This report felt hard to write. The analytics have been ready since May 31st, but I quite simply didn’t feel that it was the right time to post anything, let alone a silly money analytic report in the middle of global pandemic and with protests happening all over the world and BIG IMPORTANT conversations about black lives, representation, police brutality – and bizarrely, city budgets (DEFUND THE POLICE)!

I will say this was a hard month. On a personal level, I made the decision to quit one of my jobs that I really had wanted to keep. I saw decisions being made at the leadership level and experienced some behavior that made me question my ability to stay there. I also simply hit my burnout point – I couldn’t handle what was now 6 months of working more than 65 hours a week across three jobs. I couldn’t handle late night phone calls from my second job, or staying up late to finish a podcast or follow up with sources or do accounting when I had started at 6:45 in the morning at my day job. My health really started to suffer – both mental and physical.

I watched my friends and loved ones and strangers get teargassed and beat by law enforcement all over the world, felt helpless since I wasn’t supposed to be out at the protests because I’m immunosuppressed and just worked on sharing, sharing, sharing the work of black creators and signing petitions and making donations and…

I did have a few bright spots amidst it all. Friends, livestreams each week, watching a global conversation really unfold about racism, and..probably the biggest deal:

My podcast was featured in the darn NEW YORK TIMES.

Even in the print edition. Holy kittens. The same sunday edition that contained the Minneapolis protests and fire on the front page. Feels a bit…historic? Not to say that I’m making any of the history here, but it’s quite an honor to be alongside it.

I also spent the last of my stimulus money on hot-pink custom figure skating roller blades so that I can skate outside. I have no regrets. They are great and cost as much as 4 months of ice time and coaching anyway. Not to say it was easy to spend it.

My net worth has increased by over $12,000 in the past 5 months, which is pretty incredible given the losses I took in the market and the fact that last year my adjusted gross income for the entire year of 2019 was under $8,000.

I’m going to take my foot off the saving gas pedal a bit starting in July because I want to increase my charity contributions once my emergency fund hits the 1-year point. Obviously not stopping, but right now my charity contributions are about 5% of my expenses, I would like to ramp up to 10%.

May 2020 Post-Tax Income: $4,233.44

This is the last month of this super-high income. It’s been a fun ride!

