Quick note at the top: my full annual report zine (like 2016’s) includes fun graphs and stats on miles flown, tacos, people seen, mood, and more!

It comes out January 21st, 2021. Personalized copies will be sent via snail mail to every single patron – even $1 patrons. Sign up as a patron before January 17th to get a copy mailed!

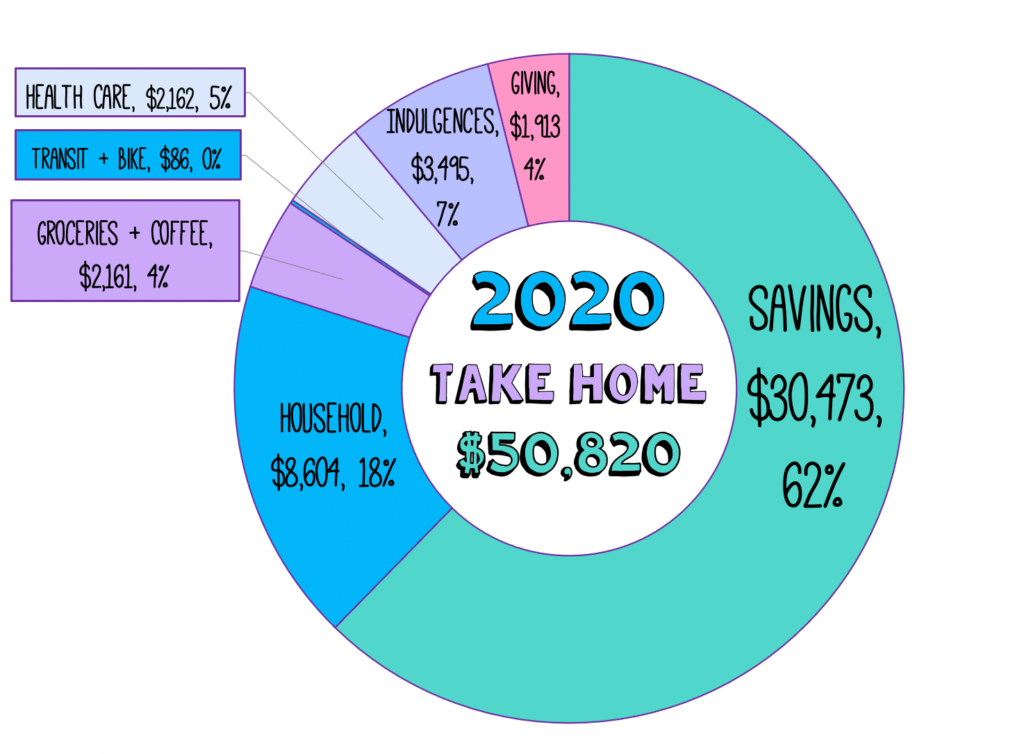

Well, 2020. I reached and exceeded all my financial goals in the worst (global) year of my lifetime. 2020 was the highest income of my 16-year working career. The high income came at the cost of working more than 3,120 hours this year. Those hours represent the time spent at a full-time job, a 15-20 hour a week job for 6 months, running a side business that averages around 12 hours a week (a business which used to be my full-time job), and a short period finishing out my job as a barista in January.

It was a lot of work, and it was terrible for my mental health. I am very grateful to have the privilege and the luck (leaving the service industry 2 months before a global shutdown!? what the heck?) to still have work in a time like this. Having such a high income allowed me to donate more than ever before, while still exceeding my savings goals.

I was able to save over $30,000 this year, which represents more than my usual pre-tax income.

Saving money sure is easier when you’re making the median income (and have still have expenses similar to when you’re making minimum wage).

- Stimulus: $1,800

- Tax Refunds: $603

- Day Job #1: $34,889

- Day Job #2: $5,333.37

- Day Job #3 Tips + Wages: $678

- Oh My Dollar!: $6,810.16 (Full report comes out soon!)

