April Expense Report

So, this month wasn’t much to shake a stick at. Ideally, the best finances are boring finances, so I’m always happy to see an “easy” month.

A few things that were notably high this month: fitness (my annual gym fee came due) – which is kind of ironic, since this was my lowest gym-trip month this year, at only 4.5 times per week. Coffee budget was also pretty high, a direct result of how many meetings I had and how stressed I was (I really wanted “treats” frequently). I’m pretty sure I’ve been overusing caffeine, so it might be time to examine that…

I fell off the daily gym wagon because of all the work I was doing to get Get Your Money Together Bootcamp online ready (lots of time in the TV studio). However, I got back to daily workouts in the last week of the month, so I hope that keeps up during the month of May.

I’m still not drinking alcohol, which has been great for my budget, but as the weather is getting better, there’s a lot more social time at bars and I have still been dropping $4-6 each time I go out for some non-alcoholic drinks. Still half the price of a cocktail!

Essential Expenses (in descending order): $837.33

Rent: $615.00

Groceries: $160.20

Electricity: $28.19

Internet: $20.00

Household Goods: $7.94

Transport/Bike: $6.00 (Biketown)

Health Care (in descending order): $251.00

Health Insurance: $231

Co-pays: $20.00

Trans-Siberian Railway Trip

No expenses in April – put $785.44 aside towards May expenses

Running total YTD: $322.66/$3,000 budget

Wardrobe Redo Project: $0

No expenses in April

Discretionary (in descending order): $182.24

Travel (non-work): $84.48 (hotel for Amsterdam trip for non-work days)

Fitness Annual Fee: $50.00

Fitness Monthly Membership: $39.00

Spending “Fun” Money: $8.76 (candy and office snacks)

Discretionary Food & Drink (in descending order): $67.68

Restaurants: $21.50

Bars: $17.00 (4 trips for social occasions, all non-alcoholic)

Soda Stream CO2 Refill: $14.99

Coffee: $14.19

Misc: $45.00

Arts Tax: $35.00

Charitable giving: $10.00

Savings (not pictured above): $100

Roth IRA contribution: $100

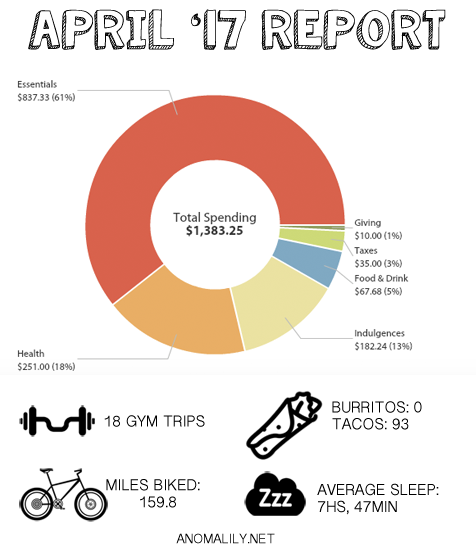

Total Spending: $1,383.25

Total After-Tax “Day Job” Income: $2,289.38 (worked extra hours!)

YTD Spending: $7,095.80/$20,000 maximum goal

(35% of total at 33% through the year)

Income Statement

I am not currently taking a wage from my business, Oh My Dollar! – I started up officially just 6 months ago, and am still in the growth stage. Luckily, I saved quite a lot of cash “buffer” – equal to around a year’s expenses- before I took a leap into my own business.

I am hoping to begin taking a small salary from my business in July and at that point I might publish more thorough business income/expense statements. The business is profitable right now (and officially enough to live on as of this month!)

My stated income comes from my March paycheck, because I live on last month’s income. That means all income from April was allocated towards May’s expenses.

6 thoughts on “April Expense Report”

Comments are closed.

Likes