2021. Honestly, it was barely any different from 2020! The past two years of pandemic blur into one weird mix of pandemic work-from-home low-key-stress “is it getting better?” followed by “oh no it’s getting worse again”. Feeling ineffective at dealing with the crises and stress I saw in my communities while just making my little bus schedules every day from the same desk. I know there were highlights and lowlights, but the defining daily feelings of the past two years were monotony and low-level anxiety.

Am I really “high risk?”

Living through a global pandemic, I have had to reconcile with my internalized ableism. I’m not someone who usually feels that I’m “high risk”. I mostly forget I have a chronic illness. Yes, the finances of being reliant on an expensive drug (now up to $10,300 for a four-week supply) means I spend dozens of hours a year on the phone trying to make sure my health insurance will cover it. It also makes things like international travel just a smidge more logistically complicated. But I don’t feel “sick” or “high risk”. I can squat 150% of my bodyweight! I travel through developing countries in packed open-air cattle train cars. I bike up mountains carrying all my stuff! Yes, I ride a custom bike built to adapt to my bunk wrists and I can’t use a manual can opener on my own, but I don’t “feel” like someone with a chronic illness.

OH THE IRONY! While writing the previous paragraph, I got a call from my drug co-pay assistance program and then ended up spending 18 minutes on the phone listening to pharma boilerplate in order to re-enroll in the program. Oh, the tiny time costs of having a chronic illness.

I remember when my primary care physician put “long-term use of high-risk medication” on my chart, I was slightly miffed. After so many ineffective treatments, this drug is “miracle drug”. It’s so effective for me that I’m almost symptom-free, and only requires me to inject myself once a week. I’m always aware of how much “worse” I was when I had no treatment prior to the Affordable Care Act.

But I am high risk when it comes to an infectious disease outbreak. My “miracle drug” is an immunosuppressing medication with an FDA “Black Box” warning printed all over it – reminding me every time I open my fridge that it reduces my ability to fight infections. I am required to be tested for TB every year in order to renew my prescription because I could die from having even latent tuberculosis while taking this drug. I’m required to get a flu shot each year because I’m much more likely to catch the flu. I’m not allowed to get certain vaccines (like yellow fever) because I’m more likely to get severely ill or die from the small amounts of live virus in the vaccine than I am to develop anti-bodies from the vaccine.

But since Covid-19 is a novel disease, and the vaccines are brand new, the past two years have people like me left searching for any scraps of studies that include us:

- Which vaccine is more likely to be effective?

- Am I at higher risk for severe disease than someone twice my age?

- Should my friends that are former smokers be in line to get vaccines before me?

- Should I be considered in the same category as someone who got a solid organ transplant?

- Should I pause my drug prior to getting the vaccine in order to be more likely to develop antibodies?

Even my rheumatologist (who has 90% immunosuppressed patients), was simply left looking through not-yet-published studies and polling her colleagues to make an “informed guess”.

To add to this uncertainty, I ended up getting the Johnson & Johnson vaccine (individuals had no choice in vaccines at the time I got mine), which is significantly understudied, even more so in immunosuppressed people. While other American immunosuppressed people who happened to get the Pfizer or Moderna vaccines were qualifying for “third shots” in the summer in order to boost their chances of forming more antibodies, I was left with just my single Johnson & Johnson shot, and no information on how to proceed for another 3 months.

I’m not usually someone who overthinks her risk – but after losing an uncle to covid complications last year, and watching previously healthy friends become chronically ill from long covid – it’s been a tiring two years of calculating and re-calculating my risks.

And I’m in the most privileged position possible – I had a work-from-home job all year, I don’t have household members that are higher risk than me or work/go to school outside the home and I live in a country rich enough to have early vaccine access. My native language is English and I’m educated enough to be able to read at least the summaries of most academic studies on vaccines.

But I’m f*cking tired of never knowing what’s safe or not safe. Never knowing what the best next choice is to make. So that’s my 2021 report. I’m tired.

Community Disconnect

I went 18 months without volunteering in person for anything – being scared and confused about my risk profile meant I wasn’t able to help with mutual aid sandwich making or deliveries, teaching finance workshops in person, and my mainstay volunteering was halted. While I was able to pivot to teach the Pay It Fur-ward personal finance workshops online, it’s much harder to get teenagers experiencing homelessness to attend yet another zoom workshop, no matter how many grocery gift cards you offer as incentives. Total, I spent 89 hours and 27 minutes this year volunteering, about 1/2- 1/3 what I had in the past.

