I’ve been at this whole “teaching personal finance” thing for a few years now, but it was only in November 2016 that I decided to give it a go as a full-time business instead of a volunteer gig and occasional side hustle.

I learned a lot about business my first year, and as clichéd as it sounds, I’m still learning every day. Entrepreneurship is very similar to small nonprofits and politics. Many of the skills are the same but go by a different name (donor prospecting = sales, grant writing = pitching, communications = marketing). But there’s also some clear mindset differences. It’s been quite the learning curve to see where those lie.

donor prospecting = sales

grant writing = pitching

communications = marketing

One thing that has delighted me is the lack of a poverty martyr complex in entrepreneurial circles. In nonprofits, people are often subtly proud of their low salaries (living in poverty to serve those in poverty). At the very least, they accept them as a tradeoff for doing soul-fulfilling work. But poverty is exhausting, as is service work. Both burn people out, and many leave nonprofit jobs they once loved because they need better health benefits, or just want to stop being beat down by being under-compensated while also having to administer Narcan every week.

I used to believe (implicitly and explicitly) that to do good work, I had to also be living on food stamps, with no health insurance, and be housing insecure like my clients. I now believe that I do my best work when I’m not worrying about meeting my own needs. I don’t think it’s a poor use of donor’s dollars to pay market salaries to the people doing good work.

In the world of small business, good owners recognize you need to pay employees at market level to retain them. Most understand that investing in quality production, staff, facilities – while maybe not always possible financially – does pay off. And that when you cut corners on these things, you pay for it later.

There’s other differences that are more subtle. Having spent most of my last couple years in fundraising, one thing I have delighted in is getting to sell something that directly benefited the buyer – in nonprofits and politics, you sell donors on the idea and the world they’re helping create, but they don’t get any benefit directly other than warm fuzzies. I had to look people in the eye and ask them for $50, $500, even $50,000 to change someone else’s life or fix the system. With small business I can directly say, spend $19 on this book, or $89 on this course, and it will help you. It will change your life. I love that direct impact – something I missed when I moved from programmatic roles into fundraising for nonprofits.

I know selling widgets to people isn’t anything new, but for me, having mainly worked in the social sector – it kinda is. My work has always been in service to others, but now I am in service directly to the people I’m getting money from. There’s no third party. And if they don’t feel the effects in their lives, I lose them as a customer. That’s supremely motivating to do good work, and to make useful things. And to include lots of cute cats.

Sometimes I get to watch Call the Midwife with my cat on the couch in the middle of a weekday afternoon, because I am the boss.

So, to sum up: entrepreneurship has been hard. I’ve learned a lot. Some days I wake up and I just want to go back to a day job, with a steady paycheck, an office, coworkers, and PTO. Some days I really want a boss to tell me what to do. But other days I wake up and realize I get to try to build something new. I get to make cat-filled financial videos. I dress up like Bowie to explain 401Ks. I get to write books. I get to make something that has never existed. I get to think about ROI, positioning, sales pipelines, and filing quarterly taxes. I love it all. It’s never dull. (And yes, sometimes I get to watch Call the Midwife with my cat on the couch in the middle of a weekday afternoon, because I am the boss.)

I always thought, from the outside, going into business is about making money. But, as you’ll see from the numbers, I’m not there yet. I took home about $8,000 my first year for myself. To be clear, I won’t keep doing this forever if I don’t make more money, but the awesome part is I am the one who has the agency to change that. There’s no boss or board to ask for a raise. I don’t need to hope I get an amazing grant. I just figure out what people need, make it, and sell it. And that part is so fun.

Alright, pontificating over. To the numbers!

My total gross income from the business this year was $27,360.

My net income – what I personally took home – was $7,857 after taxes and expenses (read my full income and expenses for 2017 here.)

About $10,000 of that gross income is still sitting in my business bank account, waiting to be spent on printing, shipping, and taxes.

Of the gross income, $6,000 of it was a Mercycorps NW small business IDA grant, which I had to spend on hard assets for the business, and I matched with $1,200 of my own savings through the program.

I could’ve started the business without that grant (in fact I had money coming in before I got the grant) but receiving the IDA grant helped me spend money on quality investments for the business I simply would’ve been too scrappy to invest in on my own (good camera and mics, branding from a professional designer, etc). It ended up being an excellent boon to my business.

