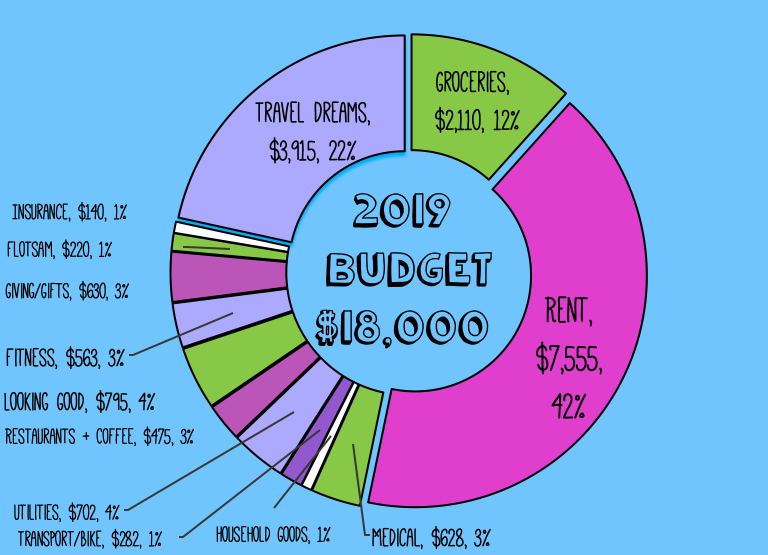

Projected 2019 Spending: ~$18,000 ($1,500 per month)

This year’s budget is very different from previous year’s budgets. Why? Well, I didn’t set an income or a savings goals this year. In 2018, I set a $10,000 savings goal as “a test of whether or not this self employment thing is really viable” – and ironically, that goal ended up being a driver for me choosing to take a full-time contract job working for someone else in the fall (while continuing to speak and travel every weekend). And while that job helped me save a lot of money, it also took a toll on my health, business, and creative energy – and it didn’t really allow me to test self-employment, since I was working for a corporation.

This year I’m trying a wild experiment: I’m trying to see if my anxious self can embrace all the savings I’ve built up over the past couple years and see if I can be okay with whittling it down some. I have a pretty informed view of my expenses after 13 years of tracking my spending, and I have the largest reserves I’ve ever built up. I’ve set aside a portion of my cash savings as a “living fund”- money I’m allowed to just spend on LIVING. I usually love to see that savings number tick up, but right now I need to focus on doing things, whether or not they bring in money.

My cash savings is big enough that I could theoretically make no money all year, and baring any unforeseen emergencies, I could actually still be financially solvent. I wouldn’t be getting ahead, but I’d make it through the year without debt. Obviously, I’m planning to make money – Oh My Dollar! makes between $800 and $3,000 per month depending on a few things – and I have contract gigs lined up. I have a bunch of uncertain business things I can’t talk about that might make money. Money will come in. But it doesn’t *always have to* come in.

For 2019, my only real financial goal is to come out ahead. If I make $18,001, and I spend $18,000, that’s okay. I am $1 ahead. This means some months I’ll spend more than I earn and eat into my savings. This means some weeks I’ll work 5 days on unpaid creative projects and only 2 days on paying gigs. I am trying to lean into the idea that I’ll be fine. I built up this buffer for a reason and that reason is to have the flexibility to create things and to travel – not take part-time jobs cleaning floors or data just to pay the bills.

The thing I most want to focus on this year is creating great informative, interesting, beautiful content and traveling a lot. I want to milk possibly the last year of getting a health care subsidy that makes my $3,000/month drug cheap and health insurance a possibility (***see note). I want to make things that I’m proud of, and let go of my worries that I’m wearing down my savings. I’m going to let go and be okay with eating down my savings.

But who really knows what this year will bring? I’m following opportunities as they come up; and life may throw some curveballs, as it does. Let’s hope I can pull this off.

Current: “Living Fund” to Wear Down as of January 2019: $7,653

(Note: this does not include my “true” emergency fund which is a separate, hard-to-access account equivalent to 6 month’s expenses nor does it include my retirement investments.)

Household & Insurance – $8,389

- Rent: $7,555 ($615 per month) This includes my predicted increase to $640 per month in June at lease renewal.

- Water, Commons, Garbage, Sewer: $330 ($27.50 per month, level billing)

- Electricity: $372 ($31 per month average) This includes higher average bill in summer due to portable AC unit; however with all the travel, this may not be necessary.

- Renter’s Insurance: $140 ($11.60 saved monthly in sinking funds)

- Household Items (detergent, TP, toothpaste, razors, etc): $132 ($11 per month average)

- Internet at Home: $0 This is now paid for by SSO’s employer due to being remote employee, was $20 per month.

Basic Food – $2,110

- Basic Groceries: $1,500 ($125 per month average) – 2018’s average was $115, but I am assuming higher cost without the farm share.

