Good things that happened

I started doing Youtube again after a 7 year break.

I’m committed to a video every single Monday this year, posted by noon pacific time! I thought my videos would be about finances but they’ve been all over the place as I find my voice in video. Go watch and subscribe please, I’m desperate!

Cool business things happened.

This is where it’s super frustrating right now, because lots of good business! things happened this month but I can’t talk about any of them yet.

I picked myself off the floor and started doing work again.

I pretty much had a solid month of bare minimum productivity in December. I was having a lot of trouble getting motivated and wasn’t entirely sure how I should be prioritizing my time. I spent a lot of December on the couch in a fuzzy dragon onesie. Turns out I mostly needed a break and mental reset.

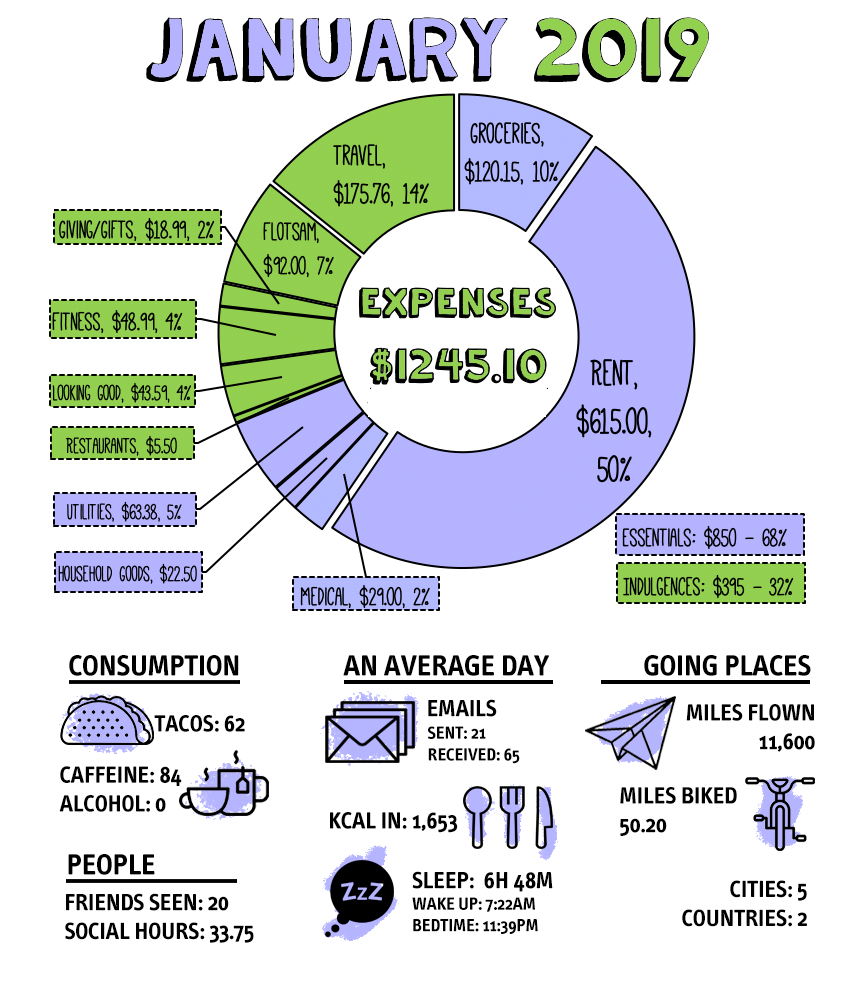

I decided to go to London in between some work travel to Chicago and New York this month (travel vlog here), and I think that helped shake me out of my funk, as travel often does. I’m back to being mostly excited about my work again and am eager to figure out how to schedule more downtime so that I don’t get as burnt out as I was in December. I clocked 190 productive hours in January and feel pretty solid about that.

PINK COUCH!

For the first time ever, I purchased a new couch (in December, arrived this month)- not just one left over from previous roommates or from the craigslist free section. All that flopping about in a dragon onesie in December on our crappy $130 ikea futon really started to hurt my back, plus I never liked how it looked. So after a lot of stress and internet research, we got a new couch. It’s pretty and pink and really soft and I don’t regret it at all.

