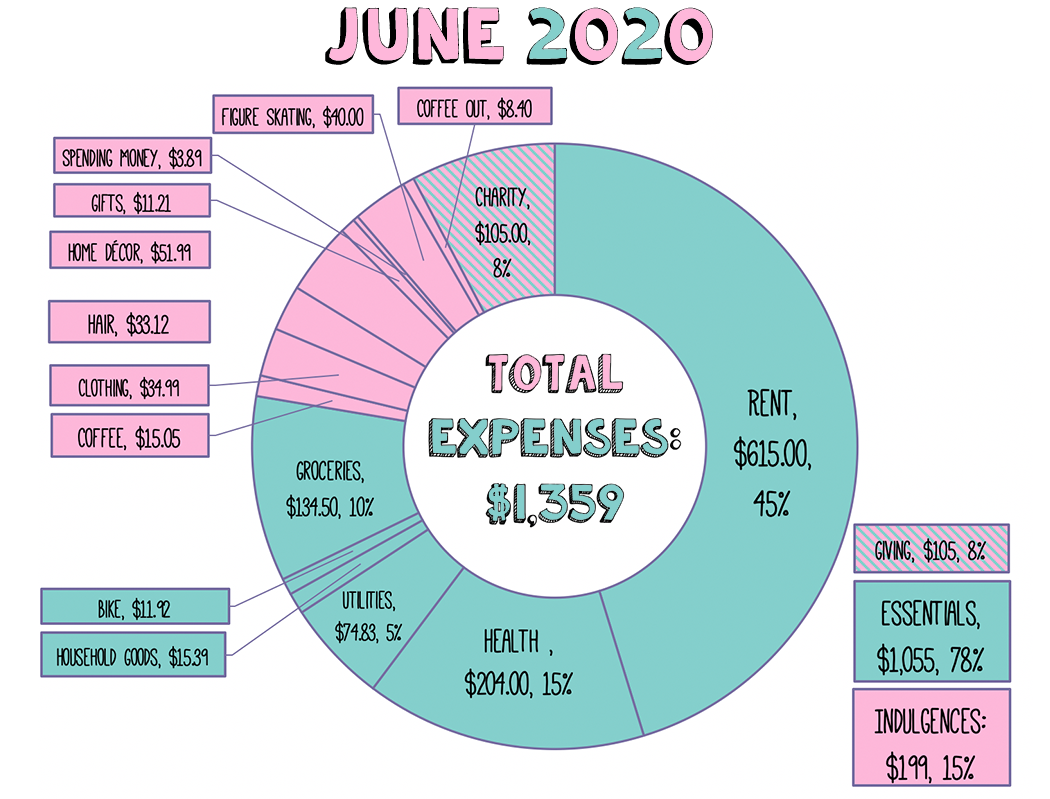

Total Spent: $1,359.04

37.6% of total annual budget at 50% of the way through the year.

Household & Insurance – $712.13

- Rent: $615

- Water, Commons, Garbage, Sewer: $32.50

- Trash: $7.50

- Electricity: $34.58

- Household Items (detergent, TP, toothpaste, razors, etc): $15.39 (TP and cleaning stuff)

- Internet at Home: $0 This is now paid for by SSO’s employer due to being remote employee, was $20 per month.

Charitable – $105.00 (8%)

I’m working to slowly ramp this up from 5% to closer to 10% now that my savings are refilled, however, I am donating more through OMD (below) on an ongoing basis.

Organizations I am supporting: Black Resilience, The Numberz, XRAY.FM and TGI Justice Project.

Basic Food – $151.55

Not loving the whole “groceries are super expensive right now” situation, and my lack of free coffee from work, but I know I am extremely privileged and lucky to not be worrying about food right now. Our CSA did start up late this month, though, which is taking pressure off vegetables.

- Basic Groceries: $123.58

- Treats (non-essential snacks): $10.92

- Coffee/Tea For Home: $15.05 (been buying locally roasted single-source coffee from Nectar Cafe...so good!)

Travel – $0 (lol)

Health – $204.00 ***Why this is cheap

- Health Insurance Premium: $204.00

Figure Skating $40.00

After 105 days of not being able to go to the rink, I have now been able to spend 2 total hours on the ice. My local rink is not yet open, and likely won’t be til Phase 3 or Phase 4, but I am traveling 2 hours round trip (on transit* + bike) to go skate at a private session in the suburbs. The rink is doing temperature checks, requiring masks off-ice, and limiting sessions to 10 people (on a 20,000 square foot facility). Skaters are warming up and putting skates on in the parking lot rather than inside, and social distancing is enforced. It’s also easy to do contact tracing because of the private nature of the sessions.