I went almost a year without seeing any friends (other than my live-in partner) in person – and those four friends we saw were for my brief, outdoor rainy, masked marriage ceremony during lockdown (done hastily in order to apply for citizenship).

I felt like my connections to my friends really broke down, as I’ve always been someone who has a wide community of relatively shallow relationships that are maintained by volunteering, frequent backyard get-togethers, and bike rides. Nearly all my friends I’ve met through activism, bike fun, or volunteering, and bike fun was pretty much halted for a year. (The bike events that kept going were tilted much more towards anti-vaxxers and anti-maskers and did not feel safe to me).

I don’t have many “deep” friendships and I’ve never been great at calls or even texts. I felt like my relationships mostly turned into seeing people’s updates on the “friend slack”, trading memes back and forth through texts, and watching people’s lives unfold through updates online. Everyone was dealing with their own stuff, especially friends with young kids. Even in that brief 2 months of bike rides and backyard parties and feeling like we were in the midst of “Hot Vax Summer” before Delta surged, many of my friends still weren’t able to do as much because their kids weren’t vaccinated yet.

Probably the main highlight of “community” this summer for me was starting and co-leading a semi-monthly fancy dress picnic bike ride – the Odd Tuesday Outing, which actually got to be the Pedalpalooza Kickoff Ride this year. Seeing hundreds of people on bikes for the kickoff ride – after 16 months of just feeling “stuck” inside my apartment – felt like a big kick of community. But it also felt weird. Like, is this really safe?

View this post on Instagram

But I didn’t necessarily do a great job of going on more rides other than my own Odd Tuesday Outing every other week. Doing social activities felt like working out a muscle that had atrophied. Each time I spent 3 hours hanging out with people, I’d wake up the next day feeling hungover from the social exertion.

Breakfast on the Bridges was still halted all summer, as was my other in-person volunteer activity. I ran a virtual version of Breakfast on the Bridges (#BYOBONB) during Pedalpalooza, but that mostly felt like I was just doing social media management, not really “connecting” my community.

I hope that once Omicron calms down (please, will it?), I can start teaching and volunteering in person again. Maybe I can help nurture my friend relationships and feel connected to my IRL community again. Maybe I can even go to a *conference*?

Budget Notes

When I estimated my 2021 budget, I thought there was a possibility I would be moving to London for graduate school in the fall. That did not happen, because the UK was dealing with a massive Delta surge at the time my application was due and I decided that it wasn’t a good time to try to move abroad.