I saw actual people not just for work.

I’m by no means extraordinary at hanging out with people yet, but in an attempt to re-prioritize my friendships, I had a pretty high “social time” this month for me – 33.75 hours total. I even went to a party. Look at me. Yes, I like my friends. I would like to un-ghost them.

I made my computer pretty on the inside.

I got a new-to-me-laptop and had to move all my files over. This caused me to descend into a fury as I learned things like the fact that I had over 200 “Untitled _.rtf” files spanning over 10 years, containing exciting things like my funeral requirements. Watch me descend into madness in this video:

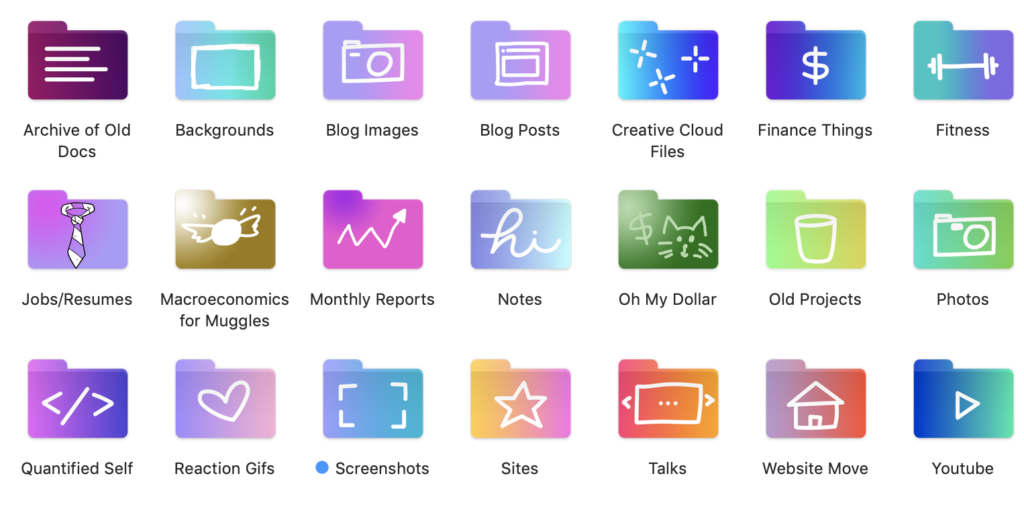

But also, I made these beautiful folder icons for my default folders (based on a set from here.)

I got a new suit because twitter told me to.

Not to make this all about consumer purchases, but I also got this suit and I really like it.

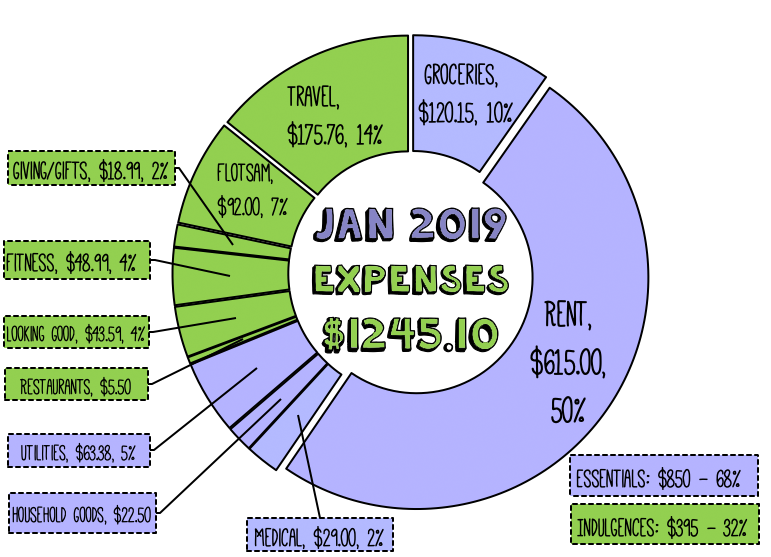

Full January 2019 Spending Report

Total Spent: $1245.10

7% of total annual budget at 8.4% of the way through the year.

