Most years, I set out my annual projected spending. Then, at the end of the year, I report back on how it shook out in reality. This process helps me curb lifestyle inflation in years my income goes up (staying true to my cheap punk rock heart). It also gives a birds-eye view of the financial impact of my other goals (since almost everything costs money!)

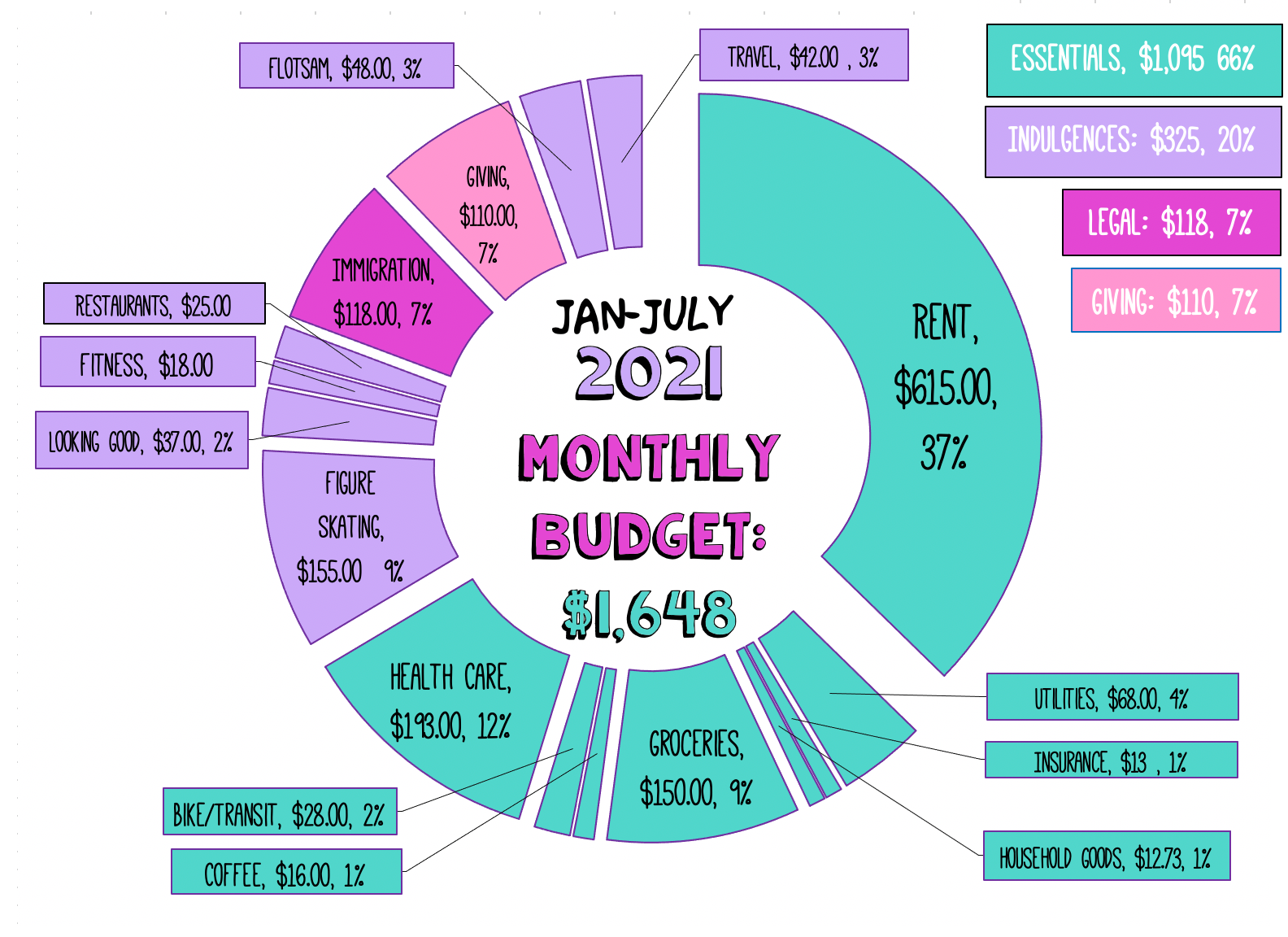

For 2021, I only did a 7 month budget instead of an annual budget. After the Year of Our Covid Twenty Twenty, predicting anything an entire 12 months in advance seemed impractical and full of hubris. Not only was the world economy in chaos, I also had my own life uncertainty. (Would I run away to London for graduate school in August? Would my rent increase when my lease was up in July? Would I lose my day job? Would travel resume? Would the ice rinks open?)