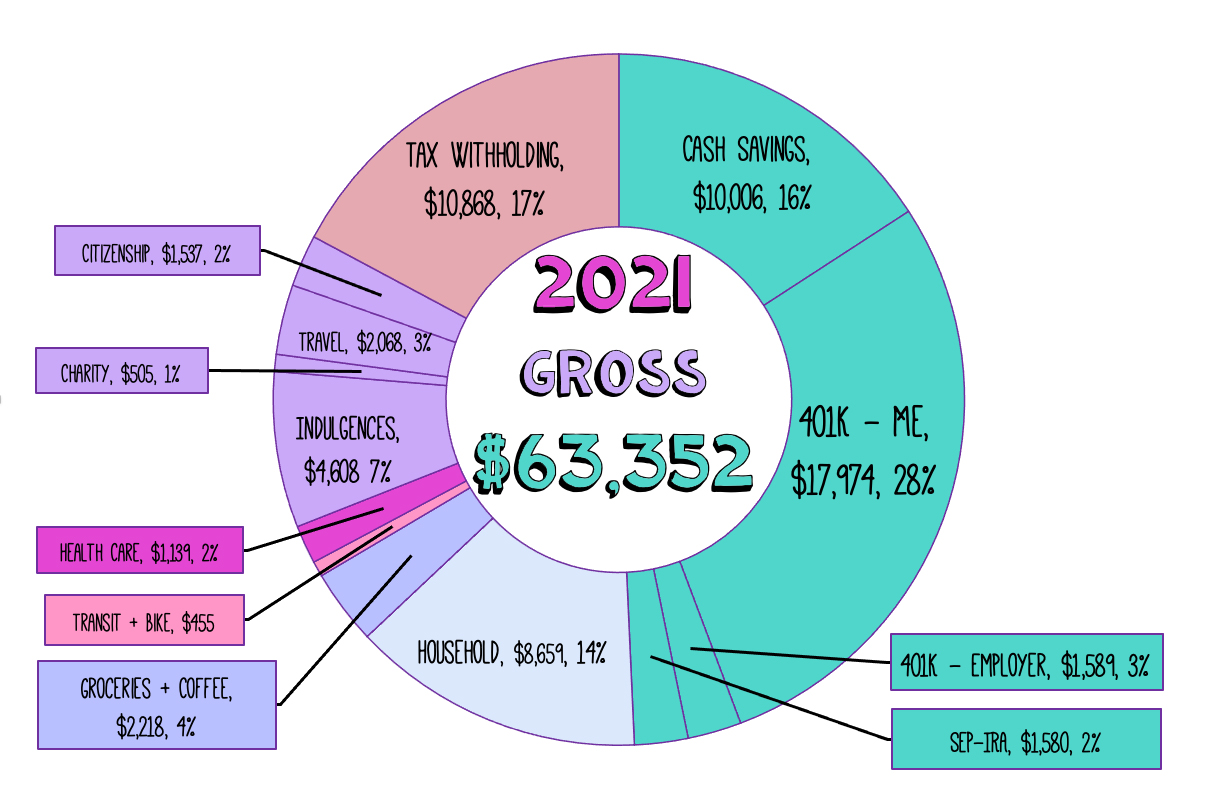

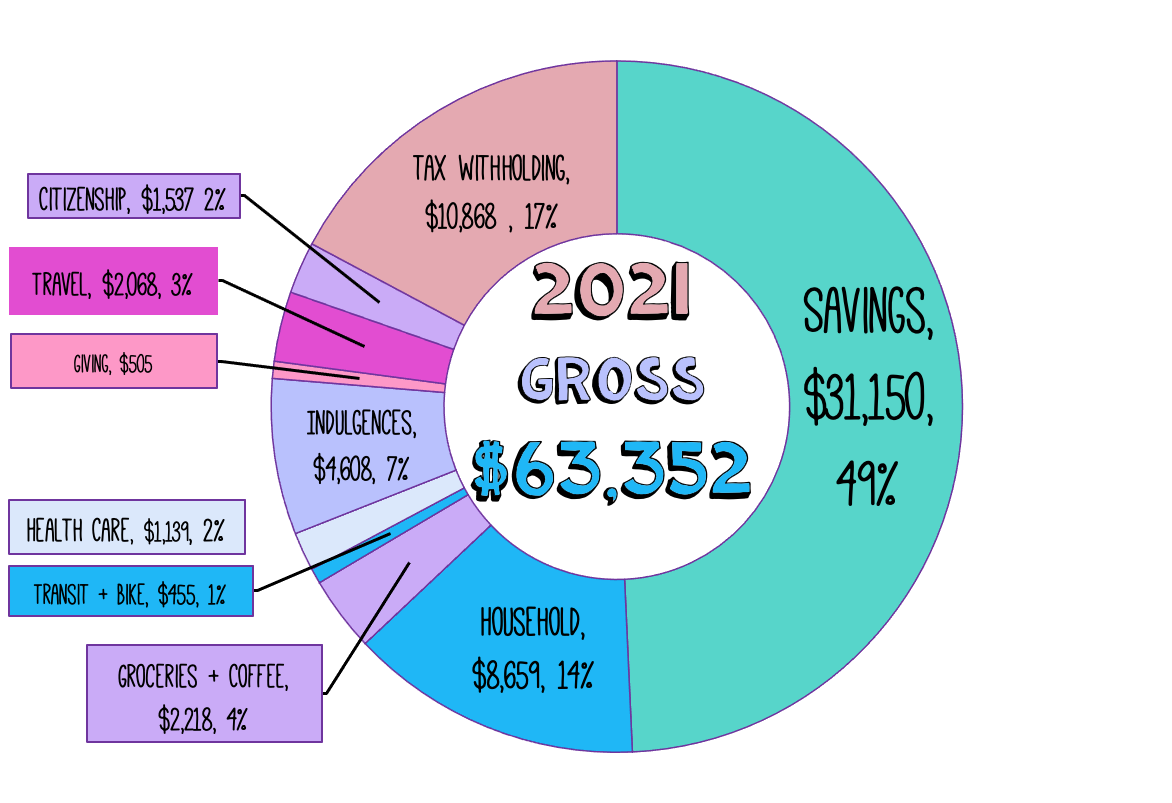

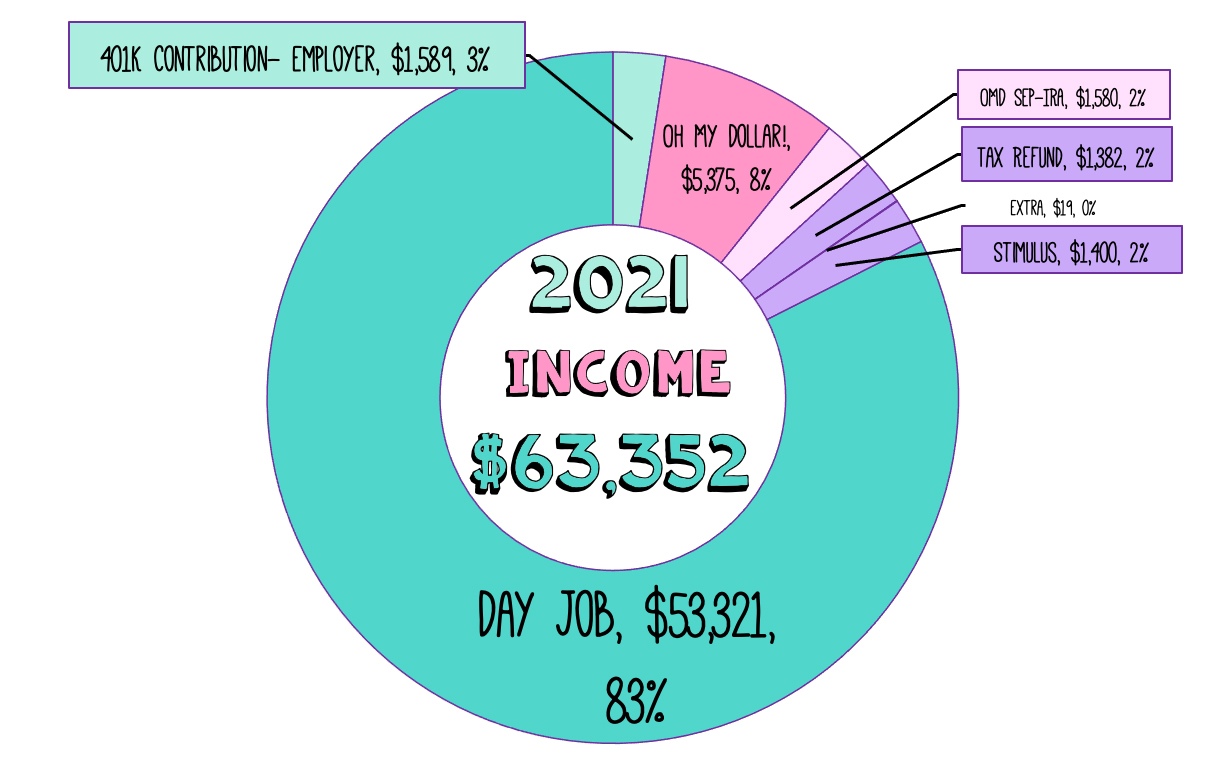

Not moving to London in August mean that the cash that I saved for paying for graduate school tuition (~$20,000) wasn’t needed and simply turned into “buffer” savings. I also kept my salaried day job through the end of the year, so I had a higher income than I predicted. This year was actually the highest gross income of my entire life!

I left my day job at the very end of 2021, and am starting a new job in early 2022 after I pass a financial licensing exam. The new job will take awhile to ramp up, and I’m back to being technically self-employed, so we’ll see how 2022 works out for income. My income goal for 2022 is $60,000.

Total 2021 Gross Income All Sources: $62,352.62

- Stimulus: $1,400

- Tax Refunds: $1,482.44 Most of this was not a usual tax refund but actually an unexpected refund of my 2021 premium credit (from health care) that was repaid due to a specific provision of the rescue act. I talked about it in this livestream:

- Day Job Salary + Bonus: $53,320.72 I got a raise in May, and ~$300 of a profit-sharing bonus.