Household & Insurance – $701.13

- Rent: $615

- Water, Commons, Garbage, Sewer: $27.50

- Electricity: $35.88

- Household Items (detergent, TP, toothpaste, razors, etc): $22.75 – includes a purchase of new Chef’s Knife

- Internet at Home: $0 This is now paid for by SSO’s employer due to being remote employee, was $20 per month.

Basic Food – $120.15

- Basic Groceries: $96.50 (traveling for 1/3 of the month)

- Treats (non-essential snacks): $12.66

- Coffee/Tea For Home: $10.99

Travel – $175.76

This represents 11 days in London, Chicago, and New York. These do not include work travel expenses including per diem for the days I was working, local transport, or lodging, which is paid for by my business. My hostels on non-work travel days I covered with Chase Sapphire Points. I went clothing shopping because the British Pound was doing absurdly poorly (thanks to Brexit uncertainty) and things were quite on “sale” when buying with USD.

- Clothing Shopping in London: $102.37 (I got a pair of pajamas, 3 pairs of socks, a dress, a pair of shoes, a transit-themed winter sweater, and a scarf.)

- Restaurants: $50.97 non-work meals and drinks with friends

- Incidentals: $17.22 laundry fees, eye mask for sleeping on plane, etc

- Bars: $5.20 an absurdly expensive crappy non-alcoholic beer at a pub in London

- Hostel: $0 ($117.00 – $117 in Chase Travel Reimbursement)

Medical – $29 ***Why this is so cheap

- Health Insurance Premium: $29.00

Fitness – $48.99

- Gym Membership: $38.99

- Supplements: $9.99 (protein powder)

Looking Good – $43.59

- Makeup: $43.59 stocked up in London on drugstore brands I can’t get here

Food & Drink Out – $5.50

- Restaurants + Bars: $5.50 drink out with friend in Portland

Giving/Gifts – $18.99

- Charitable Donations: $10

- Gifts: $18.99

Flotsam – $92

- Renewal of Global Entry and APEC Status: $70 $170 total – $100 reimbursement from Chase Travel Perks

- Home Decor: $22.00 finally bought a new duvet after 7 years of hemming and hawing

Sinking Funds – not yet spent

- Renter’s Insurance: $11.50 ($140 per year)

- Skin Care: $20 (~$250 per year)

- Haircuts: $10 ($220 per year)

Retirement savings: $100

OMD Business Income + Expenses Report

I haven’t done a business income report before because I’ve had trouble working out how exactly to present it without necessarily showing how much I make from certain speaking clients or without boring you with tiny, tiny details of every credit card processing fee I pay.

This year I’m focusing not on building my personal savings, but rather getting the business to a supporting-me-full-time sort of status, and I think it’s important to show where I am 25 months into this business since my income might be missing from my expense reports some months since I may not take an income from the business (as was the case this month.)

This is cash-based accounting, not accrual, so this only accounts for income received this month, not invoices billed. Some of the income may be work done in previous quarters, depending on how fast people pay me. That means that a number of the expenses incurred may be covered by reimbursements or sales received in another month.

Income & Sales: +$1,152.33

- Book + Kindle Sales (net after fees): $604.69

- Online Course (net after fees): $48.74

- Freelancing: $75.00

- Patreon Memberships: $383.90

- Coaching: $40

Reimbursements: +$423.62

- Speaking Travel Reimbursement from 2018 Gig (Non-Taxable): $423.62

Expenses: -$809.56

- Travel Expenses: $310.72 (Per Diem: $126.97, Transport: $97.94, Lodging: $85.81)

- Marketing/Charitable: $27.00

- Hardware: $105.99 (new hard drive after mine died)

- Hosting + Software: $50.97

- Payroll & Contractors: $100.00

- Phone: $40.00

- Shipping (COGS): $60.88

- Client Meals: $14.00

I pay quarterly estimated taxes on my business income, so I save 30% of my net (after expenses) income in a separate account. Please note reimbursements for expenses incurred – such as travel to a gig – are not considered taxable income.

Tax Savings: $102

(30% of $1152 Earned Income – $809 Expenses)

I’m so impressed at how low you keep your restaurant budget — have you written about how you do this in the past?

Christina – we just did an episode on this on the podcast. https://www.ohmydollar.com/2019/02/20/stop-eating-your-budget/