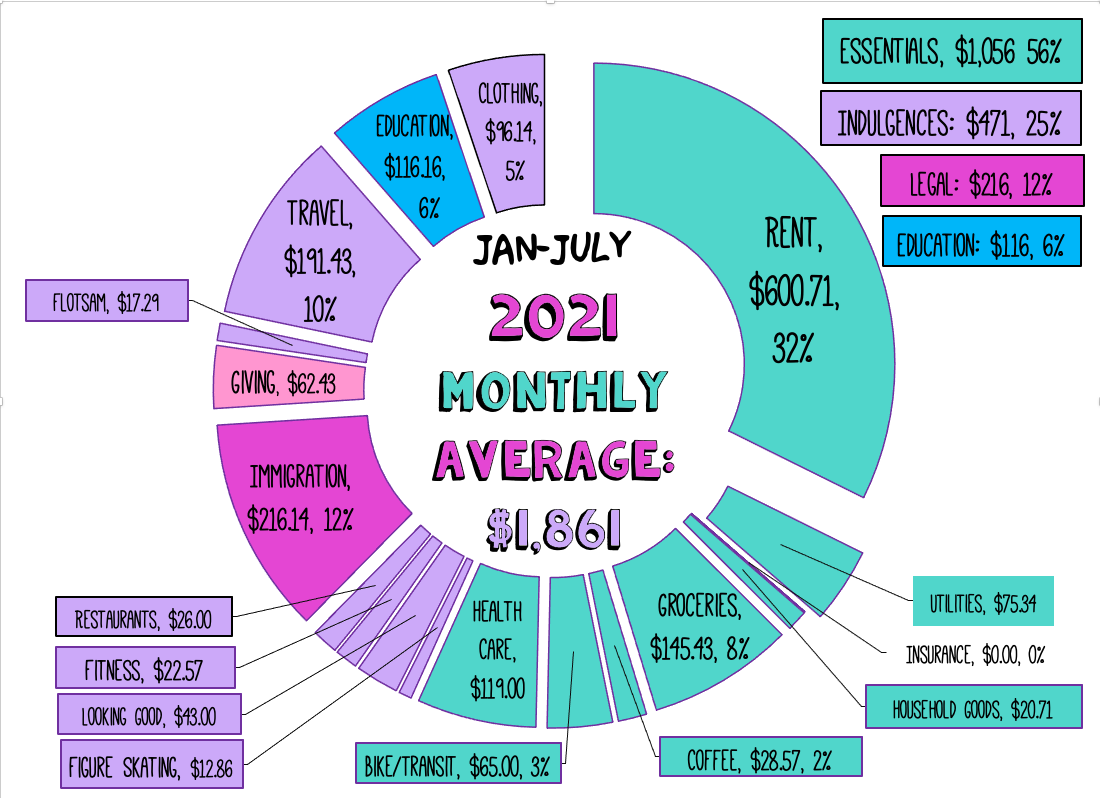

Overall, I spent a little more than I projected, some of which was out of my control (i.e. how much Croatian court translation costs) – but I also saved almost twice as much as projected. So I feel pretty good about my spending – a good mix of fun, practical, and some big-ticket items like immigration.

Having a full-time day job that pays a median income in 2021 is a big privilege – and I want to leverage my fortune by spending on some long-term splurges (EU passport! language classes!) and also saving up for inevitable future unstable times.