- Day Job Employer 401K Contribution (3%): $1,589.00

- Oh My Dollar! Income (after expenses including home office deduction): $5,374.64 My business income is slightly complicated because I include my home office deduction in my expenses, but it isn’t a hard cost paid by my business (since it’s a portion of my household expenses). Also my SEP-IRA reduces my total income for taxes but it is money I get.

- Oh My Dollar SEP-IRA: $1,580.00

- Assorted Random Income (Bank Interest, Rebates, Etc): $19.18

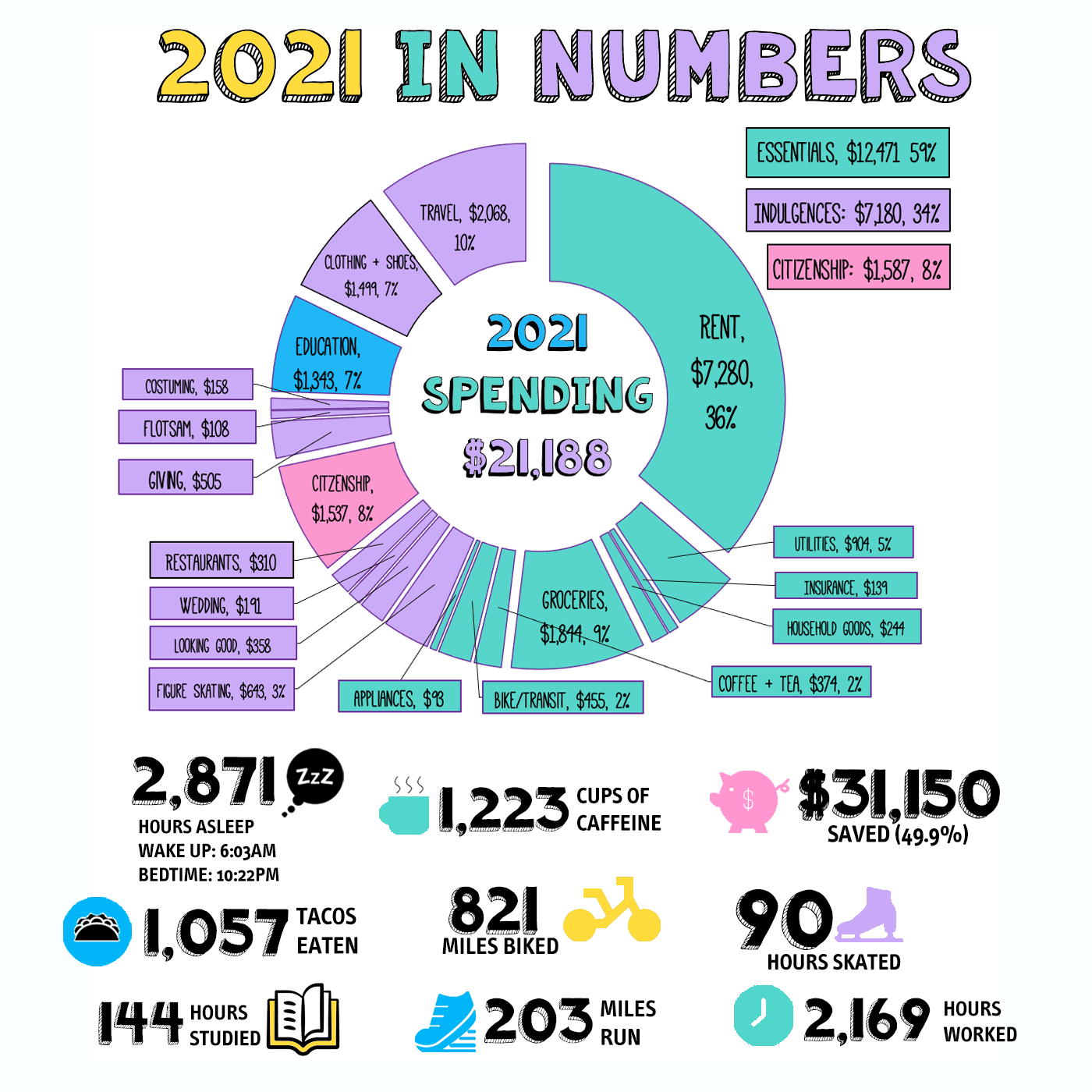

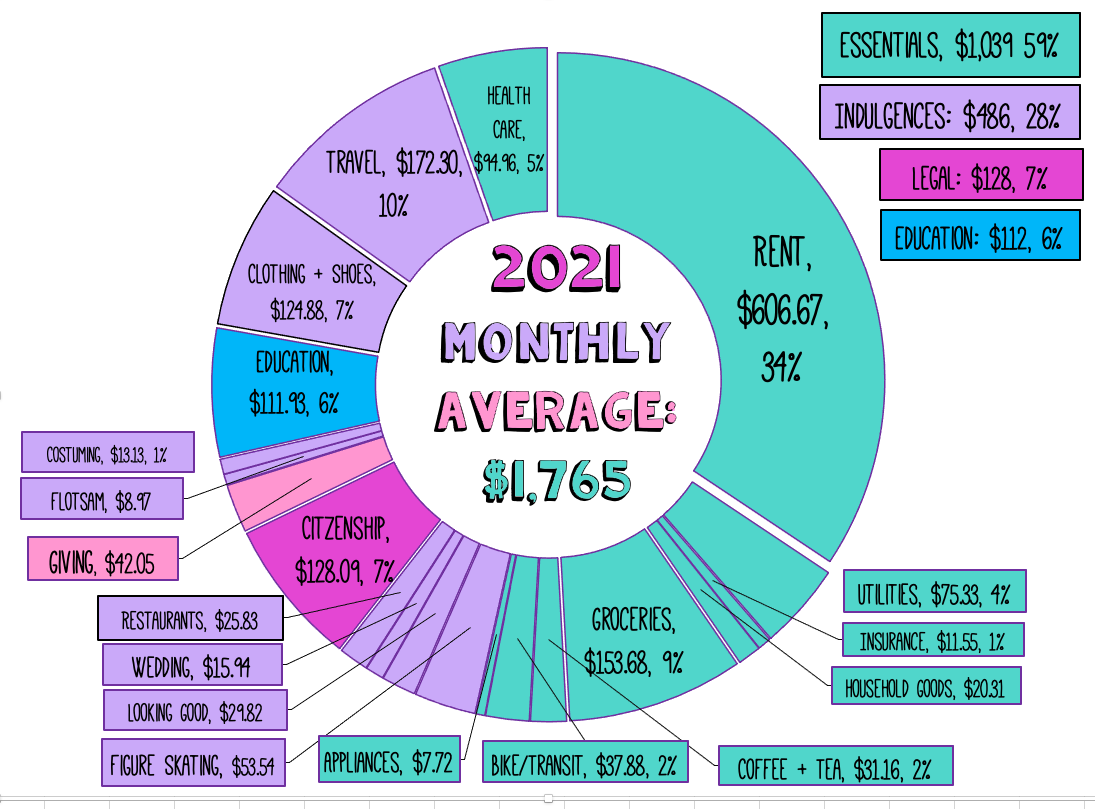

Full 2021 Spending: $21,188

Household & Insurance – $8,659

- Rent: $7,280($606.67 per month) We got a $100 credit for renewing our lease (again), so this was slightly under expectation. I pay 40% of our total rent for a 2-bedroom apartment with my partner, all other household expenses are split 50/50.

- Water, Commons, Sewer: $390 – $27.50 per month, level billing

- Trash: $90 ($7.50 per month, level billing)

- Electricity: $424.01 budgeted more this year based on hot days

- Renter’s Insurance: $138.65 No premium increase this year.

- Household Items (detergent, TP, toothpaste): $173.93

- Appliances: $92.62 Finally bought a food processor, so into it

- Internet at Home: $0/$0 This is now paid for by my partner’s employer due to being remote employee, was $20 per month.

Basic Food – $2,075

- Basic Groceries: $1,630.46 The cost of groceries went up for me – both in needing more (no free meals at work, no business travel) and the cost of groceries is inflating.

- Treats: $213.68 This is for things like snacks, ice creams, etc.

- Coffee/Tea For Home: $230.98 No more free coffee at work means HOLY KITTENS, way more coffee spending.

Local Transport – $454.50

- Bike Repairs & Parts: $440.90↓ Major overhaul of my xtracycle, preparing to sell it and some small work on my main Ahearne.

- Biketown Trips: $13.60 – A few trips when I had my bikes at the shop.

- Local Transit Trips: $0/$20↓ – I get a free transit pass through work.

