March 2018 Life + Money Report

Good things that happened this month:

- Get Your Money Together book, is in review at the printer after numerous delays due to me being sick for 10 days, procrastination, and graphic design frustrations. Unfortunately, the book printing is costing me more than budgeted (I had to make the page sizes larger for design reasons, and we added more pages than initially anticipated), and I’m also concerned the books will not arrive to backers until early May (instead of anticipated ship date of sometime in April- I’ll know soon). But it’s finally, finally there.

- Reducing Coffee Consumption I finally invested in nice green tea in an effort to reduce my coffee consumption and found a near-rhythm with Genmaicha green tea, which is delicious and a good coffee replacement, but way cheaper than matcha. I haven’t completely cut off coffee consumption, but I have reduced it from 3 cups a day to 1 cup a day.

- Trying out Vitamin B12 + L-Theanine After downing a 5 Hour Energy in an attempt to fight a really serious round of fatigue while trying to write on deadline, I discovered the magic that was big doses of B12. So, I’ve started experimenting + supplementing (with my doctor’s blessing) B12 and L-Theanine, which has been awesome.

- Establishing a skin care routine I’ve been having a lot of trouble with my skin (it hates the winter and all my working out) so I spent some money last month investing in products and beginning to use them, based mainly off a Korean style of skincare. Of course, I was attracted to this method because it can involve cat-ear headbands and extensive spreadsheets.

- Back to speaking gigs I had three gigs this month: a financial basics workshop at Reed, mini-talk and session at Bond Office Hours, and an informal panel at Go Fund Yourself! at School of Art Institute of Chicago. All those were really, really fun. I have four gigs scheduled for April.

- Work travel Two work travel trips, and frankly, I love them so much. I love airports. I love being in motion. I like having a purpose to my trip. I like teaching personal finance to new people. Plus, it helped that on my San Francisco trip I stayed with a dear friend I hadn’t seen in months!

Things I want more of in coming months:

- Time to work on the business without distraction – This is a carryover from last month, but I made concrete changes this month (scaling back my hours at part-time job and resigning a volunteer position). Both of those changes will show some fruit in May. April will be a low business hours month (about 72 total predicted) , but I think May will finally give me space and time to really focus.

- More Data Art! – I am starting the 100 day project on April 3rd, with the goal of creating 100 different pieces of data art! I started using the quantified self tool Exist.io this month (review will be coming) and this will factor into my art.

- Balance – April is going to be a schedule-packed month, and I’m likely going to put in close to 200 hours of productive time between my 3 jobs. Even with a lot of work, I’m trying to take at least 2 FULL days off total this month, and continue to take daily time for fitness, meditation, cooking meals, and reflection (in the form of both data tracking and journaling).

- More group fitness classes – I started working at my part-time fitness job for the free classes, but my schedule there, ironically, made it hard to attend classes. Now going down to 1 shift per week, I hope to attend more classes instead of just my treadmill and lifting at the Big Box Gym.

Things I want less of in coming months:

- Low-Paid Work For Other People I scaled back my hours at my part-time fitness job to one day a week – starting in April. For the month of April, this is being replaced by some freelance data work (that has a much higher hourly rate than the just-above-minimum wage fitness job), but in May and beyond, I hope to spend 5 days/week working on Oh My Dollar!, rather the 2 days/week I’ve been averaging. This is important because I’ve been feeling very stretched by the hours spent Working On Other People’s Businesses, when I know my own would benefit from more time and attention.

