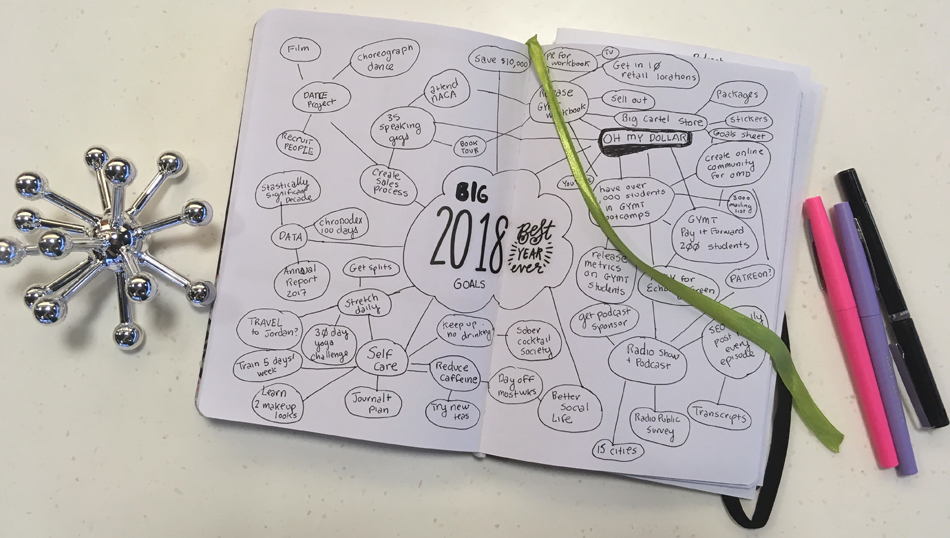

Most years, I write up my goals for the year, and then evaluate how I did at the end of the year. In 2017, I published 50 goals and evaluated how I did (I gave myself an A-). Now, 50 goals was a lot. So I kept it simpler this year, with just five goals in each area, and a list of habits I’d like to continue/cultivate.

Here are this year’s goals:

Financial

- Save ≥ $10,000 (more on this below)

- Make money from the Oh My Dollar! podcast (sponsors or Patreon)

- Reduce amount of money spent on clothing from 2017 totals

- Track treats & coffee separately in grocery budget

- Publish public Monthly Expense Reports

Business

- Get radio syndication up to 10 cities

- Release & sell out 1st Print Run of Get Your Money Together Workbook (1000 copies)

- 35 speaking gigs

- Teach personal finance to 200 low-income folks through Pay It Fur-ward nonprofit partnerships

- Launch Get Your Money Together Bootcamp local hosts program & guide

Lifestyle

- Secret Dance-Related Project (to be revealed this summer)

- Get my splits back (oh so close!)

- Release A Statistically Significant Decade: A Data Memoir of my Twenties zine

- 150 hours of social (non-work) time this year (tracked on Beeminder here)

- Three bike camping trips this summer

In addition to those concrete goals, I also want to cultivate and continue some habits this year. Here they are:

- Weekly meal planning (cont’d)

- Stretching daily (cont’d)

- Daily German practice (cont’d)

- Flossing daily (cont’d)

- Working out 5 times per week (cont’d)

- Sleeping at least 7.5 hours per night (cont’d)

- Reducing caffeine consumption to less than 3 cups daily

- Daily journaling

Just for the record, here are some back burner projects that may come up this year, or might not:

- Jane & The Austens (Regency-Era Costumed Feminist Punk Band)

- Public time tracking art project

- Creating more free purrsonal finance videos on youtube

- Portraits of creatives with their budgets

- Sober Cocktail Society (bar listing & happy hours for creative non-alcoholic drink options)

- Transportini

- “Why is US health care broken?” podcast (alternatively titled “Lily rants about health policy”)

- Learning conversational Russian

Goal #1: Saving >=$10,000

I chose this goal because it is a goal that relates to three things at once: spending less, saving more, and increasing my income. My expenses have stayed relatively low the past couple years, other than health insurance and travel, so I can’t hit this goal by cutting expenses alone. I project a similar level of spending, between $18,000 – $20,000 (personal) for 2018.

The goal of saving $10,000 ($833/month), would indicate a gross income of ~$35,000 (gotta plan for taxes in there) at my current spending level. This is a stretch goal over my 2017 earning, but presumably within reach. This would put me at a 28% savings rate for the year, not nearly as good as when I had a full-time day job, but respectably comfortable.

