August 2018 Life + Money Report

YTD Spending: $10,478/ $20,000 maximum goal

(52% of total at 66% through the year)

This month was all about setting up systems to recover from the couch vortex of July and learning to reassess, reset, and recover my goals for the rest of the year (both business and personal). I started out the month trying to just get back on my feet and figure out what projects I wanted to focus on after missing a bunch of internal deadlines I had set for myself last month. In July, I was dealing with a touch of depression, a lot of overwhelm, and far too much uncertainty.

This month, I spent a lot of time deep cleaning the apartment while watching “getting your life together” videos on youtube and spent way too much time convincing myself that a new planner would solve my problems (I did start using a daily planner though on top of a weekly planner, and frankly it has helped!)

I ended up making a rather surprising (and pretty spontaneous) decision: I took a full-time 9-5 temp job for the next 3 months. I’m excited about my coworkers and the product (which is related to financial/insurance education). I started the last week of August, and after I accepted the job I spent an entire work day moving around 3 months of commitments and deadlines in order to balance the show/book/speaking engagements/volunteering with a new 9-5 schedule.

Thus far, it’s been nice, mainly doing operational support and customer success work with a media production team (lots of spreadsheets and salesforce reports). One thing that’s staggeringly sad is that I get better pay & benefits as a staffing firm temp (where the staffing firm is eating half my wage) than I did as a salaried director in non-profits. Plus, the company is in the tech space so they cater lunch 2 days a week and there’s a bunch of office snacks and free coffee. I’m easy to please.

The downside of this choice it is likely won’t have another day off of work, either at the temp job or my own business, from today until mid-November. I’ll be working 50-70 hours a week, minimum, just to uphold existing commitments. But I’ll bank a fair amount of cash buffer and set myself up to focus on Oh My Dollar! for the first several months of 2019. The power of a cash buffer to free up my own creativity has proved to be powerful. I feel like I’m making decisions from a place of abundance, not scarcity, again.

Plus, I enjoy just being part of an office environment again – commutes, coffee break chats, meetings, having your butt in a chair that’s not in your apartment for ~8 hours a day – these are all things I had started to miss over the past 2 years of working mostly for myself.

Good Things that Happened

- I shot another Purrsonal finance video at Pixie Project – part of the youtube content I’d like to put out the rest of this year. (Editing still in progress, will be out in September I hope.)

- I started diving hardcore back into youtube, and I have been appreciating seeing where some of the old-school youtubers I’ve been following since their early days (over a decade now! WOW I AM GETTING OLD!) are with their careers (like Daniel Howell + Phil Lester, CommunityChannel, or Wheezywaiter) and how some of the styles have changed as new youtubers come onto the scene.

- {Possibly relatedly} Rediscovered how much I LOVE reading good fanfiction again. It’s such an excellent way to relax into a story quickly when you don’t have to assemble the universe in your head, and reading the comments as the story goes along feels so much more interactive than reading a book and then…? What? Reading goodreads reviews?

- Took a class on color grading at Open Signal. My videos are gonna be gorgeous now, thank you very much.

- I was featured on Forbes.com, thanks to Debt Free Guys, a fabulous queer financial podcast.t

- I got these ridiculous boots and they bring me so much joy. I wish they were appropriate to wear.. everywhere in all weather.

Things I need to work on in coming months:

- Finding the Fun in Fitness Again Working out has generally been something I get to do, not something I have to do. It helps me manage my mental health and stress, feel stronger, and eat nachos when I want. It’s the basis of most of my self-care plans. But in June I cancelled my 24 hour fitness membership, with the idea that I would start up my training for the Half Boring Half Marathon, and wouldn’t need an indoor gym, so I might as well save some money. I would, of course, still be able to take strength training class at the boutique gym I work at. However, this August we had more that 10 days where the air quality was in the “unhealthy” territory due to wildfire smoke, and I couldn’t run outside and found myself unwilling to spend 55 minutes biking to the boutique gym in bad air quality for a 45 minute workout. I essentially fell off the working out train, and got seriously behind on my half-marathon training. I can feel my arm muscles start to soften.