Projected 2021 Monthly Budget: $11,536

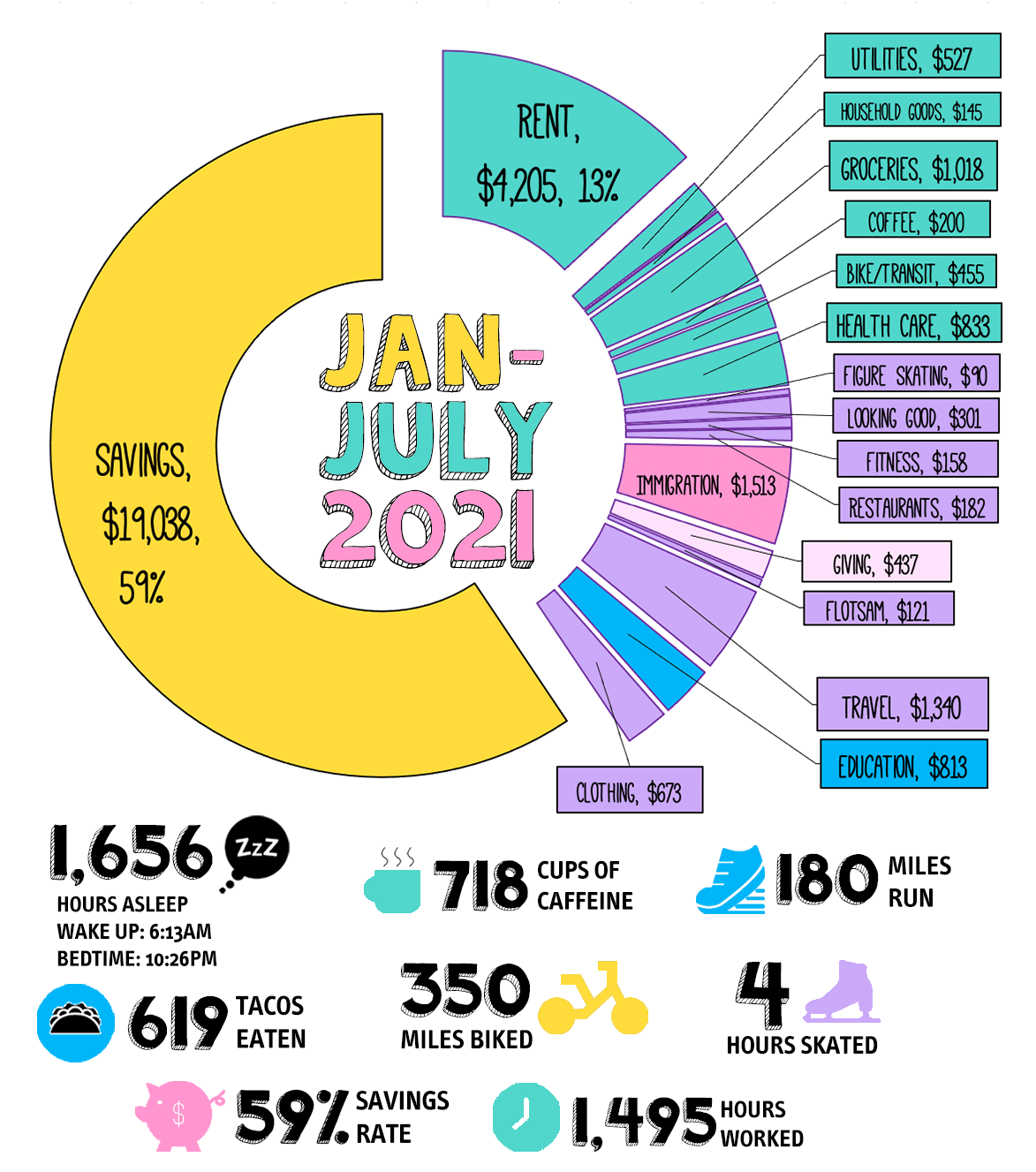

January – July 2021 Spending Report

$13,023.35^/$11,536 budget

$1,861 per month^/$1,648 per month budget

This is the average for 7 months of expenses for 2021!

Household & Insurance – $5,332.21/$4,991^

($761 per month)

- Rent: $4,205/$4,305↓ ($601 per month) We got $100 each as a bonus for renewing our lease. The same monthly rate was offered to us for renewing.