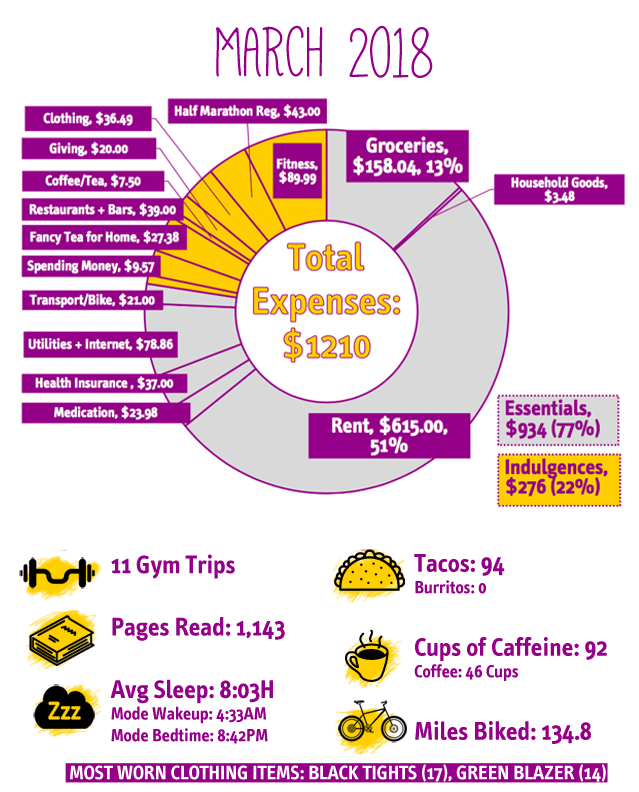

- YTD Spending: $3,833/ $20,000 maximum goal

(19% of total at 21% through the year)

Essential Expenses (in descending order): $900.36

Rent: $615.00

Groceries: $158.04

(Groceries – $126.83, “Treats” – $30.21, Coffee/Tea for Home – $1.00)

Electricity: $31.39

Health Insurance (after subsidy)*: $37.00

Medication not covered by insurance: $23.98

Water/Garbage: $27.50

Internet: $19.97

Transport/Bike: $21.00

Household Goods: $3.48 (Cleaning Supplies)

Notes: Treats budget is down from last month, but it still needs improvement. I still buy impulse snacks when I’m feeling sad/when I’m procrastinating.

Discretionary Food & Drink (in descending order): $78.33

Restaurants: $24.00 (fancy Departure meal to celebrate Aaron’s new job)

Coffee/Tea Out: $7.50

Fancy Tea: $27.38 (I made myself budget for fancy tea separately to encourage myself to decrease coffee consumption.)

Bars: $15.00 (mocktail at Departure + club soda at bar outing + kombucha at show)

Discretionary (in descending order): $199.05

Clothing: $36.49 (one dress from Poshmark)

Half Marathon Registration: $43.00 (saved for in my half-marathon sinking fund!)

Fitness Membership: $89.99 ($41.00 membership + $48.99 annual fee)

Charitable Giving: $20.00

Pocket Money: $9.57 (I hate to admit this was energy shots…)

Money Set Aside in Sinking Funds (Not Yet Spent): $66.11

CSA Farm Share $21.00 ($250 per year)

Bike Drivetrain Repair Fund $23.61 (towards $200 in May)

Renter’s Insurance $11.50 ($140 per year)

Haircut Fund $10.00 ($55 every 5 months)

Dance Classes: $20

Savings: $550.00 (50%)

Traditional IRA contribution: $100

Cash Savings: $450

($3,644 YTD or 36% towards my goal of saving $10,000 this year)

Total After-Tax Income: $1093.69

Oh My Dollar!: $275 (this is my paycheck after expenses, COGS, and tax)

Part-time Fitness Studio Job: $818.69

My income was low this month due business expenses involved with printing the book and travel (and a delayed freelance check, of course), but luckily last month I “sent” forward quite a bit of my income to future expenses, completely covering this month and next month’s expenses from my February income.

This foresight to send my tax refund forward meant that I could save 50% of my income for this month, despite the fact that my expenses were higher than my income. I am a huge fan of using windfalls to save for future expenses instead of buying fancy things – because security is a core value for me, and my income is so variable. I try to have as long a wait as possible between acquiring money and using it on expenses.

My expenses are budgeted through mid-May, meaning I have $1,857 in my checking account allocated towards future expenses but not reflected in my “savings total”.

The savings total reflected is only money set aside specifically as long-term savings/retirement investing, not for future expenses.

*Health Care Subsidy Note

My high-deductible health insurance is super-cheap at $37 a month, thanks to taking the low-income ACA health care subsidy (down from a “sticker price” of $284 per month). This subsidy is based on an adjusted gross income (AGI) of $22,000 – which I hope to exceed, if my business goes well. If I do exceed that, I will have to repay a portion of my health care subsidy, up to $2,964.

Because of receiving the health care subsidy, I’ve switched from putting my retirement savings in my Roth IRA to a Traditional IRA, since Traditional IRA contributions are deducted from your AGI.

This means that if my income goes up by $5,500 and I manage to put that all in my Traditional IRA, I will owe nothing back for my health care subsidy because my AGI will not change (Roth contributions are not deducted from AGI because they are post-tax).