- Treats: $300 ($25 per month average) – this is a category for cookies, chips, things I don’t really need but try to emotionally compensate with. I track it separately from regular groceries just to be aware.

- Coffee/Tea For Home: $120 (assuming $10 per month average) – 2018 was $8.47 per month with some free office coffee.

- Farm Share: $0 For the first time in ~6 years I am not getting a farm share as I will be traveling too much to make use of it

Local Transport – $282

- Bike Repairs & Parts: $150 Got a major overhaul last year, so this is just going to be a chain/cable replacement tune-up.

- Bike Share Membership: $72

- Local Transit Trips: $60 (this does not include business trips to airport)

Medical – $628***

- Copays: $50 So, I have crap insurance ($7,500 deductible/OOP max) but have co-pay assistance for my $3,000 per month drug from the drug company – which means I hit my OOP max in March of each year

- Health Insurance Premiums: $348 $29 per month out of pocket from a $284 per month sticker price with federal subsidy based on $22K income – see note***

- Dental Exams/Cleanings: $230 This is the cash rate for twice yearly exams & cleanings. I am extremely lucky I haven’t had a cavity yet so I usually don’t need more than this.

- Contacts: $60 (two boxes, purchased once a year for wearing for costumes/sports, otherwise I wear glasses, and I just got a new glasses in September)

- ***Unknown amount for travel insurance for emergency medical coverage when abroad***

Fitness – $563

- Gym Membership: $518 $38.99 monthly plus $50 annual fee

- Aaptiv Membership: $45 Annual subscription to audio fitness programs

Looking Good – $795

- Haircuts: $220 Give or take every 3 months.

- Makeup: $100 A professional necessity I do not enjoy but is expensive and I have to buy it because HD cameras are unforgiving. I will need to replace my $60 HD foundation at some point this year.

- Skin Care: $180 $15 per month average – I like fancy sunscreen and nice moisturizers, sue me.

- Eyebrow Threading: $45 I don’t get this done often ($15 each ~2-3x year), but damn do my eyebrows look great when I get it done.

- Clothing + Costumes: $250 – $20 per month – This would be the lowest this category has been in 3 years (it was $0 for all of 2016), but I have plenty of clothing so I should only need mending and possible tight/sock replacements.

Food & Drink Out – $475

- Restaurants + Bars: $325 ($27 per month average) consistent with 2017/18 levels; usually this is about 0-2 cheap meals out a month, and a few pricier ($17-$25) meals for birthdays/holidays. I don’t drink so bars are usually a soda water for me. This does not include meals during work travel, paid for by the business.

- Tea/Coffee Out: $150 ($12.50 per month average) consistent with 2017/18 levels.

Giving/Gifts – $630

- Charitable Donations: $240 ($20 per month average) pulling way back in 2019 from $3,000 annual high (2015) but up from $222 low (2018), contingent on income.

- Gifts: $150 – A pretty consistent annual amount, give or take a wedding/baby.

- Patreon Memberships: $240 ($20 per month spread over many creators) This is done prior to my own cash out, so it doesn’t appear on my monthly reports.

Flotsam $220

- Entertainment (theatre, movies): $100 I spent $18.99 for all of 2018 so this is maybe too high. But I live right next to an amazing movie theatre; I should go more often.

- Spending Money: $120 $10 per month – This is for candy, library fines, random things not captured elsewhere, my 2018 average was $5.66 but over the past 3 years, I averaged $10 a month.

Retirement savings: $1,200 – $5,500

This priority is significantly dialed back for me this year – how much I contribute really depends on how my income does; the minimum I’ll put into my Traditional IRA is $1,200 as I contribute $100 per month automatically but I will put extra aside in my Traditional IRA if my income goes higher than my estimates, in order to not have to repay my health care subsidy.

Travel Dreams!!! $3,915

So, this is the big one. In 2019, I want to spend all my darn money on travel. All of it. I hope to make some money, too, and not go broke, but I’m planning to go to quite a few countries. It’s really quite a lot of travel and I have plenty of savings. I will be working on all of these trips so some costs will be covered by my business or clients; but below are my personal (non-business) cost estimates below.

Chicago/London/NYC (January): $345- flights already purchased

- Accommodation Costs: $0 (all booked + covered by points or client)

- UK SIM Card Refill: $30

- Food Costs: $150 (This is a high estimate for 5 days of non-work travel – 5 days are on business per diem; but London and NYC are expensive.)