- Water, Commons, Sewer: $227.50/$227.50 ($27.50 per month, level billing)

- Trash: $52.50/$52.50 ($7.50 per month, level billing)

- Electricity: $247.25/231^ ($41 per month average) This included a higher rate for running our portable AC during the summer.

- Renter’s Insurance: $0↓ I saved $13 per month in a sinking fund, but I only pay this once a year in August.

- Household Items (detergent, TP, toothpaste, razors, etc): $74.87/$87.50↓

- Air Filters: $70.49/$0^ Bad Air Quality because the world is on fire means this is a new expense

- Internet at Home: $0 This is now paid for by SSO’s employer due to being remote employee, was $20 per month.

Basic Food – $1,150.96/$1,162↓ ($164 per month)

- Basic Groceries: $883/$945↓($126 per month average) – a little lower than predicted but offset by higher treats and coffee category

- Treats: $135/$105^ – this is a category for cookies, chips, things I don’t really need but try to emotionally compensate with. I track it separately from regular groceries just to be aware.

- Coffee/Tea For Home: $132.28/$112^ This has increased as my stress levels increased. Related?

Local Transport – $454.60/$200^ ($64 per month)

- Bike Repairs & Parts: $441 My xtracycle tune-up and new wheel and cassette cost more than I originally expected. But now it is in good shape to sell, if I decide to. Plus, a brake and cable replacement on my main ride.

- Biketown: $13.60 To and from picking up my bikes from the shop.

Fitness – $158/$126^ ($23 per month)

- Obé Subscription: $79/$126↓ – Had Obé subscription for working out at home through the Dark Times

- Half Marathon Registration: $54/$0^ – Registered for a half marathon to motivate myself to train

- Weights: $15.99/$0^ – Dumbbells for home

- Training Clothing: $9/$0^– sports bra from goodwill

Health – $665.4/$1,353↓ ($95 per month)

I can’t even get into how complicated my health care costs were for 2021 (Some day I’ll finish the long form post on this). It got even more complicated because I didn’t actually end up having to repay my overpayment of the 2020 health care premium subsidy – instead I got that money back from the IRS due to the American Rescue plan changes to the 2020 tax code. I talked in this livestream about what happened with that:

- Payback 2020 health care subsidy: $0/$1,153↓

- Copays: $581/$160^: This is the cost of co-pays and other out of pocket costs – not including what is covered by co-pay assistance for my drug (which has been $8,118 year to date prior to hitting my out-of-pocket maximum).

- Health Insurance Premiums: $0/$0 My HDHP is paid for premiums through work at $0 cost to me.

- Dental Exams/Cleanings: $84.20/$20^

Figure Skating – $90/$1,090↓ ($12.86 per month)

The rinks were closed for most of the winter, and I waited to go back until after I was fully vaccinated. So this was much, much lower than I’d hoped.

-

Ice Time: $80/600↓

- Coaching: $0/300↓ (Private lessons)

- Fees: $0/100↓ (annual USFSA membership)

- Skate Sharpening: $0/40↓

- Costumes, Laces, Bunga Pads, + Tights: $10/$50↓

Looking Good – $1,141.34/$265^ ($163 per month)

- Hair: $169.75/$100^ I am so happy I was able to pay a professional to cut my damn hair – twice!

- Makeup: $132.07/$60^ A professional necessity.

- Skin Care: $167.20/$105^ I like fancy sunscreen and nice moisturizers.

- Clothing: $576.76/$0^ It’s been a hard year. I bought clothing. All purchases were used or from an independent, ethically made brand. I’m currently selling some high-dollar clothing and will hopefully repay some of this category.

- Bras: $56.11/$0^ Needed a “new” used bra.

- Shoes/Shoe Repair: $39.45/$0^ Got a pair of shoes used.

Food & Drink Out – $249.67/$175 ($35 per month)

- Restaurants + Bars/Takeout: $181.61/$105^ Once things started to re-open with covid-patios, I tried to go some restaurants. About half of this total came from spending money at restaurants when staying in a hotel during 2 days visiting LA for our consulate appointment

- Tea/Coffee Out: $68.06/$70↓ mostly nice coffee drink to reward myself for long runs!