This goal is also kind of a test of how viable this self-employment thing is. If by the end of the year, I haven’t been able to save $10,000, it might be time to start looking for a full-time job and make Oh My Dollar! a side gig only. (My market value as a full-time employee is much higher than $22,000 a year – closer to $50,000 – $65,000 depending on the work.)

One thing to note is that if my gross income goes above ~$22,000 as this goal requires, I will have to set aside up to $2,832 towards repaying my monthly health insurance subsidy at tax time. I am not counting saving for that as part of my $10K savings goal because it will be a consumer expense.

Current Monthly Take Home Earnings ($21,120)

- ~$400 per month from Oh My Dollar!

- ~$500 per month from freelancing (the goal is to 100% replace this with OMD income by June)

- ~$860 per month from part-time job at fitness studio

My current back-of-the-envelope income and expenses only gets me to $402 per month savings, as you can see below.

Cutting the fat from my below budget is possible, to be clear. If money is tight, I can carve out another ~$192 per month. The “easiest” thing to go is the trip to Jordan, which adds another $100 of savings per month into the budget.

The other discretionary things to cut are my gym membership, dance classes, clothing budget, restaurants.

Cutting all of that frees up $92, but then I eat 0 burritos and have many holes in my tights and don’t get to go use the weight racks and hot tub at the gym, which would make me sad. I would rather earn $92 extra dollars than cut those things.

So obviously, it’s going to take raising my income, through a combination of business activities, to get to that $10K savings goal.

Annual Spending Budget: $16,319 ($1,358 per month)

Household & Insurance – $8,406

- $7,380 – Rent

- $330 – Water, Commons, Garbage, Sewer

- $336 – Electricity

- $240 – Internet

- $140 – Renter’s Insurance

- $120 – Household Items (detergent, TP, toothpaste, razors, etc)

Basic Food – $2,110

- $1,860 – Groceries (including coffee/tea)

- $250 – Annual farm half-share

Transport – $310

- Bike Repairs & Parts – $250

- Transit Trips – $60

Medical – $774

- $100 – Copays before OOP Max reached in March

- $444 – Health Insurance (*with subsidy based on $22K income – see note)

- $230 – Dental Copays

Extra Food & Drink – $620

- $360 – Restaurants & Bars

- $180 – Tea/Coffee Out

- $80 – Alcohol for hosting

Fun Stuff – $2,099

- $564 – Fitness Membership

- $500 – Clothing/Costumes

- $250 – Dance Classes

- $220 – Haircuts

- $150 – Cosmetics (ugh) and Skin Care

- $150 – Gifts

- $120 – Entertainment (shows, movies)

- $120 – “Spending Money” (candy, library fines, flotsam)

- $100 – My Own Birthday Treat (whatever that may be)

- $45 – C02 Refills for Sparkling Water

Personal (Non-Work) Travel – $1,400

- $1,200 – Trip to Jordan for Wedding (hotel/hostel, fuel surcharges, food)

- $200 – Travel Hacking CC Fees

Charitable – $600

This is the minimum I’d like to give. I’m not happy with my 2017 giving levels. I would like this to be higher but I’m very much playing this by ear with income. Much of the charitable activities I have on the docket for 2018 are in-kind.

Savings Tier: $833

- $375 – Cash Savings

- $458 – Traditional IRA

I have chosen a traditional IRA instead of a Roth IRA because this keeps my Adjusted Gross Income lower since it is pre-tax – that means that I may not have to repay all of my healthcare subsidy even if my income goes up.

So, as you can see…saving $10,000 this year is a feasible but stretch goal, the perfect kind of goal!

Hi Lillian, great post. There’s nothing like seeing someone else lay out their goals/resolutions in concrete fashion like this to inspire me to do likewise, to transform nebulous intentions in my head to specific resolutions and plans. So I’m gonna get to work on it. Thanks, and happy new year!

It’s fascinating to read about how well you’ve organized this! You’ve absolutely set yourself up to succeed. Can’t wait to follow along.

Hihihihihih I love how you’ve broken down your budget and savings!

I also want to reduce my spending on meals, dance classes, gym memberships, and clothes.

An article that can help a lot of people, thank you!

retro bowl

Your Goals, Resolutions, and Budget for 2018 are so big and good for you to get the best results. Many people like to do the best to get the right results that are bringing the solutions that are required. It is a nice way to find the best services that are providing us the results.