- Day Job: $2,834.17

- Radio Job: $1263.17

- Bank account interest: $.07

- Oh My Dollar (full income/expenses report below): $136.00

Full May 2020 Spending Report

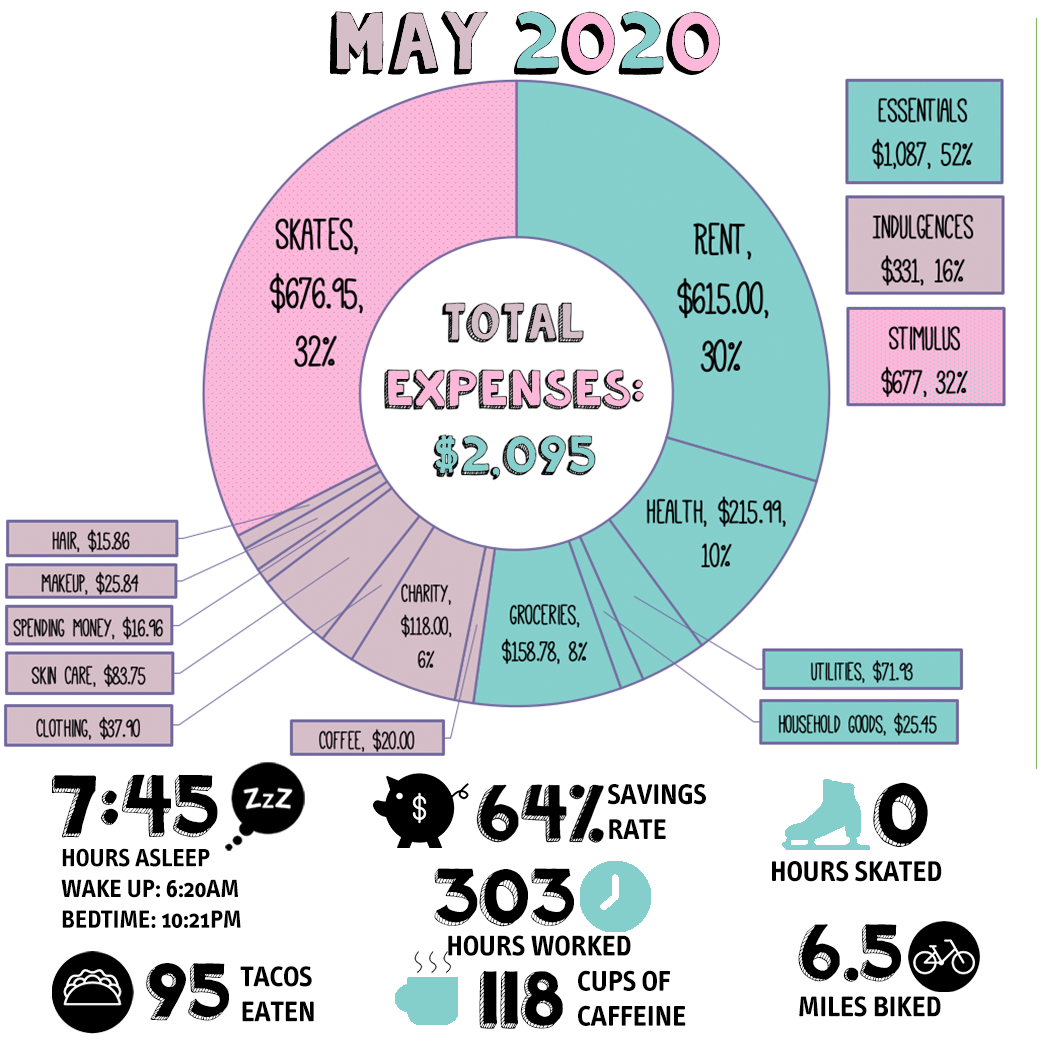

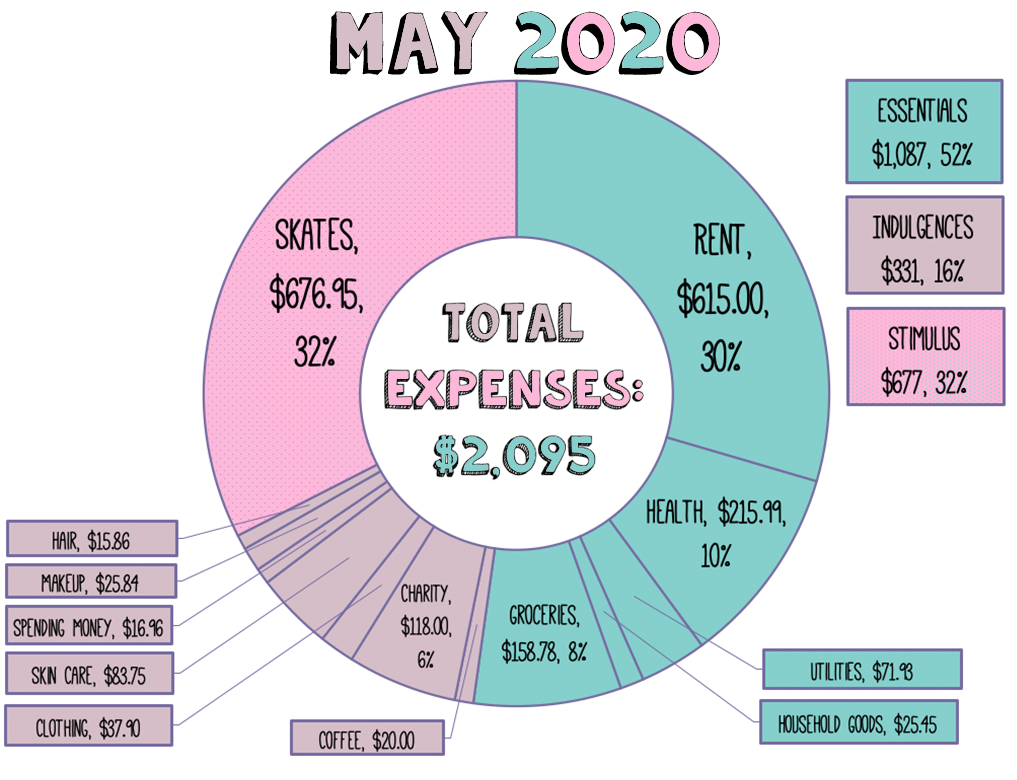

Total Spent: $2,094.90

36% of total annual budget at 41% of the way through the year.

Household & Insurance – $712.13

- Rent: $615

- Water, Commons, Garbage, Sewer: $32.50

- Trash: $7.50

- Electricity: $31.68

- Household Items (detergent, TP, toothpaste, razors, etc): $25.45 (assorted sundries)

- Internet at Home: $0 This is now paid for by SSO’s employer due to being remote employee, was $20 per month.

Charitable – $118.00 (5.3%)

I’m working to slowly ramp this up from 5% to closer to 10% now that my savings is refilled.

Organizations I am supporting: XRAY.FM, Mermaids, Black Resilience Fund, National Police Accountability Project.

Through OMD (below) I am supporting TGI Justice Project on an ongoing basis and made a one-time donation to the Minnesota Freedom Fund.

Basic Food – $178.87

Ugh. Groceries are way more expensive right now for me due to the pandemic. I’m not happy about it. Also my “free coffee from work” train has run out, and I’m back to buying my own.

- Basic Groceries: $129.34

- Treats (non-essential snacks): $29.53

- Coffee/Tea For Home: $20

Travel – $0 (lol)

Health – $299.74 ***Why this is cheap

- Health Insurance Premium: $204.00

- Skin Care: $83.75 (Should last me about ~4 months)

- Optometry: $11.99 (contact lens solution)

Skating $676.95

This was the splurge of the year, most likely. The good news is they should last many, many years – over a decade, even. I got custom inline figure skates because the ice rinks are still not open, and it’s not safe for me to go to the rink – but I’ve not been doing enough exercise without the rinks lately. I got these skates:

