May 2018 Life + Money Report

YTD Spending: $6,225.17/ $20,000 maximum goal

(31% of total at 41% through the year)

Good things that happened this month:

-

- Get Your Money Together book shipped to everyone! I spent over 40 hours mailing packages and loved it!

The books look great (yes there are some typos that snuck in darn it!) and people really seem to like the book! I’m nearly completely sold out of the air-shipped copies and need to wait until the next batch show up on the boat to mail more.

- Get Your Money Together book shipped to everyone! I spent over 40 hours mailing packages and loved it!

- I filmed + released the 401Kittens video!

- I was featured on local CBS affiliate KGW twice for Get Your Money Together! Here’s one of the clips.

- I have never had makeup skills, other than goblin king skills learned by repetition. But after seeing myself on the TV news and not loving how I looked under harsh studio lights, I finally decided it’s time to get some lessons for makeup, just to have some basic skills for video/TV. I spent a lot of money on quality makeup tools and basics (I had goblin king $2 drugstore makeup I bought ~4 years ago and nothing else).

I got a lesson at Sephora, and for the first time in my entire life, I feel like I actually know where to start. I still don’t love the process of doing makeup, but I have made it a goal to practice so I can get better. Makeup really is an art and needs practice.

Things I want more of in coming months:

- Take-Home Pay!! – I am trying really, really hard to make this darn business work and support me fully. It’s getting there. It’s making progress. I made $2,583.31 gross in May from the business – but I only took home about $800 of that after taxes, shipping (over 350 packages!), supplies, and other business expenses. But $800 is getting very close to enough to support me! I’m juggling a bunch of different income sources right now (database contracting, writing, voiceover work, selling clothing, fitness customer service gig) and I’d really like to get to the point where I don’t need to work 3-5 jobs in order to pay my living expenses and save a bit.

- Making Videos – I can’t say a ton more, but I’m cooking up a project for my birthday (July 7th) next month.

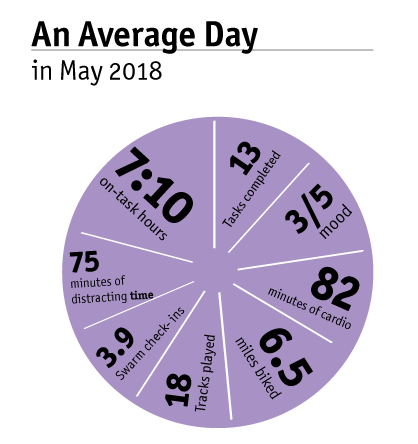

- Reading Fun Books – Days when I read fun (not business/finance) books I rate a higher mood and self-esteem. I live 2 blocks from a public library. 500 pages a month is not enough pages!

- Adventures with Friends! – I have been doing this full-speed ahead business thing for 1.8 years now, and it’s caused me to say “no” to so many invitations that some friends have stopped inviting me to things altogether. This summer, I’m striving to see friends more often and get out of my office and put in the work for my friendships. This means pedalpalooza rides, backyard firepits, runs with friends, bike camping trips, brunch parties, and happy hours. I’ve been tracking social time since the beginning of the year on beeminder, and I am at 95 hours year to date. I’d like to average 5 hours a week this summer.

- Running outside (with Aaron) – July starts my training schedule for the Half Boring Half Marathon, where I am hoping to set a personal best of sub-2 hours. When I first met Aaron (4 years ago on June) we had a regular routine of morning runs together when we were both in town, and we also had other friends join sometimes. We fell off the exercise-together wagon when we moved in together, but I’m excited to commit to actually do it!

- Yoga – A carryover from last month, I need to get back to yoga for my mental health (less for physical fitness, more for forced meditation/stress management). I cancelled my 24 hour fitness membership this month, and will be diverting that money into yoga, trying out a bunch of studios to find the right one for me. I did buy a groupon that I’ll be trying out starting in June (hence the $71 expense for fitness). Goal for this summer is 45 hours of yoga before end of September.

Things I want less of in coming months:

- Uncertainty about money I am extremely lucky that before I started my business I was making $40,000/year and was able to save ˜59% of that. And I live pretty cheap so I’ve been able to save some amount of money every month since I started the business. But the stress that comes with some months saving $2000 and other months I saving only $100 – and some months earning less than I spend, causing me to live off savings – I don’t like that stress. I want to earn more than my expenses every single month. I would like to be able to make income predictions within a degree of certainty a few months out. Especially given I need to replace my computer in the next couple weeks,

- Poor Meal Planning With Aaron gone for work about half the week and me working an average of 52 hours a week, I need to strive to be a grown-up with my meals when flying solo. My meal planning has been abandoned in favor of quick meals (pasta + sauce) and it is definitely reflected in my feelings of well-being.