Health – $1,139.46

For the first time in 5 years, I qualified for an employer-sponsored health insurance plan. It is an HDHP plan and my employer paid 100% of my $284 per month premium. The pharmaceutical company co-pay assistance program paid most of my drug co-pay and therefore I hit my $7,500 out-of-pocket maximum in February and the rest of my co-pays were free to me. I paid for dental and vision insurance through pre-tax deduction and don’t include it in this report.

- Copays and Out of Pocket for Medical: $496.27↓

- Health Insurance Premiums: $0 WHOOOOT. CHEAPEST OF MY LIFE.

- Dental Exams/Cleanings: $84.20 Copays for cleanings and exams.

- Contacts/Optometry: $234.10 I got a full years’ worth of contacts and saline is expensive, too!

- Fitness: $157.69 This was for an online workout program that I used during the dark months and for a virtual half-marathon (to keep me motivated to train).

- Skin Care: $157.69 I get my skin care online (other than my prescriptions) and do restocks every 6 months during sales.

Education – $1,343.10

- Croatian Class: $613.10 I took a twice-weekly (virtual) Croatian language class through University of Zagreb this spring. It was very high quality and I’m glad I did it.

- German Class: $530.00 I’m enrolled in a year-long in-person German language class since the fall. This is helping me improve my spoken german and level up my abysmal grammar.

Figure Skating – $642.00

The rinks were open-closed-open-closed for most of the spring as we went through waves of lockdowns. I finally started skating again semi-seriously in September once I felt like we were through the “worst of it” (lol) and I was fully vaccinated. Masks are required at the rink, but not always worn effectively by everyone. I did two private lessons and weekly group lessons this fall, but in 2022 I will need to do far more private lessons if I’m to improve and test. The Gay Games 2022 in Hony Kong were postponed until 2023.

My marginal cost of skating this year was $7.18 per hour.

- Ice Time: $508

- Coaching: $100.00

- Testing, Registration, + Competition Fees: $0

- Skate Sharpening: $16.00

- Costumes, Laces, Bunga Pads, + Tights: $18.50

Looking Good – $358

- Haircuts: $179.20

OMG I never want to have to cut my own hair again after 2020. Yay. I got two professional haircuts after being vaccinated, a bang trim, and a cheap haircut at the beauty school. - Makeup: $135.07 Just about on target.

- Hair Stuff: $46.55 This is mostly just shampoo and conditioner.

Food & Drink Out – $452.78

- Restaurants + Bars: $309.90 I am not someone who really loves going to restaurants or bars, but I did try to support the local restaurants a few times by going to the covid-patios. I also had a run of craving garlic knots from the local pizza shop takeout window as well.

- Tea/Coffee Out: $106.38 I got some nice coffee drinks for celebrating running milestones.

- Fancy Tea: $36.50 Did a nice order of tea from Harney & Sons to refill my earl grey tea (Last refilled in early 2019!)

Giving/Gifts – $504.62

Not nearly as high as I want it to be, and lower than 2020. I need to refigure my giving in 2021.

- Charitable Donations: $333.40 I gave an additional $804 through OMD as well, not represented here.

- Gifts: $171.22

Citizenship: $1,537.12

As of January 2020, a rule change in Croatian citizenship law allows me to pursue Croatian citizenship. I applied for citizenship in person in June 2021 in person at the Los Angeles Croatian consulate with my parents, and I also got legally married to my partner so that he could apply with me. When I find out if we were granted citizenship (in 2022 or 2023), I will do a full write-up on the process. In total, I spent 24 hours on paperwork related to citizenship. These are only my costs, my parents and partner also had costs associated.

- Immigration Lawyer: $520.01 This was the remaining balance, I also paid the lawyer in 2020.

- Application Fee: $236.00

- Court Translation Fees: $393.58

- Document Fees: $235.25

- Postage: $129.78 Omg so much certified and international mail

- Wire Transfer Fees: $22.50

Travel – Lapland Trip $2,067.57

I only was able to do two trips in 2021 (but better than 2020, hey!) One was a two day trip down to LA to visit the Croatian consulate to apply for citizenship in June. That was almost entirely covered by points. The other was to Finland in December. We only went to Finland because there was a big sale on flights (only $280 round trip!) and we had hotel points to use up, but it was nice to get some travel in this year.

Two of my other planned trips were canceled due to covid surges, and some of them turned into even more airline travel credits.

- Flights Taken: $279.15 PDX <> HEL – yes, it was a screaming deal!