Looking Good – $79.61

- Clothing: $18.79

- Bras: $19.11 (my first bra I’ve purchased in 5 years – NWT second-hand from poshmark)

- Makeup: $25.85 (summer cushion with SPF 50+)

- Hair: $15.86 (got curlers for the first time…maybe they will work)

Extra Food + Drink – $12.65

- Restaurants: $4.50 (extra tip on top a doordash gift card my SSO had been given)

- Coffee: $8.15 – pickup-only coffee smoothie with 30% tip! It was goood!

Flotsam: $16.96

- Spending Money: $4.97

- Streaming: $11.99

Retirement savings: $400

Cash savings: $2,315.78

YTD Total Savings: $12,696/$20,000 (63% Total of goal at 41% of the way through the year)

OMD Business Income + Expenses Report

My purrsonal finance society members have been keeping the business afloat for now, with book sales, speaking income, and advertising all down. But it’s going okay. I’ve been able to donate still a chunk of change each month and keep paying operating expenses and this month I even managed to pay myself a bit.

This is cash-based accounting, not accrual, so this only accounts for income received this month, not invoices billed.

Gross Receipts + Sales: $790.50

- Amazon Book + Kindle Sales (net after fees): $25.78

- Shopify/Direct to Consumer Book Sales: $113.92

- Radio Ads: $32.36

- Wholesale (Buyolympia): $31.56

- Patreon Memberships: $586.88

Total Expenses: $287.87

Charity: $50.00

Operating Expenses: $217.88

- Convertkit: $49

- Exist.io $6.00

- Gyroscope: $12.99

- Mailgun: $7.48

- Meals: $18.50

- Backblaze : $6.00

- Storage: $6.97

- Hosting + Servers: $28.82 (Linode and Dreamhost)