As I transition into 50-70 hour work weeks for the next few months, I need to get back to working out, as it’s the only thing that helps keep my head clear in times of stress. But I haven’t really found a “routine” that I’m excited about. Running hasn’t been very fun for me (even with Aaptiv, which is my favorite way to run to work out, since a coach helps you in your ear) and is easy to just not do when I’m doing it alone. Last time I needed a kick in my butt to enjoy working out again, I found that Classpass was a good way to get variety as well as “commit” to working out (you are charged $$ if you cancel less than 12 hours in advance). I’ll likely pick up a $50 Classpass membership again for a few months, or start dance fitness classes again.

- Prioritizing Social Media for the Business Oh My Dollar! Is a media business. Just because I don’t like being on pinstafacegram myself doesn’t mean it’s not important to my business’s growth.

- Making effective business decisions I have been sitting on a number of possible opportunities that could really transform my business, and have had trouble making efficient and quick decisions. Part of this has been the ever-evolving nature of my finances and life and schedule, but much of it is simply that I’m charting unknown territory and don’t know what’s best. But not making ANY decisions is worse that making a slightly wrong one.

- Continue to work on makeup skills I mentioned this before, but makeup has stressed me out for several years, and complete bafflement as how to do it is one of the primary reasons I haven’t gotten into doing more video. I never really learned #femmeskills in high school, or in my early 20s (not a lot of makeup or hair straightening on the hippie commune). I’ve recently started investing both money (wow is makeup expensive! I had no idea!) and time in learning about the science of skincare and the art of makeup. I’ve been taking the free classes at Sephora, and watching youtube tutorials when I can stand it. I certainly will never become a “makeup every day” sort of person, but it’s fun to learn a new skill. Femme arts are real arts, yo.

Remaining goals for the year:

- Kick butt at temp job

- Start making consistent youtube videos for OMD & AnomaLily by end of November

- Save a lot of money (increase cash buffer from 6 months > 10 months)

- Have one month of $100 grocery spend

- Get the hot pink suit I fell in love with

- Give a great TEDx Talk at TEDxMtHood

- Give an excellent workshop at PatreCon

- Give an excellent talk at Quantified Self

- Launch Patreon (I did this on Sept 1, actually, and it’s going great)

- Launch {secret product} for OMD in December

- Acquire new laptop, mine is officially coming up on its 6th birthday and having to borrow a laptop to edit video or use modern photoshop is not that effective