- NYC Transport: $30

- Incidentals Including Possible Primark Trip: $100

- London Transport including Gatwick <> Shoreditch: $45

- Chicago Transport including O’Hare <> The Loop: $20

Japan (March): $1,200 – flight already purchased

- Accommodation Costs: $0 (all booked + covered by points)

- JP SIM Card: $40

- Food Costs: $500 (This is an estimate for 17 days of travel; Japan is pretty expensive)

- Robot Burlesque Dinner Restaurant: $40

- Transit including JR Rail Pass: $260 (rail travel locally, Mt Fuji <> Bus, and Tokyo <> Kyoto)

- Bike Rental: $60

- Souvenirs: $200 (including clothing, notebooks, and that Japanese sunscreen I really like)

- Temple/Museum/Cat Cafe Fees: $100

Temporary Relocation to Berlin with trip to London/Brighton (summer): $1,490

I’m trying to design my life and my business to spend 4-6 weeks of the summer working remotely from Germany with a side trip to go to the youtube convention Summer in the City in London and Brighton (UK) Pride in August.

- Flight: $80 in taxes; rest on points

- Accommodation: $600 ~$500 for sublet in Berlin; $100 for Brighton AirBNB; rest of accommodation on points or couchsurfing

- Food/Coffee: $250 – I will use my usual grocery budget ($145 per month), plus this amount for dining out + drinking all the Club Mate in Berlin over ~6 weeks. I know how and where to eat affordably in Berlin, my average monthly food costs when I last lived there (2012) were about $100 per month, $150 including beer/bars (but I don’t drink any more.)

- Local Transit (BVG in Berlin; London Underground): $80

- Train tickets Brighton <> London: $50

- Fun Things Budget: $250 This is for things like going out clubbing in Berlin (lol yea right I’m too old but hope springs eternal) or anything else.

- Mobile Hotspot in Germany: $50 So that I can like…umm, use the internet.

- Top Up UK SIM: $20

- Fitness Abroad: $60 This is for a gym or yoga pass in Berlin.

- Flight between London and Berlin: $50 (Ryanair estimate)

Train to Istanbul; Ferry to Greece; Flight Back to Berlin (summer): $880

To be totally honest, this is a pretty optimistic trip plan; but I’m hoping I can travel by train from Berlin to Istanbul; and then ferry to Cyprus + Greece at the conclusion of my European summer relocation adventure. I’ll then likely fly back to Berlin on a discount airline before heading home to the States before my Schengen area visa runs out. If I can afford the time and money, a train back from Greece is preferred.

- Turkish Visa: $20 The rest of the countries are Schengen.

- Accommodation: $240 (this is for hostels in Budapest, Bucharest, Transylvania, Istanbul, and Greece – I will try couchsurfing if possible)

- Berlin > München Train: $40

- München > Budapest Train: $60

- Budapest > Bucharest Train: $50

- Bucharest > Istanbul Train: $70

- Istanbul > Southern Turkey Train: $30

- Ferries from Southern Turkey > Greek Isles > Athens: $40

- Food: $200 Food is cheap in eastern/southern Europe and Turkey so this might be a vast overestimate.

- Museum Fees/Flotsam: $100

- Flight between Greece and Berlin: $50 (Ryanair estimate)

Monthly Business Overhead Costs: $154.98

Not in personal budget!

I have a number of costs that are not reflected in my personal budget. Most of these would not exist if I was not self-employed, as they would be covered by my employer or unnecessary. Many are covered by clients when I travel to speak. Some of these costs include: business travel costs including per diem (food) on the road, costs to replenish inventory, printing and shipping costs, video production and equipment costs (including laptops and cameras), and things like Wifi or data when traveling.

Those are project-based and vary depending on work, but I will list out my monthly overhead, including my cell phone, paid for by my business.

- Mobile Phone Plan: $40 per month

- Adobe CC Membership: $15 per month

- Convertkit: $39 per month

- Teachable: $29 per month

- legal transcripts for Podcast via Sonix: $15

- Web Hosting: $12

- Google Storage: $1.99

- Apple Storage: $2.99

***My usual disclaimer about my health insurance premium!***

Per usual, I have to make a disclaimer about my health insurance since American heathcare is broken and I have fallen into a weird personally fortunate loophole of the current US brokenness. I am extremely happy to have ACA-compliant health insurance available through the healthcare.gov exchange – I mostly didn’t have health insurance before the ACA passed as an adult.

I have the absolute cheapest plan on the Oregon market, which is $284 per month for a single, non-smoking 31-year-old female – which comes with a whopping $7,500 deductible before a single thing is covered ($7,500 out-of-pocket maximum). It would be considered a “catastrophic” plan for most people.