- Assorted Random Income (Bank Interest, Rebates, Etc): $102.93

- Podcast Studio: $599

Total 2020 Post-Tax Income All Sources: $50,820.43

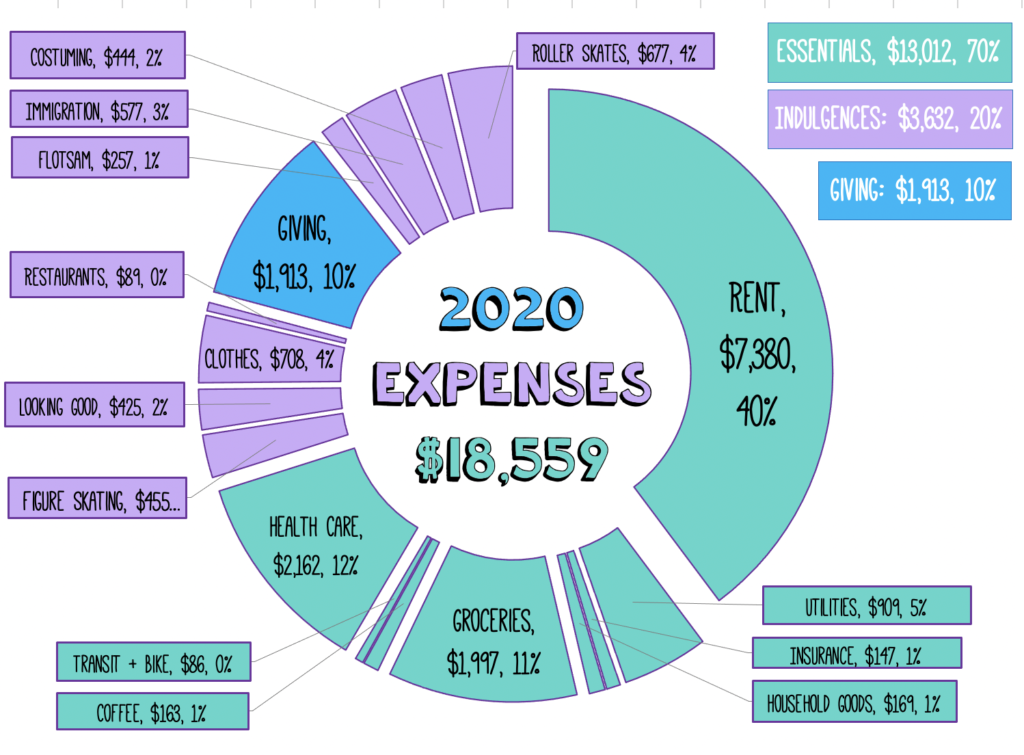

Full 2020 Spending Report: $18,559/$21,000 Budget↓

Household & Insurance – $8,605/$8,389^

- Rent: $7,380/$7,555↓ ($615 per month) I expected my rent to increase in November when my lease was up, but the pandemic meant it didn’t go up.

- Water, Commons, Sewer: $390/$360^ ($27.50 per month, level billing)- this went up by $2.50 a month

- Trash: $90/$90↓ ($7.50 per month, level billing)

- Electricity: $429/$396^ This went WAY higher due to being home 27/4 all year, working from home with lots of cameras and computers and servers running, and 2 weeks of not being able to breathe inside during 400+ AQI and not being able to open the windows and running every single thing we could think of to clear the air (it didn’t work until we got an air purifier.)

- Renter’s Insurance: $147/$156↓ No premium increase this year.

- Household Items (detergent, TP, toothpaste): $169/$132^ Slightly higher due to air purifier filters and increased cost for cleaning products and gloves.

- Internet at Home: $0/$0 This is now paid for by SSO’s employer due to being remote employee, was $20 per month.

Basic Food – $2,140/$1,830^

- Basic Groceries: $1,685/$1,500^ The cost of groceries went up a lot for me – both in needing more (no free meals at work, no business travel) and the cost of groceries has risen a lot.

- Treats: $176/$300↓ This is for things like snacks, ice creams, etc.

- Coffee/Tea For Home: $143/$96^ Free coffee through work ended in March, had to start buying my own.

- Farm Share: $128/$0^ We did get a farm share this year after it became clear we wouldn’t travel.

- Delivery Tips & Fees: $7.85/$0^ Grocery delivery, tried it out, not my thing, very lucky to have other people that were willing to shop for me since I am immunosuppressed.

Local Transport – $86/$170↓

- Bike Repairs & Parts: $12/$150↓ No major work was done, just bike tape.

- Local Transit Trips: $0/$20↓ – I get a free transit pass through work, and also have nowhere to go.

- New Pannier: $74/$150↓ I got a new pannier on sale, and spent $15 getting my old one repaired.