I was very much on the fence about whether it was safe to go as an immunosuppressed person, but after talking with my doctor, we decided for now, the risks were worth it given the precautions taken – especially given how poor my mental health has been without figure skating. Mental health is part of health.

Unfortunately, ice time is really expensive ($20 for 45 minutes – 1 hour) because the sessions are running at half capacity and there’s no “cheap” public sessions to take advantage of. Year to date, my marginal cost of skating is $10.21 per hour.

- Ice Time: $40.00

*I was nervous about transit, but honestly it’s been completely or nearly empty in the MAX every time I’ve ridden, and everyone has been wearing masks.

Looking Good – $79.61

- Clothing: $34.99 I bought myself a used pusheen robe and have no regrets.

- Hair: $33.12 (shampoo bar, curlers, setting lotion, and hair spray- if I can’t get a haircut, I might as well learn how to do my damn hair)

Extra Food + Drink – $8.40

- Coffee: $8.40 – pickup-only coffee smoothie with 25% tip! Nom!

Flotsam: $67.09

- Home Decor: $51.99 – I bought a full length mirror! Finally! I haven’t owned one…ever? I had one built into the 1970’s-style closet in an old rental apartment, but otherwise, never had one! I need it for outfit selfies, obviously, since no one actually sees what I am wearing in person anymore.

- Spending Money: $3.89

- Gifts: $11.21

Savings

Now that my emergency fund is back to being roughly equivalent to a year’s expenses, I have started to ramp up my savings in other categories, including retirement again.

I do not qualify for my employer-sponsored Simple IRA until Jan 2021, so for now I am saving in a traditional IRA – particularly because I expect to have a high tax burden this year.

I have also begun saving cash towards the possible goal of paying for a master’s degree in cash in 2021-2022. There is nothing certain about that plan, but the worst case scenario is that I save cash and I have more cash saved and can always invest it instead if the masters doesn’t happen. Not really terrible, all things considered.

Retirement savings: $400

Cash savings: $2,315.78

Savings rate: 61% of Post-Tax Income

YTD Total Savings: $14,243/$20,000

(71% Total of goal at 50% of the way through the year)

OMD Business Income + Expenses Report

My purrsonal finance society members have been keeping the business afloat for now, with book sales, speaking income, and advertising all down. But it’s going okay. I’ve been able to donate still a chunk of change each month and keep paying operating expenses and this month I even managed to pay myself a bit.

I am looking at doing some small product launches in the fall, and that means I need to save cash to be able to buy inventory. I’m leaving a lot of money in the business right now to prep for that.

I’m also hoping to start paying freelance writers in July, which is scary, but has been a goal for OMD for years and I’m ready to start paying people with life experiences other than mine to write about finance (particularly trans folks and BIPOC).

This is cash-based accounting, not accrual, so this only accounts for income received this month, not invoices billed.

Gross Receipts + Sales: $1060.63

- Amazon Book + Kindle Sales (net after fees): $67.12

- Shopify/Direct to Consumer Book Sales: $126.87

- Radio Ads: $15.41

- Wholesale (Buyolympia): $89.14

- Patreon Memberships: $762.09

Total Expenses: $530.70

Charity: $130.00

Operating Expenses: $247.68

- Convertkit: $49

- Exist.io $4.00

- Gyroscope: $12.99

- Mailgun: $7.68

- Meals: $13.

- Backblaze : $6.00

- Storage: $6.97

- Hosting + Servers: $30.00 (Linode and Dreamhost)

- Media Subscriptions: $5

- Advertising: $2.00

- Office Supplies: $22.59

- Professional Development: $56.00

- Sonix: $15.00 (will be phased out as I do the work to copy old transcripts out of their player)

- Adobe Creative Cloud: $29.99

- Supplies for Videos: $14.94

Cost of Goods Sold: $93.75

- Shopify Monthly Fee: $29.00

- Stickers: $29.00

- Samples: $38.00

- Shipping: $26.75

Contractors: $25.30

- Transcription: $25.30

Net Income: $502.63

- Tax Savings: $125 (25% of net income)

- Lily’s Salary: $150.00

Thank you for every other informative site. The place else could I am getting that type of information written in such an ideal approach?

I have a challenge that I’m just now working on, and

I’ve been on the glance out for such information

These factors led to its improvement, making it possible for anybody to conduct helpful testing prior to construction. I’ll be in a position to produce more pieces this style.

Thank you for yet another informative site. Where else could I find such well-written information presented in such an ideal way? I’m currently working on a project and have been searching for this kind of information.