There’s two absolutely bizarre things in my favor, however, neither of which I expect to continue into perpetuity –

- I have a chronic autoimmune condition that has only responded to treatment with one drug – a weekly shot of entercept (Enbrel). Each weekly shot is about $800, and must be delivered on ice to my house by a specialty pharmacy. This all sounds terrible, right? Well, the first piece of good news is that it works- my RA is completely managed with almost no pain or activity restrictions.The other piece of “good news” is that this drug is SO expensive with no generics available (under patent protection in the US for another 10 years) that the company that makes it offers a co-pay assistance program, which does not have a high or low income requirement – you can receive up to $18,000 of your co-pay covered by the drug company each year – as long as you are on private insurance and not Medicaid/Medicare. The drug company’s co-pay assistance counts towards my deductible.This co-pay assistance pays for my ~$3,000 a month of medication, which means I hit my $7,500 deductible AND out-of-pocket maximum by the 2nd week of March, all covered by the drug company. After that point, my medication, labs, doctor’s visits, and everything else are paid for by the insurance because I’ve hit my out-of-pocket maximum, which means I pay $0 for the rest of the year aside from my monthly premiums.

- Currently, I have a relatively low Adjusted Gross Income (AGI) of ~$22,000. This is slightly lower than my gross income because I contribute to a Traditional IRA (which lowers your AGI), have business expenses, and generally haven’t made a ton of money the past couple years (or really ever depending on who’s measuring stick you use.) This means that I receive a monthly health care subsidy that lowers my costs to $29 per month. Because this is based on estimated AGI, if my 2019 AGI exceeds $22,000, I will need to repay the health care subsidy up to $3,060 (more needs to be repaid the higher my income goes.)

I thought this same thing. Her monthly budget I can easily spend on one dinner. I was gonna say fancy dinner but tbh one Postmates order can be more than that.

Ha! I only do postmates when traveling really.

Also I think I’ll be in Germany in August as well though I’m haven’t worked out the details yet.

Awesome! I’m in the same camp, still trying to figure out the details. I have a lot of in-process business things that makes my future a little fuzzy after April, so here’s hoping!

This was so fascinating to read, Lillian. Thank you for sharing!

Thank you! I put it up mostly for myself, and am delighted when it’s helpful or interesting for others!

Thanks for sharing this! I was living off my savings in 2018, but feeling guilty and weird and ashamed about it. I plan on continuing to do so in 2019 but with new framing around it. Naming the account something like “living fund” and understanding that past me was working towards this kind of flexibility and freedom are good reminders to not go running back into the arms of full-time work that’s NOT FOR ME.

Oh lord I can’t pay out of pocket for the shot. But the good news is it is not an infusion, but self-administered. I receive the shot from a refrigerated box via courier in monthly amounts (4 shots) and as of last year I am able to get pre-authorization from my insurance to get up to 10 weeks of the shot to get delivered to my house at once to take abroad. I spend a bunch of time calling insurance, getting my Rheumatologist to approve it when I’m going abroad and then can get a bigger supply brought by the courier. The actual shots are stable for like ~18 months in refrigeration so stockpiling is only an insurance issue.

The big issue with long-term travel is refrigeration. The shots must be refrigerated but as of 2016 is allowed via the FDA to be out of refrigeration for 14 days (within a small temperature range) BUT you can’t put it back in the fridge once you take it out. That means for ~3 week trips, I take a shot right before I leave, and bring two along with me out of refrigeration which lasts me 2 weeks as long as I’m not staying somewhere that’s like 100F.

For a month-long trip, I skip my last shot of the month (since it is an immunosuppressant, I have to skip it if I’m getting a cold anyway, so missing a week’s shot sucks a little but isn’t hugely problematic.) Two weeks of skipped shots does become an issue since, umm, I don’t take this medication just for funsies, so any trip over 5 weeks has a different strategy.

For longer trips, I have to make sure I have access to a refrigerator at my destination (sometimes choosing an airbnb or hostel over a regular hotel for that reason, but you can ask a traditional hotel to store them in the kitchen) and then I have a special carry-on refrigerated lunchbox style thing (given to me by the drug company) that I take on planes. I usually try to find a public bathroom with needle disposal boxes (all airports have them) to get rid of the needles, but sometimes I actually just carry them home :-P

Always happy to share my experience with the drug! I was so nervous to go on entercept due to the travel logistics (& cost) involved, but luckily it has mostly been great except for the $36,000 annual cost. And the drug is the only thing that has worked to treat my condition (RA) despite me trying literally every other commercially available drug for it before this.

This is really one expensive budget. Thank you for sharing your thoughts. This will help us out a lot.

sprunki mods.Sprunki Mods are a revolutionary collection of add-ons that elevate the Sprunki experience. Each phase embodies a unique blend of immersive themes, dynamic soundscapes, and captivating visuals, offering endless opportunities for customization and creativity.

Your approach to balancing savings with living life fully is super relatable, especially after that health-draining corporate gig.

Wow, her travel budget is impressive! I’m over here struggling to beat level 50 on royal match and she’s planning trips to 8 countries, haha! Seems like a cool experiment, focusing on experiences over savings.