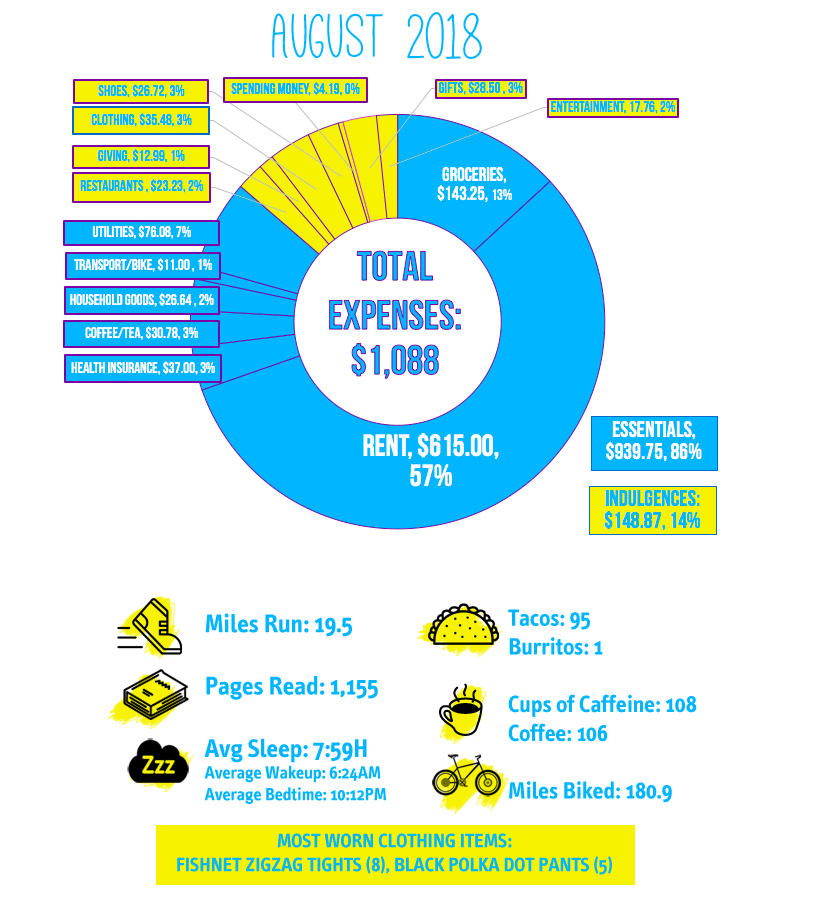

Full expenses report – $1,088.60

Essential Expenses (in descending order): $728.72

Rent: $615.00

Groceries: $157.28

(Groceries – $113.38, “Treats” – $29.67, Coffee/Tea for Home – $14.08)

Electricity: $48.58 (this is what happens when the air quality is “unhealthy” and you have to run the air conditioner 1/3 of the month)

Water/Garbage: $27.50

Internet: $0 – our internet is paid for by my SSO’s employer due to being a remote employee!

Transport/Bike: $11 (Bike Share + TriMet Ticket during bad air quality)

Household Goods: $26.64 (annual trash bag restock, deodorant, semi-annual laundry detergent)

Health Related Essentials (in descending order): $37.00

Health Insurance (after subsidy)*: $37.00

Discretionary Food & Drink (in descending order): $39.38

Restaurants: $23.23 (3 meals – 2 tacos, 1 burrito, and one post-yoga hippie lunch)

Coffee/Tea Out: $16.75

Discretionary (in descending order): $112.63

Clothing: $35.48 (two things used)

Shoes $26.72 (pair on sale from modcloth)

Gifts: $28.50

Entertainment: $17.74 (Crazy Ex Girlfriend + popcorn!)

Charitable Giving: $12.88

Money Set Aside in Sinking Funds (Not Yet Spent): $115.32

CSA Farm Share $21.00 ($250 per year)

Renter’s Insurance $11.50 ($140 per year)

Skin Care: $26

Haircut: $26.82

Makeup: $30.00

Savings: $100.00 (20%)

Traditional IRA contribution: $100

($4,038 YTD or 40% towards my goal of saving $10,000 this year)

June Total After-Tax Income: $507.29

Oh My Dollar!: $244

Part-time Fitness Studio Job: $263.29

Because I budget one month ahead, I was able to still set aside savings money despite earning less than my expenses this month.

My expenses are budgeted through September, meaning I have $1,184 allocated towards September’s expenses but not reflected in my “savings total”.

The savings total reflected is only money set aside specifically as long-term savings/retirement investing, not for future expenses.

*Health Care Subsidy Note

My high-deductible health insurance is super-cheap at $37 a month, thanks to taking the low-income ACA health care subsidy (down from a “sticker price” of $284 per month). This subsidy is based on an adjusted gross income (AGI) of $22,000 – which I hope to exceed, if my business goes well. If I do exceed that, I will have to repay a portion of my health care subsidy, up to $2,964.

Because of receiving the health care subsidy, I’ve switched from putting my retirement savings in my Roth IRA to a Traditional IRA, since Traditional IRA contributions are deducted from your AGI.

This means that if my income goes up by $5,500 and I manage to put that all in my Traditional IRA, I will owe nothing back for my health care subsidy because my AGI will not change (Roth contributions are not deducted from AGI because they are post-tax).

There are many genres that you have played, but you might have overlooked one. Let’s test it out right away!

Loved this post—your honesty about burnout and finding balance with a 9–5 is really inspiring.

Stealing is not an optional feature added for excitement. It is a core mechanic that shapes how every player behaves.