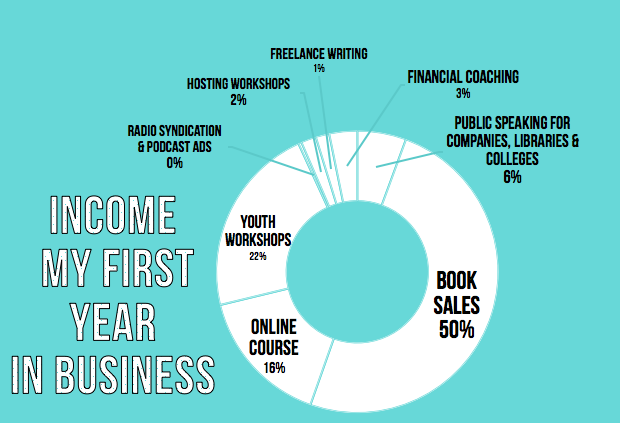

My earned income came from the following sources:

- Get Your Money Together Book Pre-Orders (50% of gross) – the Kickstarter was a huge source of gross income for me. The expenses for this are significant due to printing, taxes, shipping, processing fees, and illustration costs, so the representation of gross doesn’t translate to my personal pocketbook as much. My take-home was about 20% of the total.

- Get Your Money Together Bootcamp Online Course (16% of gross) I pre-sold early access to the course, and released it on Tax Day (4/18) 2017. Since then, the course has more or less been passive income, though I’d love to expand a few sections, and the marketing work never stops.

I was extremely lucky that I had excellent friends volunteer to help me film most of the course at our public access station (it airs on cable TV sometimes as a recurring segment!) so my production costs were free. I did all the video editing myself on a borrowed laptop. The set was decorated by my mom. I am abundant in amazing community that has made this thing possible. - Low Income Youth Workshops (22% of gross) Thanks to some excellent nonprofit partners and my grant-writing skills, I now receive grant support to provide free financial literacy education to low-income youth. I had to get certified as a WOSB (Women-Owned Small Business) to do this, which was quite the process.

- In Person Corporate & College Workshops (6% of gross) Colleges and companies pay me to teach their students and employees about financial literacy. I love doing this, but sales are the hard part. I also did a fair amount of unpaid speaking gigs for marketing (at conferences and elsewhere), but the work to set those up far outweighs the benefits.

- Radio Syndication fees (.5% of gross) Oh My Dollar! started being picked up by other cities’ radio stations in the fall and when they air segments, I get a tiny amount of royalties. I’m working on expanding this through direct sales to station program managers but also through the PRX platform.

- Self-Hosted In Person Workshops (2%) This was my original model, but the sales and cost of renting (even cheap/subsidized) space and the amount of marketing costs to fill the room was too high to pencil out. High person hours for low return. I’ve stopped doing this.

- Freelance Writing and One-One-One Coaching (3%) I don’t want to grow these avenues, as it’s a ton of work for not that much return. This is something that could go excellently to hire out though in the future.

- Podcast Ads (0% of gross) I have some deals in the pipeline for 2018 for podcast ads, which I hope to make several hundred per month. You need to get to a minimum number of listens (about 30,000 a month) before you can even pitch podcast advertisers (Hence 0 for my first year).

Growth trajectory + paying my bills

The business still isn’t supporting me fully every month, but luckily back when I was making $39,000 a year, I was saving more than half of my income so I have a significant cushion to weather the low months without going near my emergency fund. My essential expenses are around $1100 per month, so a few low-paying, easy part-time jobs (I currently clean toilets and mop floors) and freelance gigs have covered the gap, and I’ve still been putting away savings (cash and retirement) every month. You can read more on my 2018 financial plans here.

If I don’t grow my net income this year, I won’t be able to continue this as a full-time gig.

But looking at the pipeline, the current podcast growth, and all the promising partnerships I have set up for this year, I feel optimistic that by this time next year, I’ll be taking home close to what I was when I worked for someone else. I spent the first year creating products, laying the foundation, and making investments in the future. So here’s to entrepreneurial optimism! I AM DOING THE THING.

Thanks for reading all that, friend :-)

Good pep talk about entrepreneurship.

Also… I loved the “poverty martyr complex” (hehe).