Health – $2,090/$2,151↓*

*This is complicated. I also have about $1,200 saved – not counted in my overall savings total – that will need to be repaid with my 2020 taxes due to receiving health care subsidies for my exchange plan from May – December 2020 after I qualified for a workplace plan.

- Copays: $20/$50↓

- Health Insurance Premiums: $1,849/$1,731^

- Dental Exams/Cleanings: $0/$230↓ My appointments were canceled due to covid.

- Contacts: $191/$140^ I got a full years’ worth of contacts and saline is expensive, too!

- Fitness: $30/$0^ Trying to get weights to work at home, dammit!

Figure Skating – $455/$2,606↓

The rinks closed in March, re-opened in May, shut back down again in June, re-opened in November, shut back down 2 weeks later, and are now closed again. I went once during each rink re-opening, but we’ll see when it’s safe again. One rink has already been forced to close.

Ice time is much more expensive due to covid, because there’s no group lessons or public skate to be had, and they’re limiting to 10 people on the ice so the cost is higher.

- Ice Time: $181/$1,200 ↓

- Coaching: $222/$816↓

- Testing, Registration, + Competition Fees: $0/$300↓

- Skate Sharpening: $17/$90↓

- Costumes, Laces, Bunga Pads, + Tights: $35/$200↓

Looking Good – $1,133/$832^

- Hair: $182/$220↓

One haircut before lockdown plus a lot of various things to try to figure out how to do my hair now that it’s super long because no haircut 😂 - Makeup: $105/$100^ Just about on target.

- Skin Care: $138/$180↓ Moisturizers and sunscreen galore!

- Clothing: $708/$330^ I bought more clothing than predicted, trying to support small black-owned businesses and indie designers. I also splurge on a fancy raincoat (used) and replaced my worn-out bras after 6 years.

Food & Drink Out – $110/$300↓

- Restaurants + Bars: $89/$180↓ Noooowhere to go. I usually only spend money out during meetings and birthdays, which obviously did not happen this year. I tried to get some takeout to support local businesses, but it’s just not where I get joy from spending. I’d rather buy a cute dress from a small designer!

- Tea/Coffee Out: $21/$120↓ I got some nice coffee drinks for celebrating running milestones.

Things that are a direct result of working 3 jobs – $72/$720↓

- Cleaner $0/$720↓ (lol covid meant no house cleaner)

- Massage: $72/$0^ Right before lockdown, I did get a massage.

Giving/Gifts – $1,913/$1,000^

“Overspending” I feel great about.

- Charitable Donations: $1,403/$550^ I gave an additional $557 through OMD as well, not represented here.

- Gifts: $98/$150 ↓ This is regular birthday/thank you gifts.

- Mutual Aid:$409/$0^ This was mostly to support gofundmes and getting resources to undocumented families in our local school district.

Assorted Unexpected Costs $1,698/$0^

- Roller Blades:$677/$0^ When the rinks shut down, I spent part of my stimulus dollars on custom hot pink figure skating roller blades so I could get some skating practice outside.

- Costuming:$444/$0 I got a custom made costume for Halloween (it was originally intended for my birthday in July…but covid shutdowns mean I got it in October). It brings me joy.

- Immigration Costs: $577/$0 As of January 2020, a rule change in Croatian citizenship law allows me to pursue Croatian citizenship. I am now in this process and paying a lawyer to assist.

Flotsam $257/$450↓

- Entertainment (theatre, movies): $6/$100↓ Lol theatre lol.

- State Fees: $26.00/$0^ Replacement Driver’s License after a theft.

- Home Decor: $52/$0^ I bought a mirror for outfit selfies (priorities).

- Cat Stuff: $35/$0^ Dora got some novelty surgery cones.

- Streaming: $12/$0^

- Spending Money: $56/$120↓ Mostly candy.

- Bike Camping: $0/$80↓ Um campsites were closed and also public restrooms..well…not the safest in a pandemic.

- Shoes & Shoe Repair: $70/$0^ One used pair of boots and the cost of shoe repair on two pairs of shoes.

Travel $0/$2,115↓

Well, we all know what happened there.

Savings 2020 Final Report

Retirement savings: $6,000

Cash Savings: $24,473*

(This does not include cash savings expected to be spent in the next 2 months, including my health insurance subsidy repayment).

2020 Savings Rate: 61% of Post-Tax Income

2020 Total Savings: $30,473/$20,000 goal

Cool post.