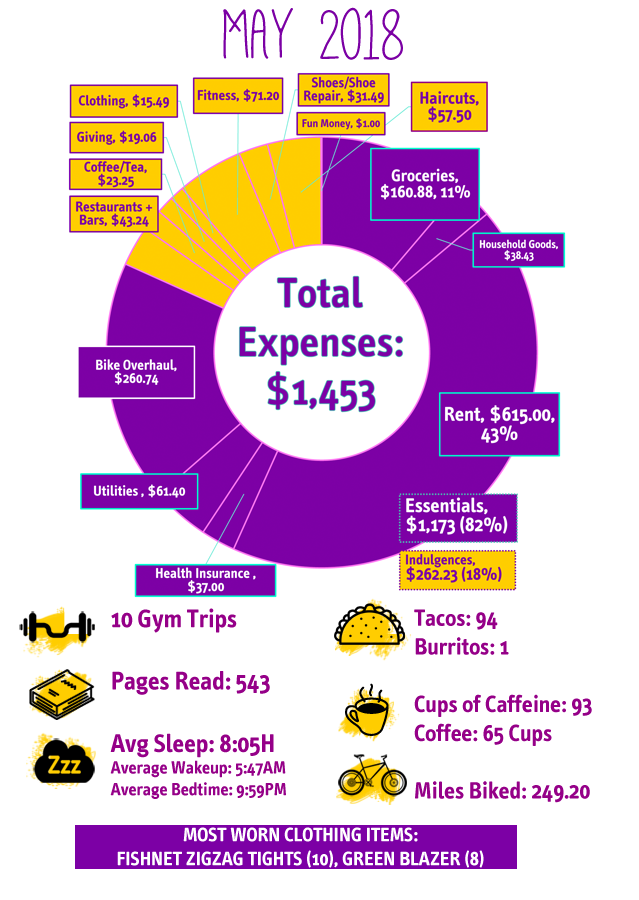

Full expenses report – SPEND ALL THE MONEY THIS MONTH!!

Essential Expenses (in descending order): $1,180.95

Rent: $615.00

Groceries: $168.38

(Groceries – $133.47, “Treats” – $27.41, Coffee/Tea for Home – $7.50)

Electricity: $33.90

Health Insurance (after subsidy)*: $37.00

Water/Garbage: $27.50

Internet: $0 – our internet is paid for by my SSO’s employer due to being a remote employee!

Transport/Bike: $260.74

I got extensive work done on my bike, which is my main form of transportation – a new drivetrain, rebuilt wheels, new cables/housing. I saved for this in my sinking funds. I was extremely lucky I was offered the birthday gift of splitting the cost of an overhaul, which brought this cost down significantly!

Household Goods: $38.43 (Every 6 month stock up of toilet paper and every-three-year paper towel stock up, plus new conditioner)

Discretionary Food & Drink (in descending order): $58.99

Restaurants: $38.74 (six meals – smoothie at work cafeteria, burrito, bagel with vegan cream cheese, vegan poutine, fancy salad from new place that opened in our building, fancy vegan mac and cheese from Vtopia)

Coffee/Tea Out: $15.75 (I had a ton of carryover left in the budget so I just went wild!)

Bars: $4.50 (kombucha)

Discretionary (in descending order): $195

Clothing: $15.75 (A cat dress from Poshmark – too small, need to resell)

Two-month Yoga Groupon: $71.20

Charitable Giving: $19.06

Shoes $31.495 (A pair of shoes that were too high so I am reselling them!)

Haircut: $57.50 (from sinking funds)

Fun Money: $1 (candy)

Money Set Aside in Sinking Funds (Not Yet Spent): $44.50

CSA Farm Share $21.00 ($250 per year)

Renter’s Insurance $11.50 ($140 per year)

Skin Care: $12

Savings: $140.00 (10.3%)

Traditional IRA contribution: $100

Cash Savings: $40.00

($3,764 YTD or 37.6% towards my goal of saving $10,000 this year)

This month’s savings are low because of high business expenses from shipping over 350 packages (resulting in low business paycheck)!

Total After-Tax Income: $1354.37

Oh My Dollar!: $800

Part-time Fitness Studio Job: $554.37

My expenses are budgeted through June, meaning I have $1040.07 in allocated towards June’s expenses but not reflected in my “savings total”.

The savings total reflected is only money set aside specifically as long-term savings/retirement investing, not for future expenses.

*Health Care Subsidy Note

My high-deductible health insurance is super-cheap at $37 a month, thanks to taking the low-income ACA health care subsidy (down from a “sticker price” of $284 per month). This subsidy is based on an adjusted gross income (AGI) of $22,000 – which I hope to exceed, if my business goes well. If I do exceed that, I will have to repay a portion of my health care subsidy, up to $2,964.

Because of receiving the health care subsidy, I’ve switched from putting my retirement savings in my Roth IRA to a Traditional IRA, since Traditional IRA contributions are deducted from your AGI.

This means that if my income goes up by $5,500 and I manage to put that all in my Traditional IRA, I will owe nothing back for my health care subsidy because my AGI will not change (Roth contributions are not deducted from AGI because they are post-tax).