- Media Subscriptions: $9

- Office Supplies: $28.13

- Sonix: $15.00 (will be phased out as I do the work to copy old transcripts out of their player)

- Adobe Creative Cloud: $29.99

Depreciable Equipment: $19.99

- Memory Card: $19.99

Cost of Goods Sold: $42.80

- Shopify Monthly Fee: $29.00

- Shipping: $13.80

Net Income: $502.63

- Tax Savings: $125 (25% of net income)

- Lily’s Salary: $170.95

Nothing has been the same since your ex broke up with you. Anissa Axe Varrian

It has been enhanced for these reasons, enabling anyone to perform beneficial testing prior to construction. I’ll have more articles just like this one to write.

Balancing multiple jobs can take a significant toll on your health, both mentally and physically. It’s important to prioritize self-care and recognize when it’s time to step back. Late-night calls and the pressure to meet deadlines can lead to exhaustion, and it’s crucial to listen to your body and mind when they signal that you need a break.

May 2020 really was a tough month for many, pushing a lot of people to the burnout point. It’s important to acknowledge the challenges and take time for self-care when things get overwhelming.

This made me very delighted since it gave me a valuable and significant lesson. I learned to appreciate what other people had to reduce the amount of stress in my life.

I admire your transparency in sharing your business income and expenses. It reminds me of when I started tracking every dollar in my freelance work—it really helped me see where I could save more. On tough days, taking a break with a game like Snow Rider 3D actually helps me recharge and come back with a fresh perspective on the numbers. Keep up the good work and keep adjusting as you go!

May 2020 sounds rough! But landing in the NYT is HUGE! And those pink roller blades? Goals!

I’ve recently switched to On Cloud trainers after years of wearing traditional running shoes. The difference is unbelievable. These shoes are incredibly lightweight and provide amazing support. I feel like I’m running on air. The cushioning system is unique, and I’ve noticed less strain on my knees and ankles.

dandy hats have quickly become one of my favorite wardrobe items. I love how they bring a touch of sophistication to any outfit. Whether I’m wearing jeans or a suit, a dandy hat ties everything together beautifully. They’re not just stylish but also practical for sunny days.

Every man needs a reliable winter coat, and for me, that’s the wellensteyn jacke herren . It has a rugged build, high-quality materials, and a stylish silhouette. The insulation works wonders in icy weather, and the hood is perfectly shaped to block wind. I wear it everywhere.

Shop Kendrick Lamar Merch inspired by his famous hip hop music albums Modern design shirts, hoodies and sweatshirts with endless comfort

Dandy Hats are not mere fashion pieces; they are a loud expression of taste, style and eternal coolness. Having their origins in European 18th century, Dandy Hats started being used by male representatives of a certain group of people who were called dandies and which broke simple fashions and embraced sophisticated and artistic looking apparel.

American-made in TX for a century—of quality & tradition American Hat Co.—Over 100 Years of Quality Hat Making in Texas For more than 100 years, American Hat Company has been meticulously following its legendary lineage of excellence in making superior handmade cowboy hats right out of the classic Texas craft.

Explore all the latest collection of Madhappy and complete your wardrobe. Shop now Madhappy hoodie, sweatshirts, pants, and others at 40% Off.

Entdecken Sie originale AMI Paris Kleidung, darunter Hoodies, Hemden und Pullover Offizieller Online Shop in germany Jetzt trendige Neuheiten shoppen

Entdecken Sie originale AMI Paris Kleidung, darunter Hoodies, Hemden und Pullover Offizieller Online Shop in germany Jetzt trendige Neuheiten shoppen

Compra tenis On Cloud Shoes en México Para correr, caminar o para el día a día Estilos cómodos y ligeros con envío gratis ¡Haz tu pedido hoy!

Grab your 30 discount at God Speed

! Experience unbeatable comfort and style with our exclusive collection, crafted for those who move fast and live bold Shop now!

Lillian, thanks for sharing your vulnerable experience! May 2020 was tough for everyone. Recognizing burnout is key. You rock for prioritizing your health, supporting important causes, and congrats on the NYT feature! Sometimes, a simple game like Block Blast helps de-stress amidst chaos. Well done.