Citizenship Costs – $1,512.99/$827^ ($216 per month)

This cost a lot more than expected…the whole process is a lot of paying people to move paper around! When/if I manage to get citizenship, I will make a video and blog post about the process of applying for Croatian citizenship by descent.

- Immigration Lawyer $520/527↓ This is the cost of a lawyer in Croatia who guided us through the process and prepared documents for submission.

- Translation $393.58/$80^ Official court translation fees for final documents.

- Vital Records + Background Checks: $235.25/$80^ Ugh. No way around this.

- Postage: $105.65/$0^ So much fedexing and USPSing back and forth.

- Assorted other costs $22.50/$140↓ Wire exchange fees

- Filing Fees: $236.00/$0^ The actual filing fee to the Croatian consulate.

Education – $813 ($116 per month)

- Croatian Language Class: $613.10 This was through the University of Zagreb in spring 2021.

- German Language Class Deposit: $200 – I’m taking German class from Sep – May 2021-2022

Giving/Gifts – $437.35/$770↓ ($62 per month)

- Charitable Donations: $374.66/$700↓ I donate more through OMD rather than via my personal account- but most of my donations come end of year, so this is low right now.

- Gifts: $62.69/$70↓ – A pretty consistent annual amount, give or take a wedding/baby.

Flotsam $121.10/$340↓ ($10 per month)

- Entertainment: $6/$70↓ Went to one movie theatre when they re-opened! More to come pending variants?

- Spending Money: $63.60/$70↓ This is for candy, library fines, random things not captured elsewhere.

- Costumes: $51.50/$0^ – Lolita clothing.

- Moving Expenses: $0/200↓ We did not move.

Travel $1,340.22/$300^ ($191 per month)

There were tons of good travel deals, so I ended up paying cash instead of using points for quite a few flights.

- Hotels: $178.37 – Hotels for Denmark 2021 trip.

- Restaurants: $28 – Pre-paid breakfast for Denmark 2021 trip.

- Gifts: $4.00 – Gift for friends in LA.

- Travel Flotsam (Luggage/Etc): $97.27

- Taxes/Fees for award flights from PDX<>SFO: $11.20

- Flight From SFO <> Nairobi, Kenya for Feb 2022: $674.55

-

Flight From SFO <> Billund, Denmark in Sep 2021: $346.83

Savings: $19,038/$10,000^ ($2,719 per month)

This is a combination of retirement savings (SEP-IRA and Workplace 401K) and cash savings.

My stretch goal is to save $21,000 as part of the 21 in 2021 Challenges we’re holding over at the OMD forums. I am currently at 91% of that goal at 58% of the way through 2021.

I walked through my savings and these expenses on my OMD livestream on August 1st. The savings portion starts at 24:06 if you’d like to check it out.

Thanks for information… 😘

great share. thank you!

I love the sense of community here.

You have got a perfect financial planner for a year and I have also learned a lot of good things from this planner, this is a very good job and I think everyone should learn from you.

Many people’s lives can be changed by an excellent book or article. I appreciate you offering this useful information, so please keep it current. I’ll follow you constantly.

Dinosaur Game:https://dinosaurgame.run/

Block Blast:https://blockblast.run/

Drift Boss:https://driftboss.racing/

PolyTrack:https://polytrack.run/

Infinite Craft:https://infinitecraft.click/

Sprunki:https://sprunkigame.im/

Animal Sounds:https://animalsounds.io/

Random Address Generator:https://addressgenerator.app/

Random Animal Generator:https://animalgenerator.org/

Love Pawsona:https://lovepawsona.im/

Retro Bowl:https://retrobowl.im/

Block Breaker:https://blockbreaker.run/

OvO Unblocked:https://ovounblocked.im/

I am truly amazed! We greatly appreciate your provision of this invaluable information; your article is outstanding. Additional shares would be fantastic.

Your site got my attention and shows me different perception for how we should boost our site. This is a really perfect for a new blogger like me who doesn’t want their site to be messy with those spammers who don’t even read your post but they have the guts to comment in your site. Thanks again.