- Flights Not Taken: $362.85 These are flights bought but then cancelled that didn’t get refunded in cash and instead go turned into even more *e-credits*.

- Tours/Museums $270.12 This was utterly worth it! We went on a reindeer sleigh tour and a northern lights tour in laplap (plus to the Finnish Design Museum).

- Santa Claus Express Train Sleeper Car (Two Nights, Round Trip Helsinki <> Rovaniemi): $207.98

The Santa Claus Express train in Finland to Lapland - Restaurants/Food: $141.69 Finland is expensive for food, but we kept it relatively cheap because we weren’t that into fancy food.

- Coffee and Drinks: $46.13 So much glöggi and coffee to stay warm!

- Travel Bag: $144.50 I love my new travel backpack and have no regrets about the purchase.

- Local Transport: $89.05 Buses and taxis in lapland were expensive!

- Cold Weather Clothing: $230.99 I am hoping I can resell the stuff I bought (all secondhand), but it was -25C when were in Lapland and I needed boots and a coat that could handle that temperature!

- Hotels: $225.16 These were taxes + fees on hotel nights, mostly we got them through points.

- Assorted: $24.07

- SIM Card: $15

Indulgences: $1,955.02

- Entertainment (theatre, movies): $6 One movie at a theatre (Paris is Burning, I led a ride to it!)

- Clothing: $1,354.98 I spent a LOT of money on clothing this year. Mostly used from poshmark, but really a LOT of clothing.

- Bras: $56.11 They are already wearing out and I’m offended. I last bought bras in 2015.

- Costuming: $157.59 Costuming!

- Spending Money: $101.59 Mostly candy and random other things.

- Shoes & Shoe Repair: $87.49 Two pairs of used shoes and a replacement pair of shoelaces.

- Wedding: $191.26 This was a jumpsuit from poshmark, a marriage licenses, a crown from etsy, and donuts for our officiants.

Savings 2021 Final Report

Retirement savings: $21,143.16

Cash Savings: $10,006.67

This does not include cash savings expected to be spent soon, such as travel fund and tax savings.

2021 Savings Rate: 49.96% of Gross Income (Including Stimulus)

2021 Total Savings: $31,149.83/$21,000 goal

If you read an interesting piece, you might want to share it with other people. This could start conversations and connections that make your relationships stronger.

I am quite intrigued by your website due to the exceptional quality of the posted information, which encompasses a diverse range of subjects.

You have a rare gift for turning complex topics into captivating stories that leave your readers feeling both enlightened and entertained

The game features two characters, Fireboy and Watergirl, who must navigate through various levels filled with obstacles, traps, and puzzles.

Playing video games can be a fantastic way to relieve stress. Immersing yourself in a different world or storyline can take your mind off daily worries, making gaming a great way to unwind.

I agree with author! I appreciate the calming effect of Incredibox Colorbox Mustard!

Upgrade your skills in Chill Guy Clicker to become the best player, unlock special abilities and powerful equipment.

I’ve learned so much about the world since I started playing World Guesser. Plus, it’s insanely fun!

Let your ingenuity and intelligence lead the way in your journey to escape from the police in escape road 2.

Brain Lines really makes me feel like an artist… until I realize my masterpiece looks like spaghetti gone wrong.

Very detailed report. I really like the process

And I’m in the most privileged position possible

Speed Stars is satisfying because every improvement is measurable, showing exactly how much faster you’ve become since your last run.

Thanks for sharing this! I totally get that feeling of 2020 and 2021 blurring into one long, stressful period. The ‘monotony and low-level anxiety’ while just making bus schedules, feeling ineffective, really hit home. It perfectly captures the pandemic’s unique emotional toll..

You have a rare gift for turning complex topics

Saving is a good habit, and it pays off in the future. You are good to make plans and try implementing them. I like these details, and the video explains everything.

These are the best expense reports that tell us about the idea we can create. I saw a lot of people who do not know how to do it and your details are helpful to get the issues resolved.

Thanks for sharing this raw look at pandemic life— that constant low-level anxiety and community disconnect really resonates, especially with chronic health worries.

Thanks for sharing your experience as a high-risk person during the pandemic. I really relate to that feeling of monotony and low-level anxiety you described—it perfectly captures how the past two years blurred together for me too.

Thanks for sharing your honest reflections on the pandemic as a high-risk person. I really relate to that feeling of monotony and low-level anxiety you described—it perfectly captures the blur of the past two years..