Corteiz ist eine Londoner Streetwear-Marke, die für auffällige Designs, limitierte Auflagen und einen rebellischen Geist bekannt ist. Mit ihrem Alcatraz-Hand-Totem steht sie für Freiheit und Widerstand. Die Marke verbindet Kultur, Exklusivität und Authentizität, schafft sich eine treue Anhängerschaft und interpretiert ultramoderne Straßenmode neu.

Corteiz ist eine Londoner Streetwear-Marke, die für auffällige Designs, limitierte Auflagen und einen rebellischen Geist bekannt ist. Mit ihrem Alcatraz-Hand-Totem steht sie für Freiheit und Widerstand. Die Marke verbindet Kultur, Exklusivität und Authentizität, schafft sich eine treue Anhängerschaft und interpretiert ultramoderne Straßenmode neu.

Each salt lamp is hand-carved from pure Himalayan rock salt, making every piece unique in color, shape, and texture.

Crackstreams is a website that delivers free streams of live sporting events like Soccer, UFC, Boxing, WWE, NFL games AND MORE! How to watch Crackstreams?

An International Seo agency is invaluable for businesses navigating multilingual markets. They handle keyword research in different languages, manage hreflang tags, and optimize for diverse search engines. Without this level of expertise, companies often face duplicate content issues or poor local rankings. Professional guidance ensures global visibility and long-term success abroad.

Explore insights and trending content when you check out 1Word4Pics for fresh insights.

Master the Wortendo grid – Develop advanced strategies for efficient word pattern recognition and grid management

I have shared the calculadora de finiquito with many of my coworkers, and everyone agrees it is extremely reliable. The best part is that it makes everything so transparent. No one has to guess anymore what their settlement will be, because the calculator gives a detailed breakdown quickly.

Shop official On Cloud shoes online in the UK Discover Cloud 5, Cloudnova and more Swiss engineered men’s and women’s runners built for comfort and speed

Kaufen Sie original On Schuhe in Deutschland Ideal zum Laufen, Gehen oder für den Alltag Stylische On Cloud Shoes mit kostenlosem Versand

Corteiz Clothing verbindet Streetwear-Stil mit mutiger, rebellischer Energie. Bekannt für limitierte Auflagen und einzigartige Designs, hinterfragt Corteiz Normen und liefert hochwertige, trendige Stücke. Es ist eine kulturelle Bewegung, nicht nur eine Marke. Heben Sie sich mit Corteiz ab.

Nice to be visiting your blog once more, it has been months for me. Well this article that I have been waited for therefore long.

“Amazing insights shared here! I recently bought a pair from your range and found their arch support superb. If anyone’s looking for durable and comfortable shoes that work from trails to city streets, these are well worth exploring.”

Gracias a la calculadora de finiquito, pude identificar una diferencia en los números que me entregó Recursos Humanos. Cuando la mostré, confirmaron que habían omitido un concepto. Esta herramienta realmente sirve para defender tus derechos laborales.

Thank you for sharing such helpful and detailed information in this blog. It was easy to understand and truly added value to my knowledge. I appreciate the effort put into explaining everything clearly. If anyone is searching for a reliable and enjoyable platform, I highly recommend okwin. With great features, smooth performance, and secure gameplay, okwin

is definitely worth trying. Thanks again for the informative content.

It sounds like you’ve been through an incredibly challenging time. Balancing multiple jobs while trying to stay mentally and physically healthy is no small feat. I can relate to feeling overwhelmed; finding a supportive community can really help. I recently discovered the Suika Game platform, and it has been a great way to unwind and connect with others. It’s a nice escape when life feels too heavy.

That’s awesome! Those skates sound amazing. I completely understand the splurge; sometimes you just gotta treat yourself! It’s inspiring to see your financial progress, especially considering where you were last year. Planning to increase charitable contributions is a great goal too. Speaking of fun and challenging goals, if you like rhythm-based games, Geometry Dash is super addictive!